Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe next pedestal of the payments war: Buy Now, Pay Later

BNPL is on course to contribute 12 percent of all e-commerce sales in APAC by 2023, with a projected BNPL net revenue of up to $1.5 billion in Southeast Asia that same year. Capitalizing on this expected growth will require a strategy that reflects the local landscape as well as rapidly evolving market conditions.

Change text size

Gift Premium Articles

to Anyone

B

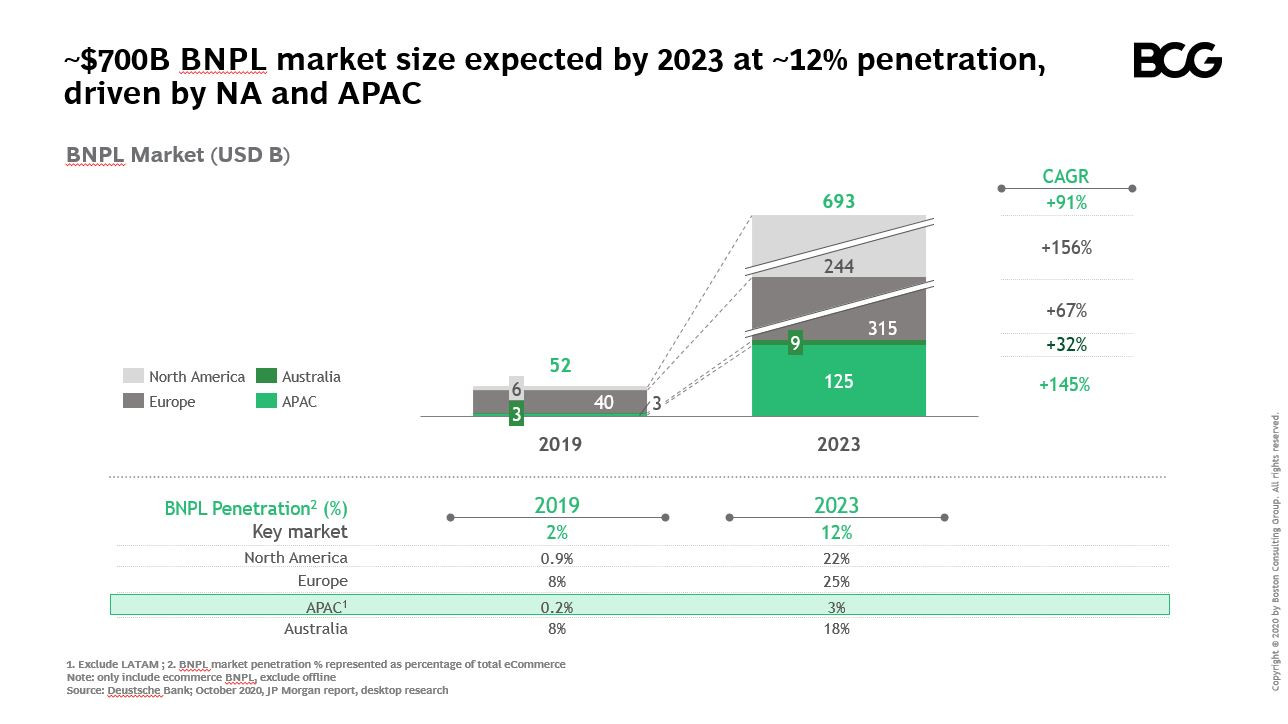

uy Now, Pay Later (BNPL) has seen remarkable growth in recent years and is on track to achieve a global market value of US$700 billion by 2023. This 90 percent compound annual growth rate (CAGR) reflects the growing penetration of this simple transactional instrument, with consumers purchasing a product now with an agreement to pay for it later.

There have been some significant moves in the space in recent years, with major BNPL provider Klarna recently valued at over $45 billion, Australia’s Afterpay purchased for $29 billion by Square, and the entrance of major fintech firm PayPal.

BNPL is expected to represent 12 percent of all e-commerce sales across the Asia Pacific (APAC), North America, Europe and Australia by 2023, up from 2 percent today. Eighty percent of all BNPL transactions will be completed online in mature markets, with a doubling of growth for in-store BNPL purchases. With low penetration today due to a lack of customer awareness and the limited availability of financial providers, APAC is expected to be the next growth story with a remarkable 145 percent projected CAGR to 2023.

Buying into BNPL in Southeast Asia

The region’s retail sales market is expected to expand from $374 billion to $457 billion by 2023, with online sales increasing 44 percent annually to represent 20 percent of total sales. That reflects a valuable growth opportunity in BNPL penetration.

With attractive market demographics and early signs of accelerating adoption, it is expected that Southeast Asia’s addressable market will be as high as $27 billion by 2023, with a projected BNPL net revenue of up to $1.5 billion. Market penetration of 6 percent is projected to be double that of the wider APAC region. In countries like Indonesia, surveys show a whopping 78 percent of respondents expressing familiarity with BNPL and its advantages.

Funding in Southeast Asia is already outpacing APAC, driven by investments in Singapore and Indonesia. Southeast Asia’s BNPL fintech companies attracted 30 percent of total APAC BNPL funding between 2016 and 2020, or 10 percent of the global total. This investor confidence is seen in companies such as Akulaku, FinAccel and Redivo.