Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsUnderstanding the surge in container freight rates

Plenty of containers are now stuck in ports across the globe because the slow repositioning of empty containers created a shortage of these storage units, and delivery delays cause exorbitant demurrage costs.

Change text size

Gift Premium Articles

to Anyone

S

ea transportation is the backbone of the global merchandise trade, which is responsible for nearly 80 percent of global trade. Container vessels are the dominant contributors, owning a whopping 60 percent of all seaborne trade in terms of value. Disruptions in the container industry might affect global trade as a whole.

With a massive decline in industrial activities, the main-line operators (MLO) responsible for carrying cargo across the globe implemented a blank sailing to avoid huge losses. A blank sailing aims at canceling planned sails by either skipping a certain port or canceling the whole set of ports.

According to Sea-Intelligence Maritime Consulting in early June of 2020, an alliance of MLOs announced that blank sailing has happened in several main trading routes globally. There were 126 in the Asia-North America route and 94 in the Asia-Europe route. The route between China and North America is the largest bilateral flow of merchandise trade, according to a United Nations Conference on Trade and Development (UNCTAD) report in 2019.

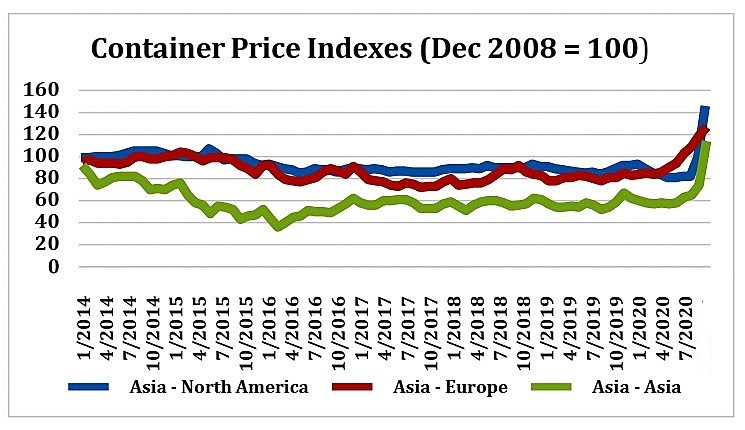

The subsequent impact of the blank sailing was soaring fright rates. Based on Bloomberg data, from early 2020 until the end of 2020, there have been ascending freight rates in major trade routes. The rate between Asia and North America increased by 58.89 percent, whereas the route connecting Asia-Europe rose by 51.19 percent and the intra-trade rates within Asia increased by 83.87 percent. In some major routes, the increase is simply inexplicable. The freight rates of Singapore-Rotterdam was US$2.015 per forty feet-equivalent unit (FEU) in early 2020, and now it books about $12.203 — equivalent to sixfold in only a span of two years

Plenty of containers are now stuck in ports across the globe because the slow repositioning of empty containers created a shortage of these storage units, and delivery delays cause exorbitant demurrage costs.

The shock in the supply side has been decoupled with the demand side. The demand for commodities has increased thanks to economic recovery starting in the second half of 2020. To illustrate, McKinsey reported that in the first quarter of 2021, expenditures for furniture and household equipment in the United States increased by 28 percent and motor vehicles and parts by 31 percent, to compensate for the drop in expenditures for recreation by 25 percent, and food and beverages, as well as accommodations by 11 percent, compared to the first quarter of 2019. This huge swap from services to manufacturing goods was a significant shock to the container shipping industry, especially its efforts to carry these goods across the globe.

To make things worse, sea transportation is also exposed to risks and irregularities that complicate the supply chain. For example, in March, there was huge congestion in the Suez Canal after a 20,000-TEU Evergreen container ship got stuck in the waterway. The incident was responsible for $6.7 million for every minute of postponement.

Other than that, a disruption in Yantian port, the third-busiest port in the world that only operated at 30 percent capacity in order to prevent the spread of the Alpha variant of COVID-19, has also contributed to the havoc. This caused the dwell time of ships to double to 16 days in the port, entailing a cascading impact of congestion across the world.

What is the outlook for freight rates?

On the supply side, the issue of congestion is starting to alleviate. Busy ports such as Yantian started to operate at maximum capacity from June 28 to clear the backlog. Vaccination has facilitated the containment of COVID-19, allowing ports and logistics back on track. In an effort to increase capacity, new container ships have been ordered, but they require at least 18 months to be ready. In addition, the shipping industry must be careful not to be too aggressive in ordering new vessels, as an oversupply might happen and cause big losses if not well foreseen.

The freight rates might not return to pre-C0VID-19 levels any time soon as we are approaching the peak seasons of August, September and October, which is when many retail shops are filling their stock in preparation for holiday sales. It is expected that the rates will be close to the initial level by mid-2022.

In Indonesia, this condition has contributed to some hurdles for exporters, especially small and medium enterprises (SME), whose products might be cheaper than the freight rates. Bank Indonesia (BI) data shows that the volume of Indonesia’s non-oil exports dropped by 12 percent in 2019-2020. Textile products, fatty acids, leather and rubber were among the impacted commodities.

The government should realize that intervention is needed in the current situation. In the US, presidential executive orders have been introduced to encourage the Federal Maritime Commission to protect US exporters from hiking fees and to improve detention and demurrage practices for container traffic — something we might consider implementing here.

***

Ibrahim Kholilul Rohman is a lecturer at the School of Economics and Business, University of Indonesia. Ahmad Nidham Khalid is a researcher at Samudera Indonesia Research Initiatives. The views expressed are personal.