Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInsight: The strategic role of PT SMI in fiscal policy and economic expansion

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s future economic growth will not be determined solely by the size of government spending, but also by how effectively development financing is managed.

With national infrastructure investment needs estimated at Rp 47,587 trillion over the next five years, Indonesia cannot rely exclusively on the state budget (APBN). Fiscal instruments are required to expand financing capacity while ensuring that development delivers sustainable and equitable economic impacts.

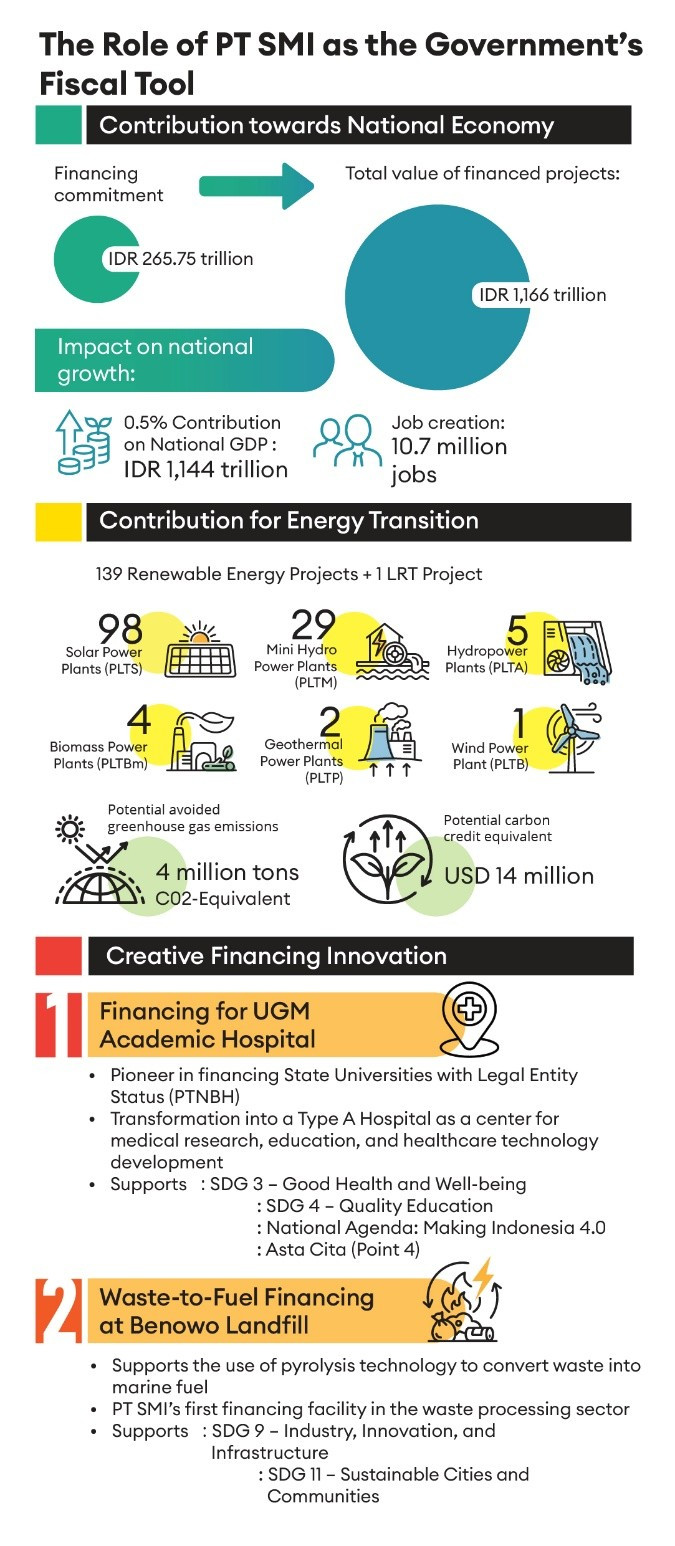

In this context, PT Sarana Multi Infrastruktur (PT SMI), plays a strategic role as the government’s fiscal tool. PT SMI not only complements the role of the APBN, but also acts as a catalyst for development financing through a more flexible, innovative and impact-oriented approach. Financing provided by PT SMI is designed to generate multiplier effects by increasing productivity, creating jobs and strengthening regional economies.

Regional development disparities remain one of Indonesia’s major development challenges. Adequate access to financing is essential to ensure that development is not concentrated solely in major cities, but also reaches underdeveloped regions and areas with untapped economic potential. Through public sector financing, PT SMI assists local governments in accelerating basic infrastructure development, enhancing fiscal capacity and stimulating local economic growth. As of November 2025, PT SMI’s regional financing commitments reached Rp 36.02 trillion, with the largest allocation directed toward road and bridge development to strengthen regional connectivity.

(Courtesy of Sarana Multi Infrastruktur)Long-term economic growth also requires a reliable and sustainable energy supply. PT SMI has positioned itself at the forefront of the energy transition by supporting innovative and strategic clean energy projects. Since 2018, PT SMI has ceased financing coal-fired power plants and has continuously expanded its green portfolio. As of November 2025, PT SMI had supported 96 climate-related projects with total financing commitments of Rp 34.1 trillion. These efforts not only contribute to emissions reduction, but also create new economic opportunities, enhance energy resilience and strengthen national competitiveness.

The energy transition is incomplete without ecosystem restoration efforts. Through its Social and Environmental Responsibility (TJSL) program, PT SMI planted 27,000 tree seedlings across 30 hectares of degraded land in West Java, in collaboration with the West Java Forestry Agency. Another example is PT SMI’s support for sea turtle conservation in Banyuwangi, East Java, which has resulted in a hatchling success rate exceeding 90 percent, with approximately 1,200 hatchlings released annually. This program also empowers local communities, involving more than 500 residents in conservation activities.

Economic growth not only depends on physical infrastructure, but on the quality of human capital. The year 2025 marked an important milestone in the development of social infrastructure in Indonesia. PT SMI became a pioneer in financing state universities with legal entity status (PTNBH), providing Rp 150 billion in financing to Gadjah Mada University (UGM) for the development of the UGM Academic Hospital. This project strengthens healthcare services, medical education and national medical research, ultimately enhancing productivity and economic competitiveness.

PT SMI’s transformation into a development finance institution (DFI) has further strengthened its role as a lever for economic growth. As of November 2025, PT SMI’s cumulative financing commitments reached Rp 265.75 trillion, generating tangible impacts including the employment of 10.7 million workers and contributing approximately 0.5 percent to national GDP, equivalent to Rp 1,144 trillion. As a DFI, PT SMI is able to finance strategic projects with higher risk profiles but significant development impact, projects that are often beyond the reach of conventional financial institutions.

To support this agenda, PT SMI continues to innovate in financing through the issuance of bonds, green bonds and sukuk in both domestic and international markets. Since 2014, PT PT SMI has raised more than Rp 45 trillion through various instruments, including bonds, green bonds and sukuk, positioning PT SMI as one of the most frequent issuers in the domestic capital market. This diversification of funding sources strengthens infrastructure financing capacity while embedding environmental, social and governance (ESG) principles across all financing activities. Financial innovation serves as a critical foundation to ensure that development is driven not only by growth, but also by sustainability.

The infrastructure built today will define Indonesia’s competitiveness in the future. From basic infrastructure and clean energy to social infrastructure, all require strong, innovative and impact-oriented financing.

Through adaptive financing strategies, cross-sector collaboration and a firm commitment to equity and sustainability, PT SMI will continue to ensure that every rupiah invested delivers economic, social and environmental value. This is PT SMI’s role as the government’s fiscal tool in supporting stronger, more inclusive and sustainable economic growth for Indonesia.

(Infographic designed by PT SMI and Kompas)