Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGaining new business perspective amid fuel price hike

The consumer price index in Indonesia has begun to increase significantly since the second quarter to the disruptions in energy and food supplies, especially after the Russian invasion of Ukraine.

Change text size

Gift Premium Articles

to Anyone

T

he need to raise fuel prices has been widely discussed in various sectors, especially after the government announced its annual 2023 budget plan in mid-August. It also has to be taken into account that Indonesia is a net importer of fuel, and its spending is strongly influenced by international oil price developments.

Through our history, inflation has been a major indicator to closely look at when fuel prices spike. Take for example the year 2014, in which social assistance via cash transfers (BLT) was used to curb inflation and help consumers.

With the recently announced plan to increase fuel prices—as government spending on energy subsidies is projected to exceed Rp 500 trillion (US$33.3 billion) the polemic on the ballooning fuel subsidy has been heating up. The government even estimated that energy subsidies could rise further to Rp 700 trillion if the subsidized fuel prices are not raised due to the steady increase in international oil prices.

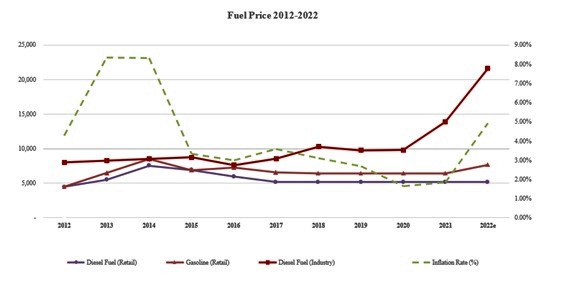

It must be noted that international oil prices have always been highly volatile, and businesses that are not entitled to subsidized fuels, have been vulnerable to the price fluctuations, as described in the chart on what has happened to fuel prices in Indonesia historically.

Although businesses have been impacted by price hikes for months, the current economic landscape spells out an overall larger impact. Increased prices (inflation) mean workers will need higher wages to account for inflation, otherwise their purchasing power will be eroded and consumer spending will be affected.

The government’s plan to increase social assistance by Rp 214 trillion, which would be distributed through cash transfers to the families most vulnerable to the impact of fuel price rises, is a classic approach that was deemed successful in helping to curb inflation in 2014 and was also adopted by other Asian countries such as Singapore (via its GST voucher scheme).

However, such a policy is still widely criticized in Indonesia due to what analysts see as inaccurate and obsolete data on lower-income households. The question then is will the cash transfers after the fuel price rise still be relevant in a multidimensional crisis, such as in the areas of commodities, energy and even health care?

The consumer price index in Indonesia has begun to increase significantly since the second quarter as a result of the disruptions in energy and food supplies, especially after the Russian invasion of Ukraine. It should be noted that Indonesia still depends on imports for several food commodities as wheat, soybeans, even garlic.

The real estate sector will also be impacted by increasing fuel prices, as logistical and production costs will increase due to higher utility prices—which will eventually factor into consumer prices and drive higher inflation in the end. Other production sectors such as manufacturing will also be affected as well.

Knowing all of this, how can businesses anticipate and prepare for the higher fuel costs? Emergency cash flow is more important than ever to cope with the upcoming rise in fuel costs. Increased productivity and efficiency can be the key to helping address the price hike—increasing output will help industries reach economies of scale. Curbing unnecessary expenses and focusing on producing high quality output will help businesses reduce the impact of the fuel price hike.

In responding to workers’ demands for salary increases, companies may provide transportation and food subsidies or allowances to maintain their productivity. Incentivizing productive employees will, in the long-term, help companies grow and lessen the impact of price increases.

Locally sourcing raw materials is also a proven win-win strategy to curb high logistical costs. An example is food and beverages, where creative solutions from industry players are being tested. For instance, some carbohydrate, protein and fat sources can be substituted with other locally sourced ingredients.

Securing multi-year contracts and requesting longer terms of payment for internal fixed costs can also be a good strategy to safeguard cashflow due to the fuel price hike, especially for business-to-business (B2B) players. However, multiyear contracts are not without implication, as it means the producer or supplier is supposed to make room for clients requesting changes.

Additionally, the energy crisis has increasingly forced the adoption of renewable energy for the long-term. While the idea of clean energy has been around for decades, adoption—such as through electric vehicles—is gaining in popularity. Companies can now start using mixed renewable and fossil fuels in production and business operations.

***

The writer is Indonesian partner at YCP Solidiance, an Asia-focused advisory firm.