Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

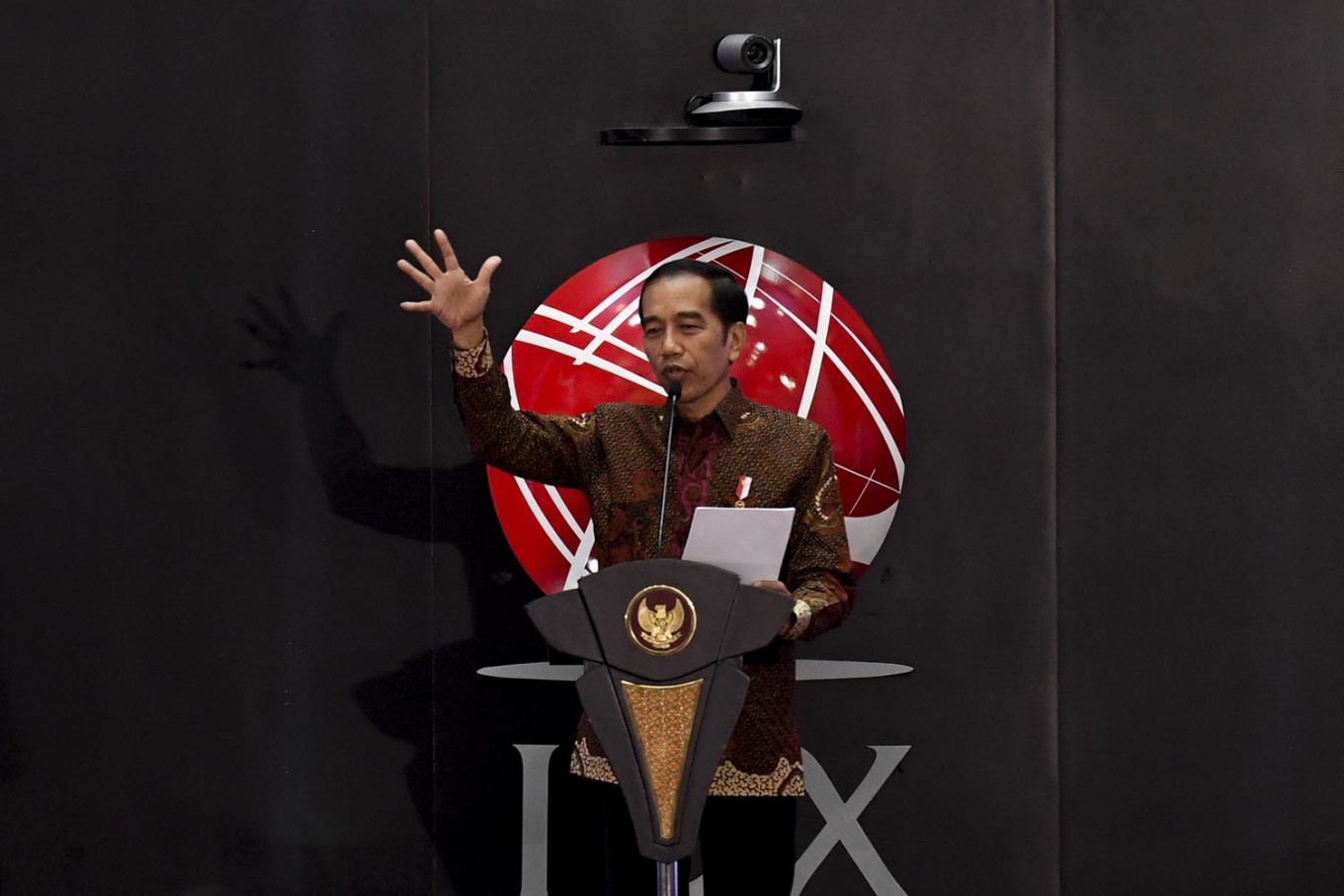

View all search results‘Don't let distrust disrupt our economy’: Jokowi urges reform in financial industry

The reform aims to close a regulatory and supervisory gap between the banking industry and other financial businesses.

Change text size

Gift Premium Articles

to Anyone

P

resident Joko “Jokowi” Widodo has called for reform in the country's financial services companies to improve the public’s trust following cases that rocked the country’s insurance industry.

He said on Thursday that the industry was in need of reform to improve regulations, supervision and capital, especially for the nonbanking financial services industry, which consists of insurance, multifinance and pension fund businesses.

Reform was also needed to make the nonbanking financial services industry be more prudent, transparent and adopt a good risk management system to maintain the public’s trusts, he said.

“Do not let distrust disrupt our economy,” Jokowi stressed during his speech at the financial services industry annual meeting in Jakarta.

The government, he went on to say, was ready to assist the Financial Services Authority (OJK), which supervises the country's financial industry, in implementing such a reform.

However, he denied that the call for reform was related to state-owned insurers Asuransi Jiwasraya and Asuransi Sosial Angkatan Bersenjata Republik Indonesia (Asabri), which had suffered trillions of rupiah in losses as a result of investment mismanagement.

“The reform has been planned for a long time and that [the cases are happening at the same time] is merely just a coincidence,” he said.

Jiwasraya announced in October 2018 that it had failed to pay out maturing JS Saving Plan policies worth Rp 802 billion (US$58.7 million). It was also unable to pay holders of policies worth Rp 12.4 trillion that were supposed to be paid in December 2019.

The Attorney General's Office (AGO) arrested on Tuesday five people, including the insurer's former boss and two businessmen, for their suspected roles in alleged corruption practices at Jiwasraya.

OJK chairman Wimboh Santoso agreed with the need to accelerate reform in the financial industry, including that of nonbanking financial services.

"It needs serious efforts because we haven't carried out any reform in the [nonbanking financial services] industry," he said at the same event.

The OJK, he went on to say, would accelerate the reform it had been carrying out since 2018 in supervision, law enforcement and capital requirements.

"We will be proactive and implement closer supervision and require a more detailed report on risks that become our attention," he said.

He, however, said that the reform would not be a quick win.

“This will take years, just like with the banking industry,” said Wimboh, referring to the banking industry reform that took place between 2000 and 2005.

Once the reform was fully implemented, the OJK would also create a policy insurance institution that guarantees customers' funds similar to that of banks’ Deposit Insurance Corporation (LPS).

He also said the reform aimed to a close regulatory and supervisory gap between the banking industry and other financial industries as the latter had never been reformed.