Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGaruda appoints new finance director in latest shake-up

National flag carrier Garuda Indonesia’s shareholders have appointed a new finance director amid the airline’s financial struggle and low demand during the pandemic.

Change text size

Gift Premium Articles

to Anyone

National flag carrier Garuda Indonesia’s shareholders have appointed a new finance director amid the airline’s financial struggle and low demand during the pandemic.

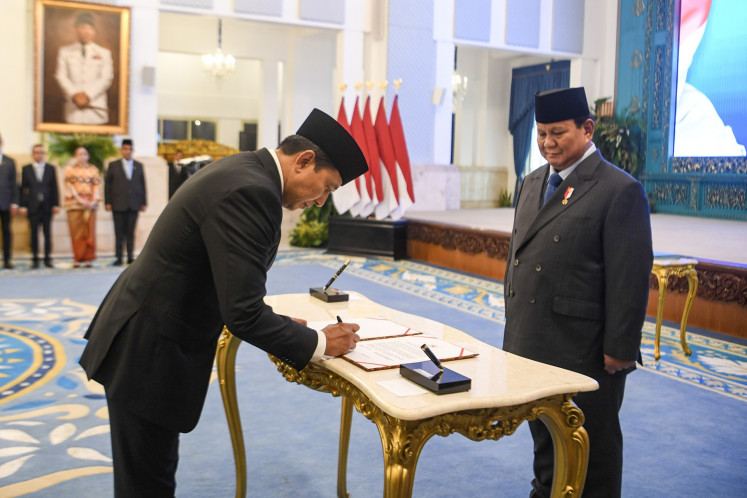

The airline, in which the state has a majority stake, appointed Prasetio as the new finance director, to replace Fuad Rizal.

Garuda president director Irfan Setiaputra told reporters on Friday after an extraordinary general shareholders meeting that the decision was a “routine” event.

He said he hoped the new financial director could expedite the airline’s ongoing restructuring, negotiation and financial management process.

“This management change is nothing but a usual tour of duty. Pak Prasetio has commendable experience as a banker and a strong legal background,” he said.

After stints at banks like Bank Niaga and Bank Danamon Indonesia, Prasetio held the position of finance director at state-owned airline PT Merpati Nusantara Airlines from 2004 to 2005 as well as that of compliance and risk management director at state-owned telecommunication company PT Telekomunikasi Indonesia (Telkom) from 2007 to 2012.

He also served as president director of the state-owned securities paper and bill printing company Peruri between 2012 and 2017.

Garuda last did a board of directors shake-up in January in a move that included installing a new president director to replace I Gusti Ngurah Askhara “Ari” Danadiputra, who was discharged late last year following the discovery of high-end goods smuggled into the country on one of the airline’s newest airplanes.

Like airline around the globe, Garuda Indonesia is struggling with low demand, as the COVID-19 outbreak and border closures force people to cancel travel plans.

Garuda Indonesia booked $1.07 billion in losses in the first nine months of the year, a reversal from the $122.4 million profit it saw in the corresponding period last year.

Its revenue also dropped sharply over the same period, falling by 67.8 percent year-on-year to $1.13 billion, according to the company’s financial report.

The Garuda Indonesia Group, which consists of full-service airline Garuda Indonesia and low-cost carrier Citilink, saw passenger numbers nosedive to 8 million passengers in the January-September period, down 65.6 percent from 23.3 million passengers carried in the same months last year.

The airline stated that one of Prasetio’s first tasks as the new finance director was coordinating with state-owned infrastructure financing company PT Sarana Multi Infrastruktur (SMI) on the issuance of Rp8.5 trillion (US$583 million) in mandatory convertible bonds (MCB) for the airline.

In July, the House of Representatives gave the green light for the government to provide the capital injection for the airline in the form of MCBs to soften the pandemic’s impact on the company.

The MCB will require conversion of the bond into stocks in accordance with the contractual conversion date. SMI is projected to act as a buyer for the bond and eventually a shareholder of the company.

On Friday, Garuda’s shareholders had also agreed to issue the MCB and were hoping to receive the capital injection before the end of the year, Irfan said.

“The shareholders have agreed for Garuda to issue the MCB with a maximum amount of Rp 8.5 trillion and maximum tenure of seven years, which will be converted into new shares once the bonds are due,” he said.

During the press conference, Irfan said that the MCB would be used to improve the company’s liquidity, solvability and to cover operational costs.

“The MCB’s main target is to propel our company, so we can recover faster, which will also help the national economic recovery effort,” he claimed.

Jasa Utama Capital analyst Chris Apriliony said on Nov. 9 that Garuda would post a better result in the fourth quarter this year, as well as in 2021, as demand for domestic travel had steadily increased in the last several months.

“We may see better quarterly results by December as the general public has started to lose their [fear] of the pandemic, which may increase demand for travel. We could see an increase in demand for domestic flights moving forward,” he told The Jakarta Post.