Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

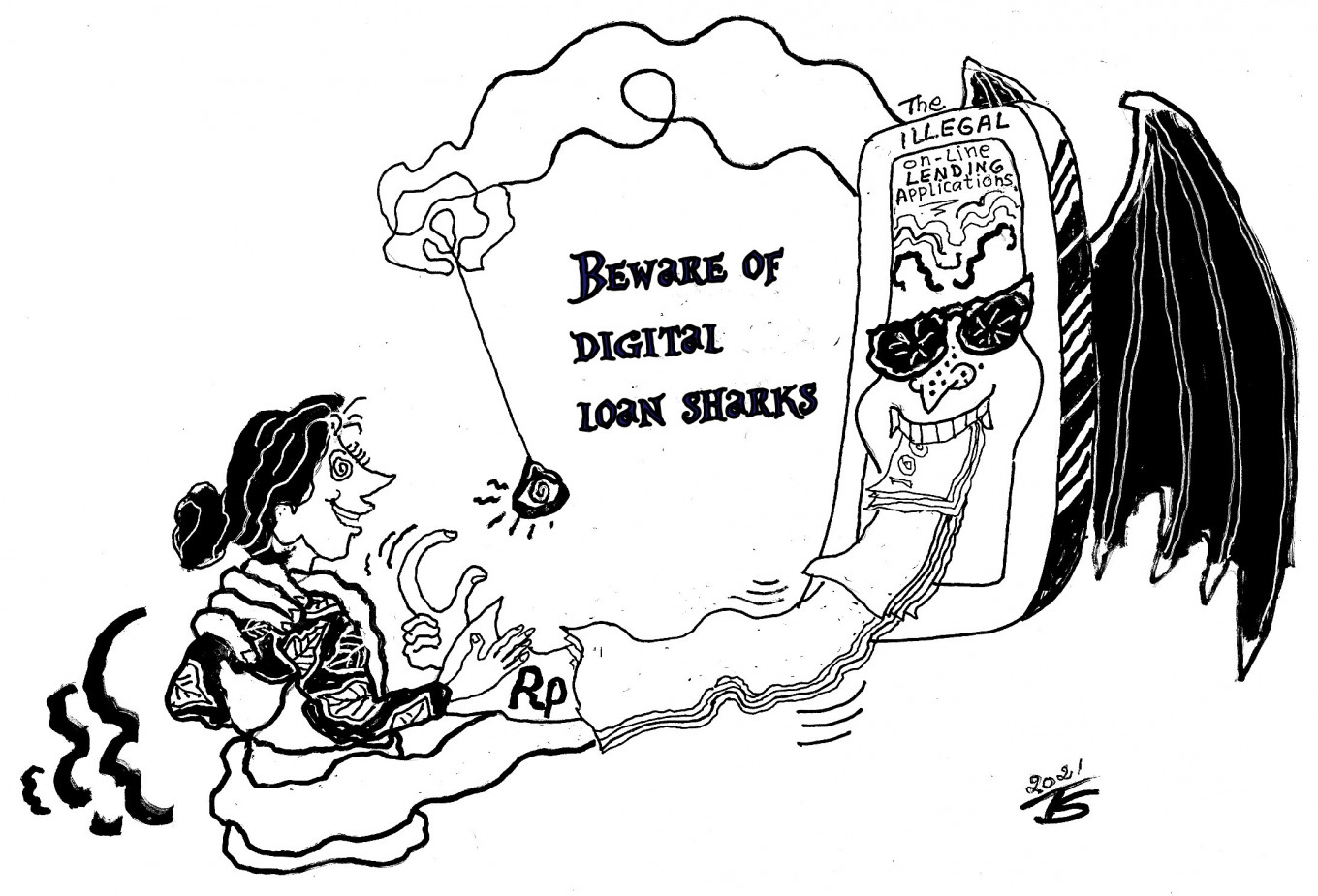

View all search resultsDebts to illegal online lenders: To pay or not to pay?

If disputed in court, loan agreements made by unlicensed businesses can be ruled illegal and therefore null and void.

Change text size

Gift Premium Articles

to Anyone

R

ecent police raids on the offices of illegal digital moneylenders, also known as pinjol ilegal, show the government’s firm stance against such operations. Much has been done to eradicate the crime, which targets victims online, including closing thousands of unregistered digital lending accounts and imposing a moratorium on fintech lending licenses.

A high-ranking government official has also stated that due to the unlawful nature of the pinjol ilegal business model, existing money lending arrangements with their borrowers can be nullified. Departing from the usual advice of encouraging borrowers to quickly pay their debts or try to negotiate for restructuring, he further suggested that borrowers should not pay off their loans to pinjol ilegal.

Unfortunately, not everyone can tell the difference between illegal and legal lenders. A lack of understanding may lead a borrower to make a wrong judgement and stop paying installments to a legitimate lender. It will cost the borrower in more interest and penalty charges. Both parties will then have to spend extra time and effort to deal with the dispute arising from the borrower’s unilateral action. Without clear guidance and further clarification, the suggestion to stop payments may pose a challenge for the online lending business.

Rather than dwelling on legal arguments if the suggestion is a sustainable solution, let us step back to revisit the factors that gave rise to the pinjol ilegal dilemma. First is the huge demand for funding in the community, either for daily or emergency purposes or for productive purposes, such as micro business capital.

Second is the inability of banking institutions to meet this demand, which can be due to arduous bureaucracy or the lack of economies of scale required to service it. The demand is then met by financial technology companies or fintechs, which offer loan products through peer-to-peer lending platforms. Unfortunately, this opportunity also tempts illegal lenders to join the online business.

Third is the inability of consumers to distinguish between the two groups, that is which businesses are compliant with the law and which are not. Those with low digital and financial literacy are more vulnerable to the aggressive sales tactics employed by illegal businesses. As a result, they may fall into the trap with serious consequences. This harms the victims and is detrimental to the growth of our financial inclusion because such illegal practices may damage the reputation of, and people’s trust in, the financial industry.

Considering these consequences, relevant stakeholders should be invited to contribute and be part of the solution. These include key players in the financial services industry, the victims and the general public.