Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGovt to merge three state-owned airlines

Move aimed at improving service, cutting costs.

Change text size

Gift Premium Articles

to Anyone

S

tate-Owned Enterprises (SOEs) Minister Erick Thohir has said he plans to merge the country’s three state-run airlines to improve services and reduce costs, although analysts have raised questions about the efficacy of the move.

Erick pointed to a similar merger of four state-owned port operators, Pelindo I, II, III and IV, which he said had halved overall costs.

Next, he said, the government would merge the state-owned airlines: national flag carrier Garuda Indonesia, its low-cost subsidiary Citilink and Pelita Air, the airline arm of state-owned oil giant Pertamina.

"SOEs need to keep bringing down costs. Pelindo has been merged from four companies into one [...] We are also pushing for Pelita Air, Citilink and Garuda Indonesia [to do the same] to bring down costs as well," Erick said in a statement on Monday.

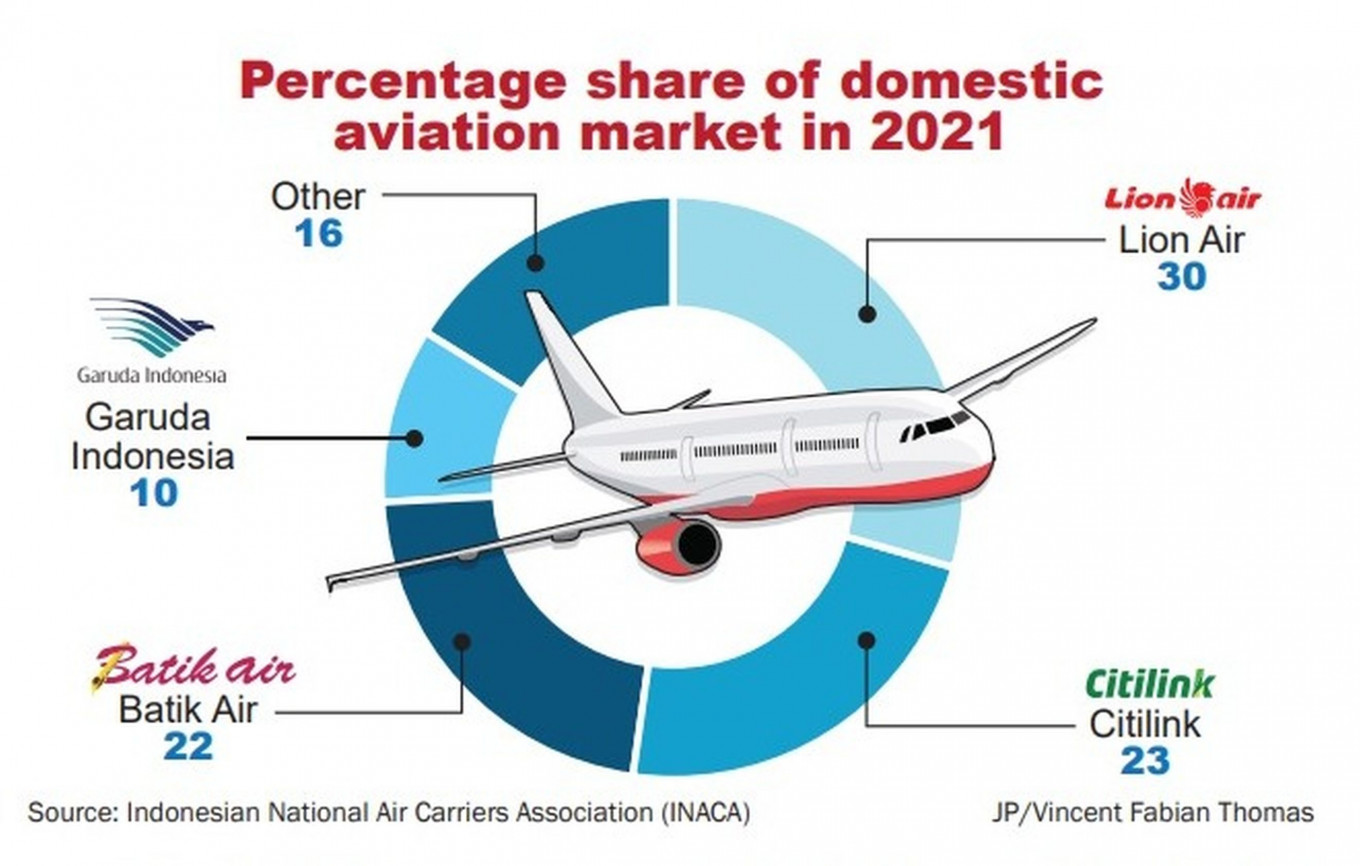

In 2021, Garuda Indonesia and Citilink together commanded a third of the domestic passenger aviation market, according to the Indonesia National Air Carriers Association (INACA).

Erick mentioned the plan during a discussion with members of the Indonesian diaspora in Tokyo, organized by state-owned lender BNI.

He added that Indonesia’s state-owned airlines had 550 airplanes, 200 short of the official target. Merging the airlines, he said, could help the country meet the target figure.

Citilink president director Dewa Kadek Rai told The Jakarta Post on Tuesday that there was indeed a plan to merge the three state-owned airlines and that a team at the SOEs Ministry was handling it.

He noted that the merger was expected to happen “this year”.

Garuda Indonesia CEO Irfan Setiaputra said in a statement on Tuesday that discussions regarding the merger were ongoing, that the plan was still in its early phases and that the airline was exploring its options.

Meanwhile, Agdya Yogandari, corporate secretary of Pelita Air, told the Post on Tuesday that the airline supported the plan.

Haris Eko Faruddin, an analyst at state-owned Bank Mandiri, told the Post on Tuesday that differences in the standards of the three state-owned airlines would add to the complexity of the merger and that the process would take a long time.

Garuda, for instance, was a full-service airline, the highest of the three conventional airline segments, followed by Pelita Air as a mid-service airline and Citilink as a low-cost carrier, he said.

Jakarta-based aviation consultant Gerry Soejatman concurred that the varying service standards would contribute to the difficulty of the merger and noted the importance of the choice of management.

"If we merge Citilink and Pelita Air to increase cost efficiency, it's better to use Pelita Air's management as a holding company” because of its healthier finances, Gerry told the Post on Tuesday.

“However, would Garuda Indonesia be willing to let its subsidiary Citilink go?" he added.

In June of last year, Garuda Indonesia acquired creditors’ approval to restructure Rp 142 trillion (US$9 billion) of liabilities. Garuda had previously been declared technically bankrupt by the SOEs Ministry for its inability to service its debt.

In June of this year, Garuda reported a net loss of $76.5 million.

Gerry said the merger could be a distraction for the state-owned airlines and that improving their financial performance should be the main focus right now.

The problem of the country’s lack of passenger airplanes could be solved if airlines regained lessors’ trust with good bottom lines, he added.

"Even after the debt restructuring, lessors are still thinking twice before leasing airplanes to Garuda Indonesia. Citilink is Garuda Indonesia's subsidiary, so it will impact lessors' trust too,” Gerry said.

“But it is easier for Pelita Air to get a lease, as it is a different company,” he added.

Even if the government merged the companies, the path to augmenting the fleet would be rocky, as lease prices were up from last year and the secondary market for planes was thinner, he said.

"Private airlines are in recovery mode. They will also chase growth next year in order to offset the drop during the pandemic. Their planes will continue to grow [in number], so just let it flow," Gerry said.