Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsMore rate hikes 'likely' needed to lower inflation: Fed official

Change text size

Gift Premium Articles

to Anyone

A

US central bank official said Saturday that more interest rate hikes "will likely be needed" to bring inflation down further, shortly after policymakers lifted rates to the highest level since 2001.

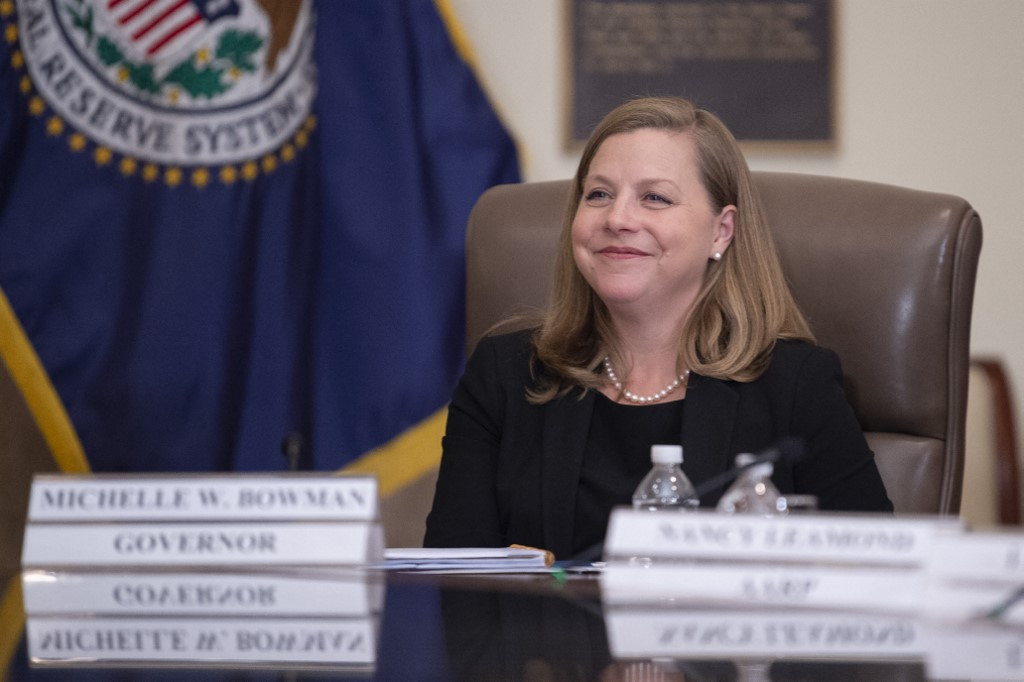

Federal Reserve governor Michelle Bowman's prepared remarks to an event in Colorado also came after a mixed employment report on Friday showing that hiring in the United States has slowed but wage gains remained robust.

Bowman said she supported the policy-setting Federal Open Market Committee's (FOMC) decision for a rate hike in July given "strong economic data and still elevated inflation."

"I also expect that additional rate increases will likely be needed to get inflation on a path down to the FOMC's two percent target," she added in her remarks.

On Friday, Labor Department data showed that the world's biggest economy added 187,000 jobs in July and 185,000 in June -- slowing from before.

But wage gains held steady at 0.4 percent, and were 4.4 percent higher than the same period a year ago in July.

Analysts noted that this could still be too elevated for the Fed.

"The demand for workers continues to exceed the supply of available job seekers, adding upward pressure on prices," said Bowman in her Saturday speech.

She added that she would be seeking "consistent evidence" that inflation is on a meaningful path down toward the Fed's two percent target, when mulling how long the federal funds rate needs to remain restrictive.

"I will also be watching for signs of slowing in consumer spending and signs that labor market conditions are loosening," she said.

Officials are expected to assess the labor market report for August, along with upcoming inflation readings, before making their next rate decision in late September.