Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia seeks new capital investors after Softbank exit

Softbank Group founder Masayoshi Son’s withdrawal from new capital city investment has raised questions on the viability of the project.

Change text size

Gift Premium Articles

to Anyone

T

he Indonesian government is scrambling to find new investors for its multi-billion dollar new capital city project following the exit of Japan’s Softbank Group.

Coordinating Minister for Maritime Affairs and Investment Luhut Pandjaitan said on Thursday that the government was turning to Saudi Arabia and the United Arab Emirates (UAE) to fill the funding gap.

The government was hoping to win over the UAE and Saudi Arabia for funds that were initially earmarked for Softbank’s Vision Fund, but that SoftBank had slashed following troubles over some of the group’s portfolio companies.

“Now, we are hoping that the Vision Fund funds from Abu Dhabi and Saudi can come here. No need to go through SoftBank again,” said Luhut.

He said that the government had been in talks with the UAE over the matter. The middle eastern country was inclined to inject more funds through the Indonesia Investment Authority (INA), and would bring in partners from around the world, including China.

SoftBank’s exit marked a blow to the capital relocation plan as the Japanese company was reportedly ready to invest US$30 billion to $40 billion in the new capital, a huge portion of the initial development cost.

Read also: Softbank pulls out of capital city project

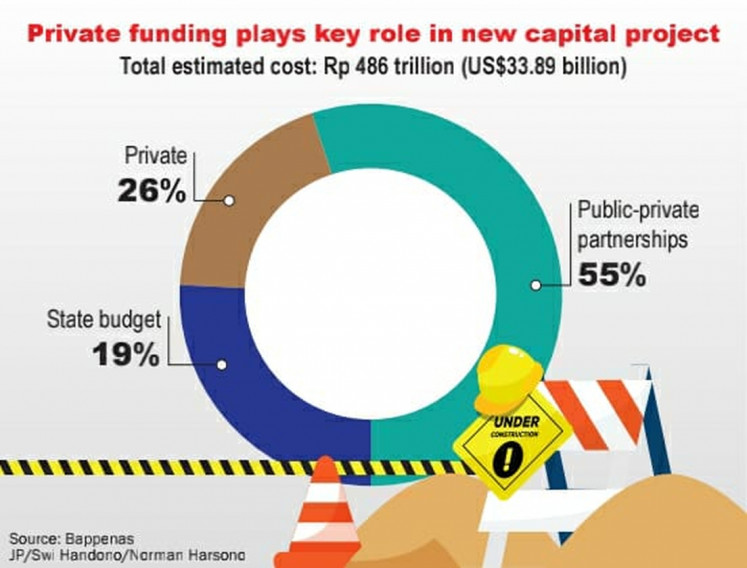

Building the basic infrastructure of the capital would cost an estimated Rp 466 trillion ($32.6 billion). The government plans to pay one-fifth of that bill from the state budget, leaving the remaining four-fifths dependent on private investments.

Luhut added that SoftBank founder Masayoshi Son no longer sat on the new capital’s steering committee. The government was looking for a replacement to serve alongside Abu Dhabi Crown Prince Mohammed Bin Zayed Al Nahyan and former British prime minister Tony Blair.

The coordinating minister was assigned by President Joko “Jokowi” Widodo to secure a replacement investor for the new capital city project.

“There are a number of investors interested in the project, both domestic and foreign investors,” said Jokowi during a visit to the site of the capital on March 10.

Jokowi has been getting cozy with Saudi Arabia and the UAE through several diplomatic visits, starting with a visit to both countries in September 2015. He achieved much greater success with the UAE, which committed $10 billion to INA in March 2021.

The Indonesian Chamber of Commerce and Industry (Kadin) and Real Estate Indonesia (REI) joined the fray by saying that they were lobbying a Spanish consortium, Madrid World Capital of Construction, Engineering and Architecture (MWCC), to replace Softbank.

Most recently, the Asian Development Bank (ADB) announced on Friday it would provide technical support for the new capital, shortly after Jokowi appointed former ADB vice president Bambang Susantono as head of the new Nusantara National Capital Authority (NNCA).

The Saudi Arab and UAE embassies did not immediately respond for comments.

Brushing off the exit

NNCA head Bambang Susantono said that withdrawals like Softbank's were a common thing in the business world. He said there was nothing to worry about, and that the NNCA was open to all investors, whether big or small.

“Pak Doni and I remain optimistic that if we can structure this new capital city project well, investors will come by themselves,” Bambang said in a video statement on Friday.

A spokesman for the new capital city project Sidik Pramono said on Monday that Softbank’s withdrawal would not hinder project development because there were other financial backers.

“Are we optimistic? That is a must. The government has committed that this does not weigh on the state budget,” he said.

Nurul Ichwan, undersecretary for investment planning at the Investment Ministry, said on Thursday that Softbank’s exit was hardly a loss to the new capital as the company had not inked any formal deals over the project.

He was also confident that the withdrawal would not create a bad image for the project.

Luhut also reaffirmed that the project would take up no more than one-fifth of the state budget.

SoftBank left the new capital project at a time when its share prices had dropped around 60 percent, dragged down by the falling share prices of portfolio companies such as China-based ride hailing company Didi and United States-based coworking space WeWork.

Viability in question

Softbank’s exit has raised questions among observers over the project’s viability and attractiveness to investors.

Siwage Dharma Negara, coordinator of the Indonesia Studies Programme at Singapore-based think tank ISEAS-Yusof Ishak, said on Monday that financial problems were unlikely to be the cause of Softbank’s withdrawal.

He said the project might not be economically attractive for investors due to its lengthy payback period.

“If the project was profitable, they would definitely enter. If not, then it would go ‘maybe next time,’” he said.

Center of Economic and Law Studies (Celios) director Bhima Yudhistira said on Thursday that it would be difficult to find investors as good as Softbank.

It was also generally difficult to find investors at the moment due to stormy global economic conditions with an ongoing geopolitical crisis, commodity price surges and monetary tightening, among other things, he said.

Bhima said that, in a worst-case scenario, the government might need to raise the state budget allocation for the project to 80 or 90 percent, whether directly or indirectly through state-owned enterprises (SOEs).

“It is either banking on the high commodity prices or finding new debt,” he said.