Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsToward competitive geothermal sector

In 2018, Indonesia became one of the biggest geothermal producers with a 1.94-gigawatt (GW) installed capacity.

Change text size

Gift Premium Articles

to Anyone

T

his year is a decade away from the deadline to accomplish the Sustainable Development Goals (SDGs). By putting geothermal power as a source of renewable energy under a microscope, one gets a very interesting picture of how to direct Indonesia’s future national energy development policy.

One of the SDGs that Indonesia lacks is renewable energy development. This goal is about how to make renewables operate well and sufficiently to power the economy in a more environmentally friendly mode. Based on National Energy Policy, the government of Indonesia is preparing to leapfrog new renewable energy’s share in the national energy mix from 7.7 percent in 2016 to 23 percent by 2025, while rapidly reducing oil and coal’s share.

Global nonfossil-based electricity sources have not been significant in the past 10 years, going by data of the Organization for Economic Cooperation and Development (OECD). As a share of the total electricity mix, they account for only about 13 percent, beaten by coal, which has increasingly dominated with a 13 percentage point difference in the same period. Based on state electricity firm PLN statistics, Indonesia’s renewable energy share in electricity generation grew around 2 percentage points in the same period, while that for coal grew much faster at about 32 percentage points –15 times more.

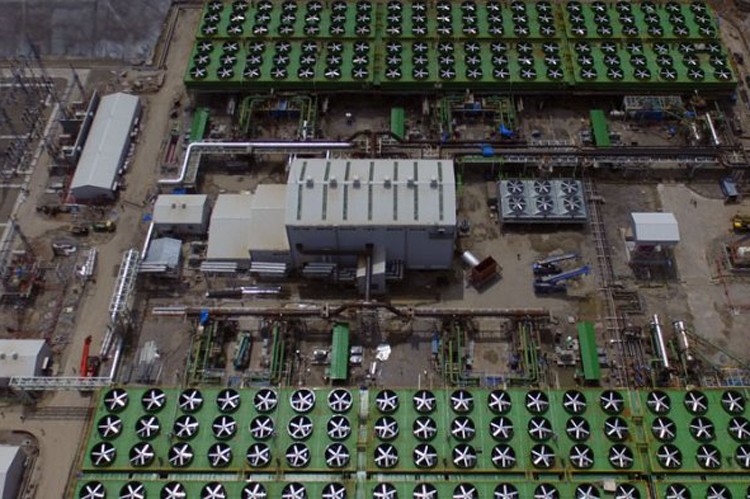

Despite the challenge, the potential of renewable energy in Indonesia is enormous, especially geothermal. Based on the Energy and Mineral Resources Ministry data, in 2018, Indonesia became one of the biggest geothermal producers with a 1.94-gigawatt (GW) installed capacity. It beat the Philippines as the previously second-biggest producer in the world. Since 2016, Indonesia’s geothermal capacity has been gradually growing at about 10 percent per year, which has contributed to a higher reduction in carbon dioxide ( CO2 ) emissions by 40 million tons in 2018 only, or about 8 percent of total emissions produced by the energy sector in 2010.

Indonesia is sitting on an additional 28 GW of geothermal hypothetical potential as of 2018. It targets geothermal installed capacity to be at 7.2 GW by 2025. Despite its natural challenge in the distributional chain, to unlock this potential, one will need to thoroughly examine what has been the “bottleneck” in the sector. This is called for especially because of its relatively slow development despite geothermal exploration starting in 1918.

First to be examined is geothermal energy’s price competitiveness. In a basic economics concept, price is determined by supply and demand. Electricity produced by a geothermal power plant is relatively expensive because of the high investment needed. Geothermal power in Indonesia could cost as much as 11.4 US cents per kilowatt per hour, but it is sold at a lower price because of the demand aspect. In comparison, coal-powered energy can sell for as low as 4.3 cents per kilowatt hour.

From the supply side, it is a no-brainer to connect the high price of geothermal power with its scale of economics. Its price is, however, still higher than that of other renewable energy. Based on various sources, mini hydro and waste-based power plants in Indonesia have high costs of $12 and 15 cents per kWh, respectively. Based on PT Geo Dipa, a state-owned geothermal developer, the cycle of a geothermal power plant uniquely consist of two processes, namely preproduction and production. Preproduction (exploration) is the riskiest and most crucial stage and therefore usually takes a long time. It is at this stage that the cost of the next stage is determined, by taking into account the capacity of the wells and infrastructure. While some investment is made at this stage, the process has high risks because of the possibility of an unexpected deviated capacity and the fact that building infrastructure necessitates land acquisition.