Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBNI partners with GoPay to make TapCash top-ups easier

BNI has announced that its TapCash e-money card can now be topped-up via GoPay.

Change text size

Gift Premium Articles

to Anyone

State-owned Bank Negara Indonesia (BNI) has announced that its TapCash e-money card can now be topped-up via GoPay.

BNI consumer business director Corina Karnalies said Monday that the partnership was aimed at making it easier for TapCash users to deposit money onto the card.

“The government is encouraging us to use cashless payments during this pandemic and that is why we wanted to make the TapCash top-up process easier,” she said during an online press briefing on Monday.

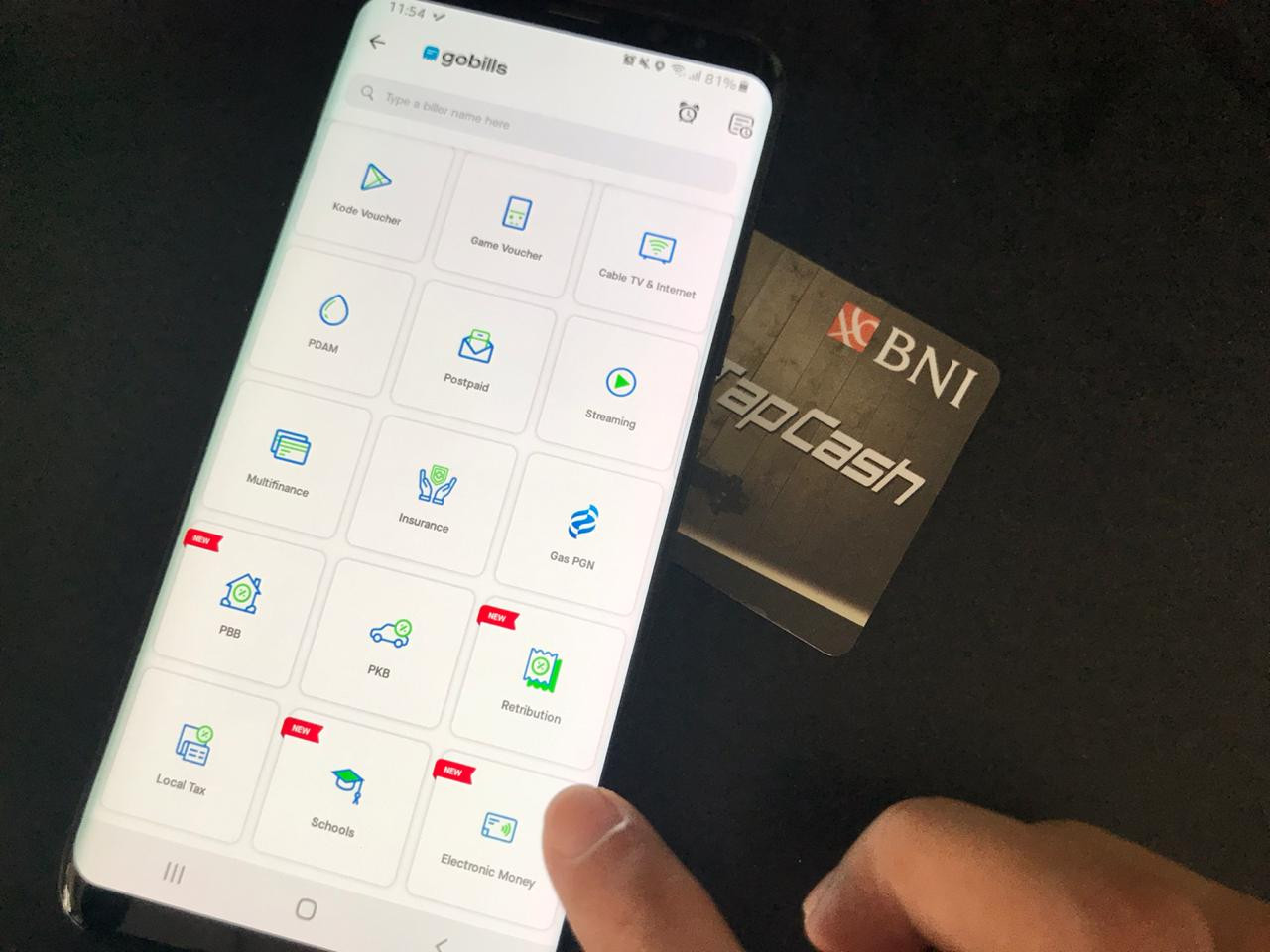

Corina added that users who wanted to top-up via GoPay needed to make sure their smartphone had a near-field communication (NFC) feature. They can then select TapCash from the e-money refill menu of Gojek’s GoBills feature.

Users can make top-ups of Rp 20,000 (US$1.41) to Rp 500,000 and can store up to Rp 2 million on the card.

After topping up, users can update their balance on the Gojek app with the NFC feature by placing their TapCash card on the back of their smartphones.

Corina said that TapCash was the first e-money card that could be topped up through GoPay, adding that BNI would also partner with other financial technology (fintech) providers and e-commerce platforms to provide top-up options.

TapCash, which has 7 million users according to BNI, can be topped up via e-commerce platforms Blibli.com and Bukalapak, fintech platform LinkAja, as well as via ATMs, mobile banking and at minimarkets.

GoPay managing director Budi Gandasoebrata said the e-money refill feature had been rolled out in the updated version of the Gojek app.

He also said GoPay transactions had seen a spike during the COVID-19 pandemic, noting also that gifting money via GoPay had quadrupled during Ramadan in April compared to last year’s Ramadan.

GoPay transfers for alms had also doubled during the pandemic either through its partners such as Kitabisa or via QRIS codes at places of worship, Budi said.

“We have also seen an increase in customers giving tips during the pandemic. They are giving more tips, more often,” he told the press. (eyc)