Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBI: Economic developments in 2024 and monetary policy direction in 2025

Indonesia's economy has shown strong resilience in mitigating the impacts of global spillovers with internationally recognized performance.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia's economy has shown strong resilience in mitigating the impacts of global spillovers, with internationally recognized performance.

First, Indonesia's economic performance is among the best in Emerging Market Economies (EMEs), with macroeconomic stability maintained along with relatively high growth. Indonesia even managed to prevent a crisis due to the COVID-19 pandemic and has continued its economic recovery until now.

Second, the strong coordination of macroeconomic policies, especially the fiscal policy of the government and the monetary policy of Bank Indonesia, has been a key pillar in maintaining national economic resilience with a balance between stability and growth. Indonesia is also highly committed to economic transformation, including improving the investment climate, infrastructure development and the downstreaming of natural resources.

Third, developments over the last five years show that Indonesia's economic performance is among the best in EMEs, with stability maintained and growth remaining relatively high. Economic growth since 2018 has been above 5 percent, except during the COVID-19 pandemic. Inflation has been kept under control at low levels, averaging below 3 percent during the 2018-2023 period, and the rupiah exchange rate has remained stable, thanks to Bank Indonesia's strong monetary policy commitment. The fiscal deficit has been kept low, under 3 percent of gross domestic product (GDP).

The current account deficit has also remained low and even recorded a surplus in 2021 and 2022, as a result of the downstreaming of natural resources. These developments demonstrate the growing strength of Indonesia's external economic resilience. Likewise, financial system stability remains intact with high banking capital adequacy ratios (CAR) above 20 percent. Banking credit has grown significantly and has played an important role in financing economic growth. These positive developments are also accompanied by rapid payment system digitization, which has become a driver of inclusive economic growth.

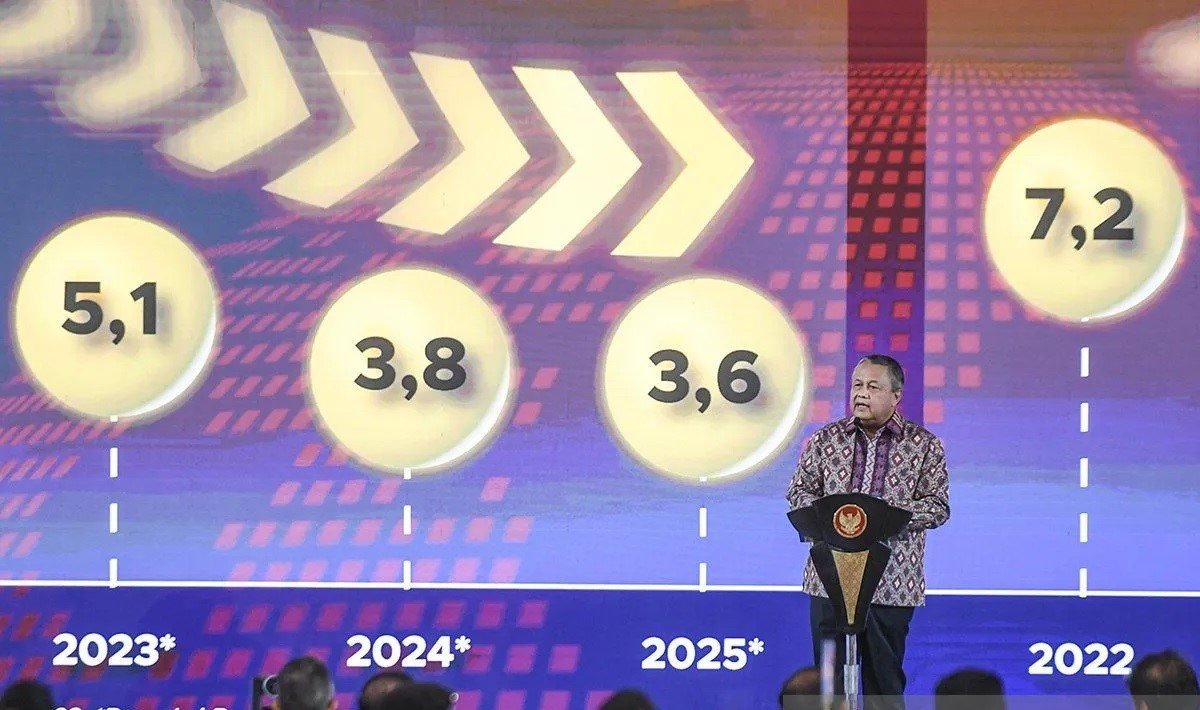

Overall, Bank Indonesia expects economic growth in 2024 to be in the range of 4.7-5.5 percent, and it will increase further in 2025 and 2026 to ranges of 4.8-5.6 percent and 4.9-5.7 percent, respectively. To this end, Bank Indonesia will strengthen its policy mix to encourage higher economic growth, closely coordinating with the government's fiscal stimulus policies. On the supply side, structural reform policies need to be reinforced to boost sectors of the economy that can absorb labor. These efforts are supported by optimizing macroprudential policy stimulus and accelerating payment transaction digitization implemented by Bank Indonesia.