Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGovernment suspends licensing for new savings, loan cooperatives amid liquidity bind

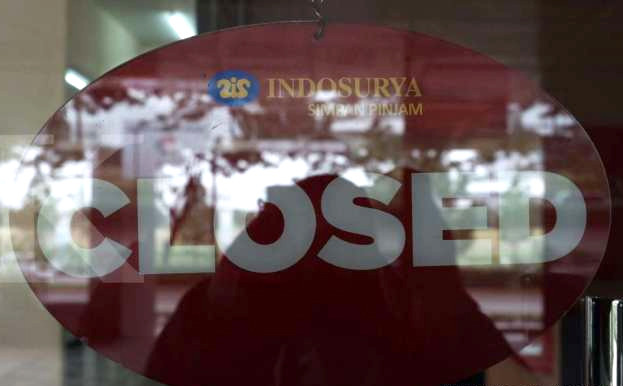

The decision was made after customers of savings and loan cooperative KSP Indosurya Cipta sought help from lawmakers to address the organization’s failure to return a total of Rp 10 trillion (US$707.51 million) to 8,000 customers.

Change text size

Gift Premium Articles

to Anyone

T

he Cooperatives and Small and Medium Enterprises Ministry has suspended the licensing of new savings and loan cooperatives for three months following an apparent liquidity bind in cooperative KSP Indosurya Cipta.

The ministry’s secretary, Rully Indrawan, said in a statement on Wednesday that the suspension had come into effect on May 29 and was part of an effort to maintain the sustainability and health of savings and loan cooperatives in Indonesia.

The ministry instated the moratorium so it could review the licensing process for savings and loan cooperatives, Rully said. The decision was made after customers of KSP Indosurya Cipta sought help from lawmakers to address the cooperative’s failure to return a total of Rp 10 trillion (US$707.51 million) to 8,000 customers.

“There are several cooperatives that have not conducted their savings and loan businesses according to principal, basic values, and the prevailing conditions of such cooperatives have caused problems for their members and other members of the public,” Rully said in the statement.

Read also: 'We want our money back', customers of Indosurya cooperative tell legislators

The ministry’s supervision deputy Akhmad Zabadi said the suspension was meant to improve the ministry’s integrated supervisory system, which he hoped would maintain the sustainability of the savings and loan cooperatives.

It is hoped that the system will improve the public image of savings and loans cooperatives, as the COVID-19 pandemic has caused several problems in the sector, such as liquidity constraints and expansion difficulties, he added.

Licensing requests submitted before the circular was issued will still be processed according to prevailing laws.

The pandemic has caused several savings and loan cooperatives to face a decline in loan repayments. Members have withdrawn their savings, causing the cooperatives to see a decline in equity and face difficulties with internal consolidation and member services.