Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAs payments become more digitalized, cyber security is paramount: BI

Cashless payments have become a lifestyle choice in Indonesia as shown in the widespread use of credit and debit cards. A 2017 Visa Consumer Paying Attitudes survey found that 76 percent of Indonesians said they could go without cash for a day

Change text size

Gift Premium Articles

to Anyone

B

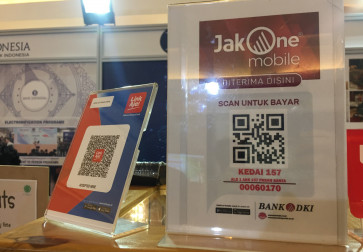

ank Indonesia (BI) continues to campaign for a '"less-cash society" with the recent launch of a centralized QR standard and further development of the national payment gateway, implementing “international security standards” to contain cybersecurity risks.

Starting January next year, the Quick Response Indonesian Standard (QRIS) will integrate existing QR-based payment apps such as Go-Pay and OVO to boost cashless transactions and promote financial inclusion in the country, said BI payment system policy executive director Pungky P. Wibowo.

“With QRIS codes, there will be no more fragmentation or monopoly of the e-payment system,” Pungky said during a press briefing at BI’s headquarters in Jakarta last Friday.

The integration of the QR payment system into the central bank’s QRIS technology is also needed to encourage micro, small and medium enterprises (MSMEs) to enter the digital market, he added.

As of Friday, there were 38 payment system providers that have begun to use the QRIS. The use of the QRIS code was mandatory and that QR-based payment apps that failed to adjust to the new system by January 2020 as stipulated in BI regulation No. 21/18/PADG/2019 would face penalties.

Pungky added that the central bank has implemented international security standards for QRIS. “The QRIS has two-factor authentication and one-time password [OTP] features as security issues are our main consideration.”

The launch of the central bank’s QRIS is expected to further boost cashless transactions and promote financial inclusion. According to a 2018 study by the World Bank, cashless transactions in Indonesia stood at 10 percent of transactions in the country. BI showed a more optimistic figure as cashless transactions stood at 24 percent of transactions in the same year.