Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFocused on Java, P2P lending not as ‘inclusive’ as hoped

A study from professional services firm EY suggests that changes in tax policy and higher loan limits may help Indonesia improve financial inclusion.

Change text size

Gift Premium Articles

to Anyone

I

mproved financial inclusion has been one of the promises of the peer-to-peer (P2P) lending business from the get-go and is reflected in a mandate for P2P firms under Financial Services Authority (OJK) Regulation No. 77/2016.

However, players in the industry are falling short of that promise, as most of their loans go to borrowers on Java Island, including micro, small and medium enterprises (MSMEs), and relatively few go to less developed regions of the country.

Analysts say a closer partnership between P2P lenders and the government to facilitate loan disbursement outside of Java, as well as changes in tax policy and larger maximum loans could facilitate financial inclusion.

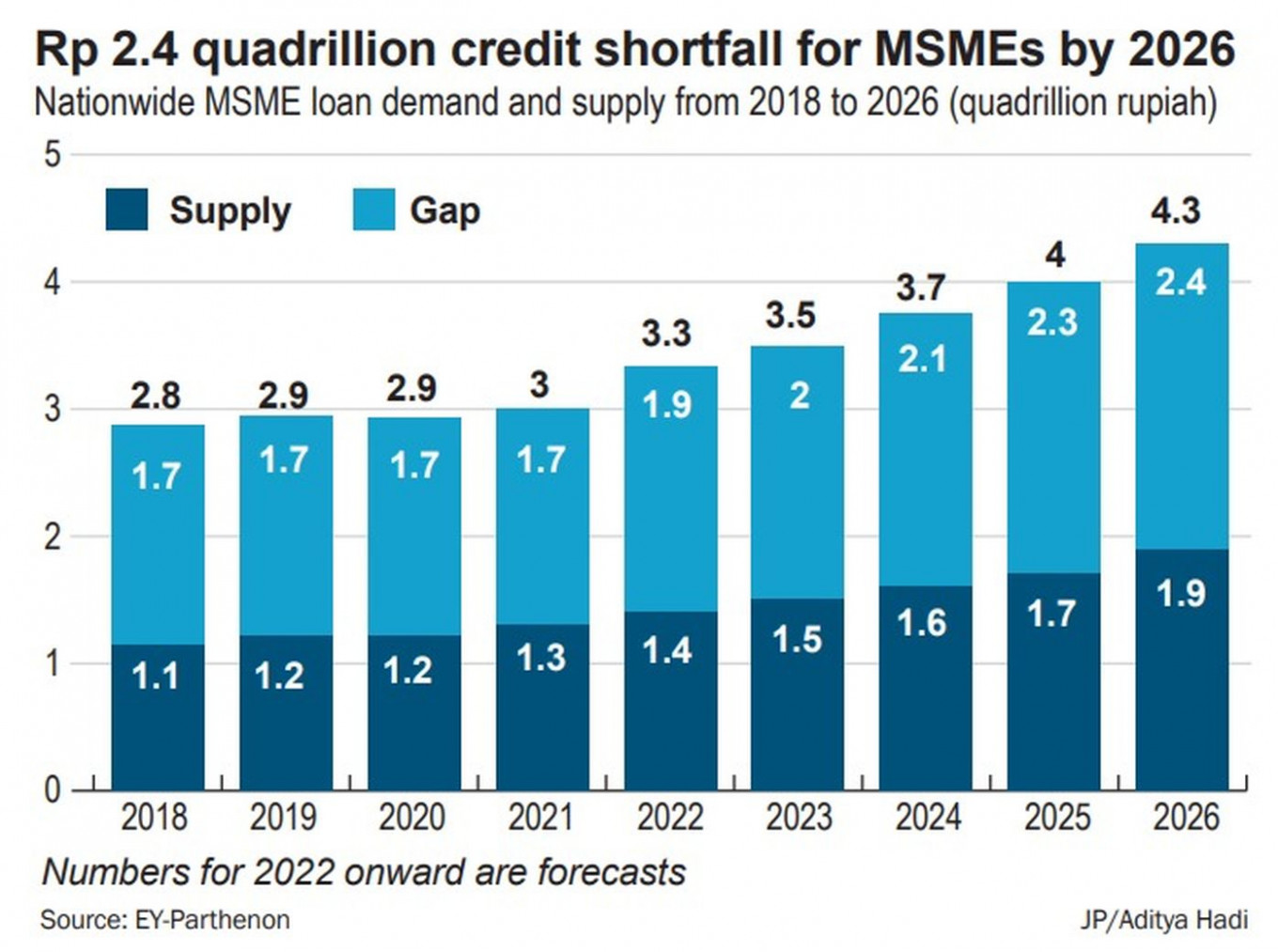

A recent study by Ernst & Young (EY) Indonesia's consultancy arm, EY-Parthenon, predicts that loan demand from MSMEs in the country will rise to Rp 4.3 quadrillion by 2026, which may result in a loan gap of Rp 2.4 quadrillion.

According to the study, which was conducted with support from the Indonesian Fintech Lenders Association (AFPI), 60.5 percent of the demand for MSMEs financing in 2026 would come from Java Island, where the majority of businesses are located.

The study forecasts that the role of state-owned banks in lending to MSMEs will continue to increase in the coming years, as they have been mandated to disburse at least 30 percent of their loans to that segment. On the other hand, the contribution of private banks, regional banks and multifinance firms is expected to either stagnate or drop.

Anugrah Pratama, a partner at EY Parthenon Indonesia, said P2P lenders could play a bigger role with the surge in MSME loan demand, as their risk appetite and platform accessibility were more suitable to the sector.

But this would require P2P lending firms to serve more users outside Java. In the report, EY noted that those fintech lenders account for less than 1 percent of the overall loan issuance to MSMEs and that their lending to the MSME segment grows at a mere 0.1 percent annually, far below loans from SOE banks, which are expected to grow 1.2 percent per year.

"The market beyond Java and Bali […] is still underserved by P2P lending firms. The financing gap will stay high if players only put their focus on those two islands," Anugrah said in a press briefing on Friday.

Anugrah explained that the focus of P2P lending firms on Java Island was not wrong from a business perspective, as the cost to expand to other islands would be relatively high, and an expansion would not be easy as the majority of potential clients there lacked financial and digital literacy.

"However, if all [P2P lenders keep] sticking around Java, the overall business will be left behind," Anugrah stated.

Nailul Huda, who heads the Center of Innovation and Digital Economy at the Institute for Development of Economics and Finance (Indef), attributed the uneven P2P loan disbursement to a lack of readiness among people outside Java.

"How could they expand if there is no market there? That's why it's more realistic for [P2P lenders] to keep the loans inside Java, as the market already exist. As business entities, they need to manage their own cash flow, right?" Nailul told The Jakarta Post on Tuesday.

Is more regulatory support needed?

MSMEs are the backbone of Indonesia’s economy, as they generate 62 percent of the gross domestic product (GDP) and employ around 97 percent of the national workforce. The government, which categorizes MSMEs based on revenue or assets, aims to get more of them to enter the digital ecosystem, which would require more financing from various sources.

In its study, EY encourages a better understanding of MSMEs business by dividing them into clusters based on the maturity of their financial and digital literacy. Combined with the segmentation based on business scale that has been used up to now, P2P lending firms and the government could identify MSMEs that still needed education and those that were ready for additional loans.

Another important aspect, according to the AFPI's external relations head, Andi Taufan Garuda Putra, is the mapping of those clusters based on region.

"Thus, financial institutions [including P2P lending firms] should be aware of the financing potential for every region. On top of that, the government and other stakeholders could also devise regulatory initiatives that are suitable in each region," Andi said in a statement.

In its study, EY proposes regulatory changes to increase the maximum P2P loan limit from the current Rp 2 billion cap, arguing that some MSMEs may need more money to finance their expansion.

Aside from that, the report notes that micro businesses lacking financial and digital literacy were struggling to maintain their financial stability. Because of that, some leeway in tax policy for those MSMEs may help, EY suggests, while encouraging lenders to give more loans to them at the same time.

Indef's Nailul said that P2P lenders and the government needed to work hand in hand to improve the financial infrastructure and human resources in other islands.

"P2P lending firms need to consider if they need to be the first who try to tackle loan inequality outside Java Island, in order to make the government aware of the problem," Nailul stated.