Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsElectricity pricing policy to promote renewable energy

The government has just released Presidential Decree No. 112/2022 on the acceleration of renewable energy development, to promote electricity production coming from renewable sources. One of the key points of the decree is to set the maximum electricity price purchased by state-owned electricity company PT PLN from producers of renewable electricity.

Change text size

Gift Premium Articles

to Anyone

T

he government has just released Presidential Decree No. 112/2022 on the acceleration of renewable energy development, to promote electricity production coming from renewable sources. One of the key points of the decree is to set the maximum electricity price purchased by state-owned electricity company PT PLN from producers of renewable electricity.

The decree sets the electricity price depending on the type of energy source (such as hydro, geothermal, solar cells and other sources), the capacity of the power plant (power plants with a larger capacity get lower prices) and location of the power plant (eastern parts of Indonesia enjoy higher prices than Java).

Also set was the maximum price, preventing prices from rising higher than that fixed in the decree. Implicitly, the decree protects PLN instead of ensuring renewable energy supply.

We highlight two issues in the decree: the maximum price policy and PLN’s purchasing price for renewable electricity from independent power plants (IPPs), both of which are key to promoting more investment in renewable energy.

As the electricity market in Indonesia is heavily regulated, we should assess the regulation carefully to find out whether these support renewable energy development or not.

For the first issue, we find the maximum price policy is a bit strange. The reason is that the electricity market structure in Indonesia is monopsony. This means there is only a single buyer of electricity in the market. In Indonesia, this is PLN that buys electricity from the IPPs.

If there is only a single buyer in the market, we do not need a maximum price policy to protect the buyer. The single buyer already has strong market power. Conversely, we think the appropriate policy should be to set a floor price to protect sellers, the electricity producers, from PLN as the powerful single buyer.

Furthermore, we believe a floor price is important to provide certainty for producers. A floor price is the minimum price that gives a normal level of profit. In addition, if the producers must put in a large investment to reach a minimum economy of scale, the floor price is useful to estimate a minimum level of return on investment.

The second issue is that the decree provides a maximum fixed price for how much PLN can buy electricity from IPPs. Note that the purchasing prices could be different depending on the type of energy, capacity of production and location.

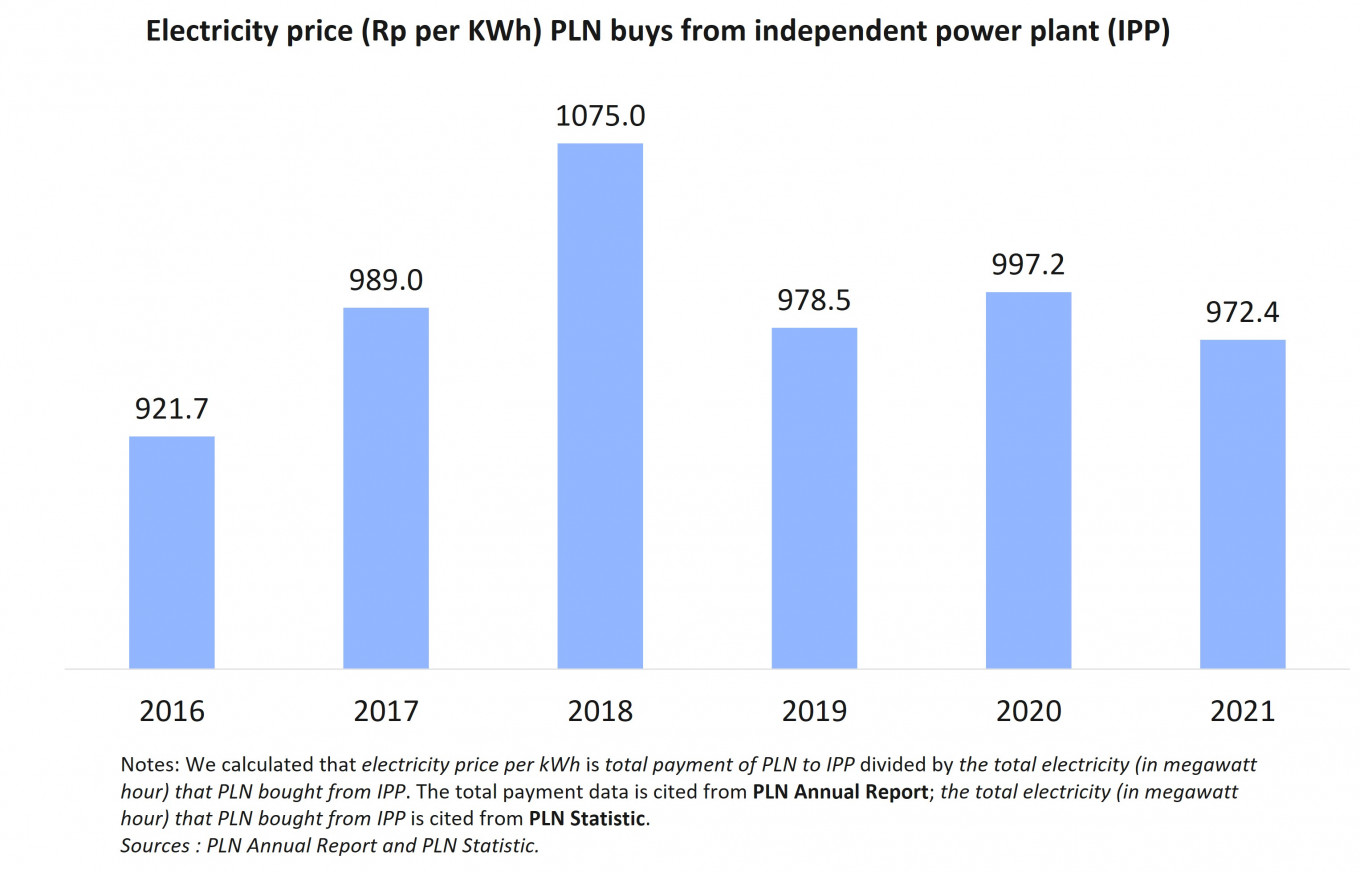

As a comparison with the current situation, our data show that the electricity price that PLN bought from IPPs has declined since 2018, which was from Rp 1,075 (7.1 US cents) per kilowatt hour (kWh), to Rp 972.4 per kWh in 2021.

We calculate the electricity price referring to the data from PLN Statistics and the PLN annual report. We define the electricity price per kWh as the total payment of PLN (in rupiah) to the IPP divided by the total electricity (in megawatt hours) that PLN bought from IPPs. The total payment data is cited from the PLN annual report; the total electricity that PLN bought from the IPPs is cited from PLN Statistics.

In our opinion, we should pay special attention to the maximum price policy and the price level that has been fixed, whether these provide a sufficient incentive for the business sector to supply renewable electricity to PLN.

Note that as the price is fully determined by the government, we never know whether the price level stated in the decree will give the right signal for producers to supply renewable energy to PLN until we ask for a response from the producers.

In addition, the maximum price policy creates an even more difficult situation because the price is not negotiable beyond the maximum level if it is too low when compared with the market equilibrium price. We are not expecting the presidential decree to be revised frequently to adapt to changes, for example, supply and demand changes, or input prices change.

Accordingly, we argue that two efforts should be implemented in the short and long terms to promote renewable energy.

In the short term, we suggest the government directly ask businesses whether they are willing to supply renewable electricity given the price stated in the decree. Of course, we hope that they are happy with the price, which means the price already provided a satisfactory profit as a return for the risks taken in the electricity business.

Otherwise, the government should provide other incentives to encourage renewable energy production, given the fixed price in the decree. An alternative policy is to provide subsidy for renewable energy production using revenue from the carbon tax that will be implemented soon.

The allocation of carbon tax revenue to the renewable energy sector is appropriate because we internalize negative externalities from sectors producing carbon. At the same time, the allocation of this tax revenue would also function to promote green sectors.

In the long term, we propose to reform the electricity market to be more competitive. The reform should distinguish between electricity distribution and generation. Accordingly, the natural monopoly is only electricity distribution, for which PLN could act as a monopolist providing the electricity distribution network.

Meanwhile, the electricity market can be competitive with a number of electricity producer players who own their power plants. These producers sell their electricity to consumers directly using the distribution network owned by PLN.

So, we can expect competition between producers in selling electricity to consumers. In other words, consumers can choose which electricity producers they prefer, with the cheapest price and the best service. Electricity producers would just pay a toll fee for using the electricity distribution network to the network owner.

***

The writer is head of industry and regional research at Bank Mandiri