Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

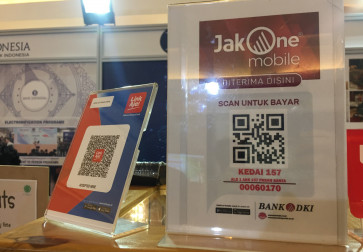

View all search resultsBI imposes fixed fees on QRIS transactions, targets 15 million merchants in 2020

The central bank has set a merchant discount rate of 0.7 percent for almost every transaction using the Quick Response Indonesia Standard (QRIS).

Change text size

Gift Premium Articles

to Anyone

B

ank Indonesia (BI) has officially imposed fixed fees for transactions using recently implemented standardized quick response (QR) codes as it aims to have 15 million merchants using e-wallet services in 2020.

The central bank has set a merchant discount rate of 0.7 percent for almost every transaction using the Quick Response Indonesia Standard (QRIS). Transactions using the QRIS in the education sector and at gas stations charge 0.6 percent and 0.4 percent of fees respectively.

Meanwhile, QR code transactions for donations or social assistance will be free from any costs.

“Bank Indonesia will conduct evaluations every so often for rate revisions,” BI payment system management executive director Pungky P. Wibowo told reporters during a press briefing held in Makassar, South Sulawesi, on Saturday.

“We will probably lower the fees but worry not because, in 2030, around 98 percent of the population will make cashless payments so the industry will get an abundance of profits.”

BI launched the QRIS in August last year and officially implemented the system in January, allowing users from one payment service to transact with any other rival service within BI’s ecosystem in a bid to encourage cashless payments.

Cashless transactions have seen a rapid rise in Indonesian society, whose internet economy is expected to grow more than three times to US$130 billion by 2025 from $40 billion last year, as shown in the e-Conomy SEA 2019 report by technology giant Google, Singaporean holding company Temasek and management consulting firm Bain & Company.