Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

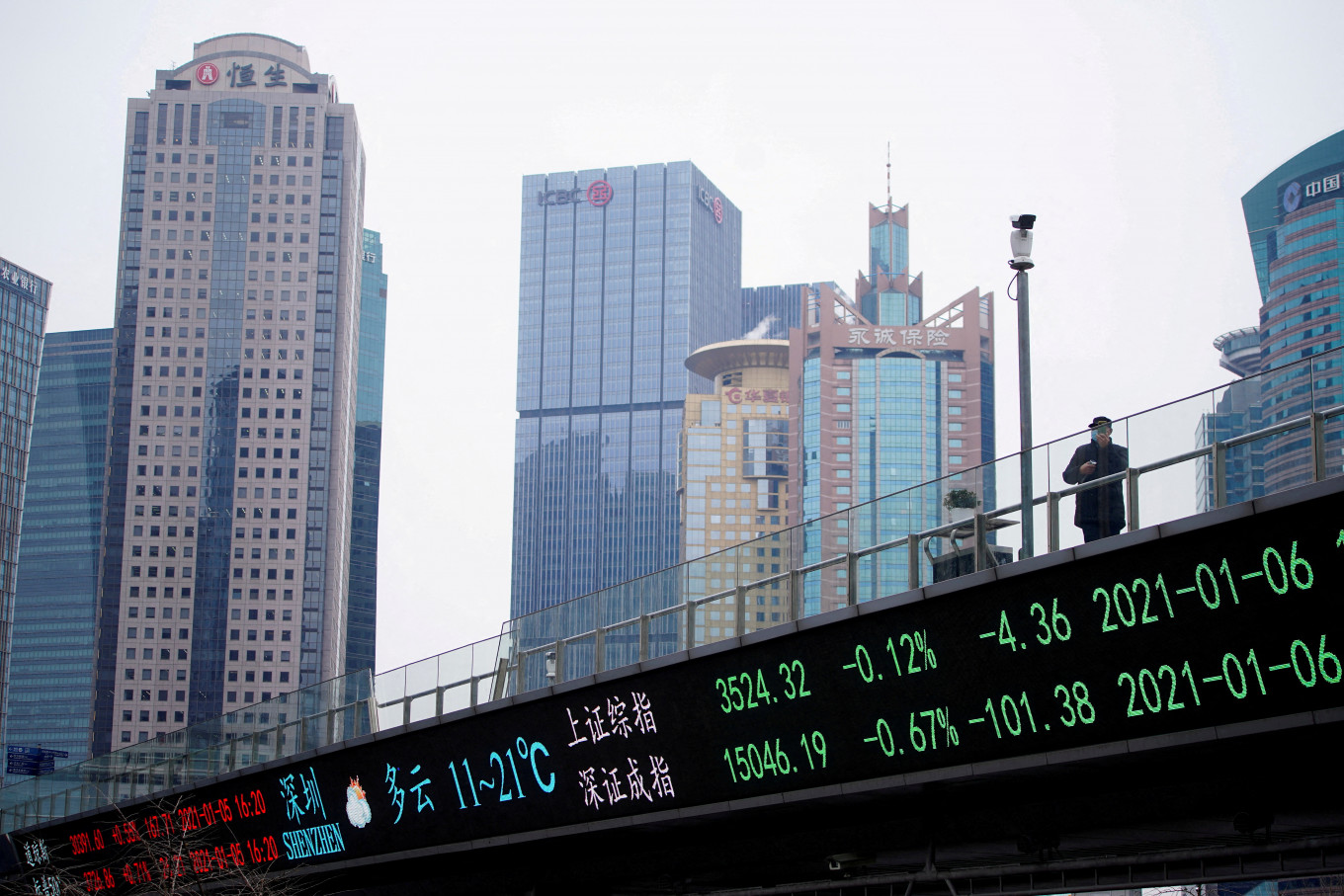

View all search resultsChina stocks rise on higher-than-expected borrowing rate cut

Change text size

Gift Premium Articles

to Anyone

C

hina stocks rose on Friday after Chinese banks cut the benchmark reference rate for mortgages by an unexpectedly wide margin to revive the ailing housing sector and to prop up a slowing economy hit by severe COVID-19 outbreaks.

The CSI300 index rose 1.4 percent to 4,056.03 at the end of the morning session, while the Shanghai Composite Index gained 1.1 percent to 3,131.40.

The Hang Seng index added 1.8 percent to 20,489.63 points. The Hong Kong China Enterprises Index gained 2.1 percent to 7,046.06.

So far this week, the CSI300 index is up 1.7 percent; the Hang Seng index has added nearly 3 percent and is eyeing the biggest weekly gain in two months.

The five-year loan prime rate (LPR) was lowered by 15 basis points to 4.45 percent from 4.60 percent, while the one-year LPR was unchanged at 3.70 percent.

The move "suggests that they are worried about piling risks in the housing sector," said Carlos Casanova, senior Asia economist at Union Bancaire Privee in Hong Kong.

"There will likely be more rate cuts to come in the next few months," said Zhiwei Zhang, chief economist at Pinpoint Asset Management. "I also expect more policy measures on fiscal, property, and platform economy."

Shanghai reported three new cases of COVID-19 outside quarantined areas for Thursday, snapping five days of no such cases.

Foreign investors were net buyers of A-shares, with Refinitiv data showing inflows of more than 8.3 billion yuan ($1.24 billion) through Stock Connect as of midday break.

Real estate developers dropped 1.3 percent following the rate cut, after a 2.3 percent jump in the previous session.

Coal miners surged 4.2 percent, transport companies climbed 3.4 percent, while healthcare and consumer staples shares added 1.7 percent each.

US President Joe Biden may talk with his Chinese counterpart Xi Jinping in the coming weeks, national security adviser Jake Sullivan said on Thursday.

Tech giants listed in Hong Kong surged 3.5 percent, with index heavyweights Tencent, Meituan and Alibaba up between 2.3 percent and 3.5 percent.