Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsWhat the EU–India deal means for global trade

The deal will affect a combined population of 2 billion people across economies representing about a quarter of global GDP.

Change text size

Gift Premium Articles

to Anyone

The “mother of all deals”: that’s how European Commission President Ursula von der Leyen described the new free trade agreement between the European Union and India, announced on Jan. 27 after some two decades of negotiations.

The deal will affect a combined population of 2 billion people across economies representing about a quarter of global GDP.

Speaking in New Delhi, von der Leyen characterized the agreement as a “tale of two giants” who “choose partnership, in a true win-win fashion”.

So, what have both sides agreed to, and why does it matter so much for global trade?

Under this agreement, tariffs on 96.6 percent of EU goods exported to India will be eliminated or reduced. This will reportedly mean savings of approximately 4 billion euros (US$64.79 billion) annually in customs duties on European products.

The automotive sector is the big winner. European carmakers, including Volkswagen, BMW, Mercedes-Benz and Renault, will see tariffs on their vehicles gradually reduced from the current punitive rate of 110 percent to as little as 10 percent.

The reduced tariffs will apply to an annual quota of 250,000 vehicles, which is six times larger than the quota the United Kingdom received in its deal with India.

To protect India’s domestic manufacturers, European cars priced below 15,000 euros will face higher tariffs, while electric vehicles get a five-year grace period.

India will almost entirely eliminate tariffs on machinery, which previously faced rates up to 44 percent, chemicals, 22 percent, and pharmaceuticals, 11 percent.

Wine is particularly notable, tariffs are being slashed from 150 percent to between 20 and 30 percent for medium and premium varieties. Spirits face cuts from 150 percent to 40 percent.

In return, the EU is also opening up its market. It will reduce tariffs on 99.5 percent of goods imported from India. EU tariffs on Indian marine products such as shrimp, leather goods, textiles, handicrafts, gems and jewelry, plastics and toys will be eliminated.

These are labor-intensive sectors where India has genuine competitive advantage. Indian exporters in marine products, textiles and gems have faced tough conditions in recent years, partly due to the United States tariff pressures. That makes this EU access particularly valuable.

This deal, while ambitious by India standards, has limits. It explicitly excludes deeper policy harmonization on several fronts. Perhaps most significantly, the deal does not include comprehensive provisions on labor rights, environmental standards or climate commitments.

While there are references to carbon border adjustment mechanisms, by which the EU imposes its domestic carbon price on imports into their common market, this likely falls short of enforceable environmental standards increasingly common in EU deals.

And the deal keeps protections for sensitive sectors in Europe: the EU maintains tariffs on beef, chicken, dairy, rice and sugar. Consumers in Delhi might enjoy cheaper European cars, while Europe’s farmers are protected from competition.

Three forces converged to make this deal happen. First, a growing need to diversify from traditional partners amid economic uncertainty.

Second, the US President Donald Trump factor. Both the EU and India currently face significant US tariffs: India faces a 50 percent tariff on goods, while the EU faces headline tariffs of 15 percent, and recently avoided more in Trump’s threats over Greenland. This deal provides an alternative market for both sides.

And third, there’s what economists call “trade diversion”, notably, when Chinese products are diverted to other markets after the US closes its doors to them.

Both the EU and India want to avoid becoming dumping grounds for products that would normally go to the US market.

The EU has been on something of a dealmaking spree recently. Earlier this month, it signed an agreement with Mercosur, a South American trade bloc.

That deal, however, has hit complications. On Jan. 21, the European Parliament voted to refer it to the EU Court of Justice for legal review, which could delay ratification.

This creates a cautionary tale for the India deal. The legal uncertainty around Mercosur shows how well-intentioned trade deals can face obstacles.

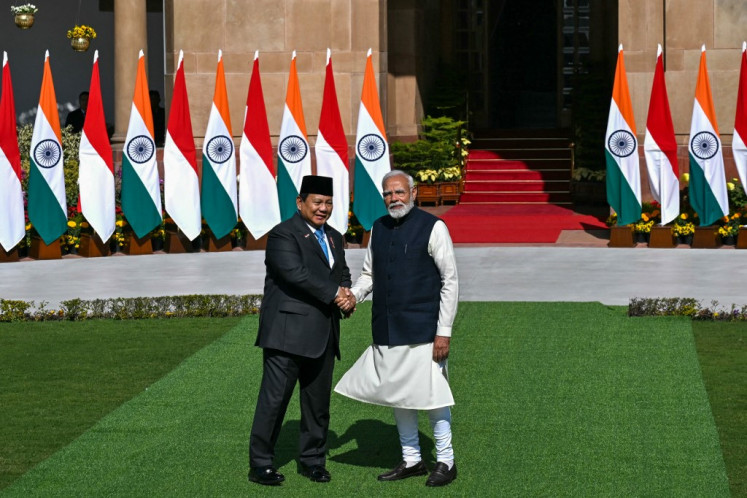

The EU also finalized negotiations with Indonesia in September; EU–Indonesia trade was valued at 27 billion euros in 2024.

For India, this deal with the EU is considerably bigger than recent agreements with New Zealand, Oman and the UK. It positions India as a diversified trading nation pursuing multiple partnerships.

However, the EU–India trade deal should be understood not as a purely commercial breakthrough, but also as a strategic signal, aimed primarily at the US.

In effect, it communicates that even close allies will actively seek alternative economic partners when faced with the threat of economic coercion or politicized trade pressure.

This interpretation is reinforced by both the deal’s timing and how it was announced. The announcement came even though key details still need to be negotiated and there remains some distance to go before final ratification.

That suggests the immediate objective was to deliver a message: the EU has options, and it will use them.

For Australians, this deal matters more than you might think. Australia already has the Australia-India Economic Cooperation and Trade Agreement, which came into force in late 2022.

Australia has eliminated tariffs on all Indian exports, while India has removed duties on 90 percent of Australian goods by value, rising from an original commitment of 85 percent.

This EU-India deal should provide impetus for Australia and India to finalize their Comprehensive Economic Cooperation Agreement, under negotiation since 2023.

The 11th round of negotiations took place in August, covering goods, services, digital trade, rules of origin, and importantly, labor and environmental standards.

The EU deal suggests India is willing to engage seriously on tariff liberalization. However, it remains to be seen whether that appetite will transfer to the newer issues increasingly central to global trade, notably those Australia is now trying to secure with Indian negotiators.

Australia should take heart from the EU’s success in building alternative trading relationships.

This should encourage negotiators still pursuing an EU–Australia free trade agreement, negotiations for which were renewed last June after collapsing in 2023.

These deals signal something important about the global trading system: countries are adapting to US protectionism not by becoming protectionist themselves, but by deepening partnerships with each other.

The world’s democracies are saying they want to trade, invest and cooperate on rules-based terms.

---

Peter Draper is a professor, executive director of Institute for International Trade and director of the Jean Monnet Centre of Trade and Environment; Mandar Oak is an associate professor at School of Economics; and Nathan Howard Gray is a senior research fellow at Institute for International Trade, all at Adelaide University in Australia. The article is republished under a Creative Commons license.

![]()