NEWS ANALYSIS: Waiting for better days for cement producers

Change Size

Workers unload cement from a warehouse. (Kontan/Carolus Agus Waluyo)

Workers unload cement from a warehouse. (Kontan/Carolus Agus Waluyo)

C

ement producers faced hard times in the first half of 2016 as domestic cement consumption fell. However, a recovery is expected to come in the second half on the back of more robust infrastructure spending.

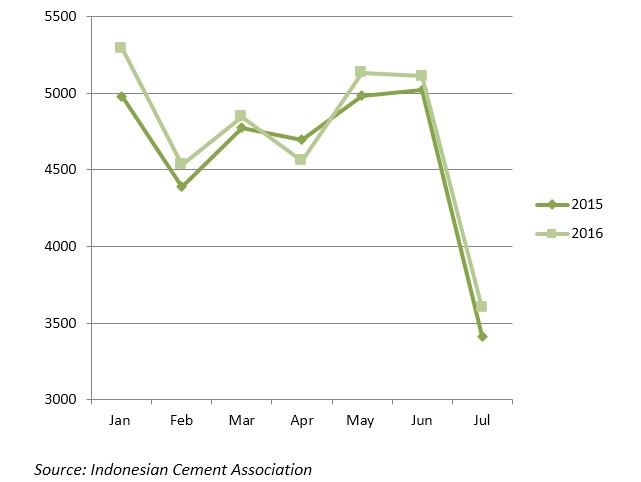

Cement sales in July 2016 showed a sharp fall of 29 percent from the previous month, due to the Idul Fitri holiday. In total, from January to July, domestic cement consumption rose only 4 percent from the same period in the previous year.

So what is the culprit? Keep in mind that the economic slowdown last year made total 2015 cement sales fall more than 9 percent from the 2014 figures. The main factor restraining domestic cement consumption is the low realization of infrastructure budgets.

President Joko “Jokowi” Widodo in a recent speech stated that the disbursement of regional government budgets is still slow. The President said that there was Rp 214 trillion of idle funds still stored in regional banks as of June 2016.

Jakarta recorded the highest amount of idle money, with Rp 13.9 trillion in its bank account, followed by West Java with Rp 8.03 trillion and East Java with Rp 3.9 trillion. "Please immediately spend it, so [the money] immediately circulates in the community," said Jokowi in front of regional leaders on Aug 4.

The infrastructure budgets of regional governments is expected to play a big part in national development. As stated in the medium-term infrastructure development plan budget 2015-2019, half of the funding to build roads, bridges, ports, railways or other projects is expected to come from the government.

In more detail, 40 percent of the infrastructure finance is to be sourced from the central government while the other 10 percent is from regional budgets. Twenty-six percent of the infrastructure allocation in the 2016 state budget is funneled to regional governments.

Apart from low budget absorption, cement producers are also facing competition with new players in the industry. A Citigroup research paper published on Aug. 15 mentioned that the 4 percent year-on-year (yoy) cement consumption growth was boosted by new producers namely Semen Merah Putih, Siam Cement and Anhui Conch.

At the same time, total sales of market leaders, including Semen Indonesia, Indocement, Holcim, and Semen Baturaja declined 0.6 percent yoy.

Potential rebound

Despite many challenges, analysts expect cement demand to rise in the second half of the year due to strong government support of the property sector and efforts to increase budget realization, among other factors.

The recently issued Presidential Decree No. 34 seeks to boost the property sector by lowering income tax on property sales to 2.5 percent from the previous 5 percent. In addition, the government has also loosened the loan-to-value (LTV) rules and made property assets one of containers to absorb repatriated funds from the tax amnesty.

It is widely believed that the policy will attract investors to the property sector, which will in turn increase demand for raw materials used in building construction.

"We think property demand will also be supported by continued lower mortgage rates, lower transaction costs for property purchases, and implementation of looser disbursement policies for second and further mortgages in the second half of 2016," said Citigroup analyst Felicia Asrinanda Barus in a research report.

The current exchange rate stability also offers cement producers the opportunity to increase profit margins in the second half of 2016. In June, the rupiah touched Rp 13,600 per US dollar, but later strengthened to Rp 13,100 a month later on the back of tax amnesty sentiment and foreign inflow.A stronger rupiah is positive for cement producers, since they purchase coal, the main fuel for cement productions, in US dollars.

--------

Source: Bareksa.com