Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsUS stock futures, dollar rise after Biden-Trump debate

While the election is four months away, investors anticipate a Trump presidency would mean lower corporate taxes, tougher trade relations and therefore higher stock prices and bond yields.

Change text size

Gift Premium Articles

to Anyone

U

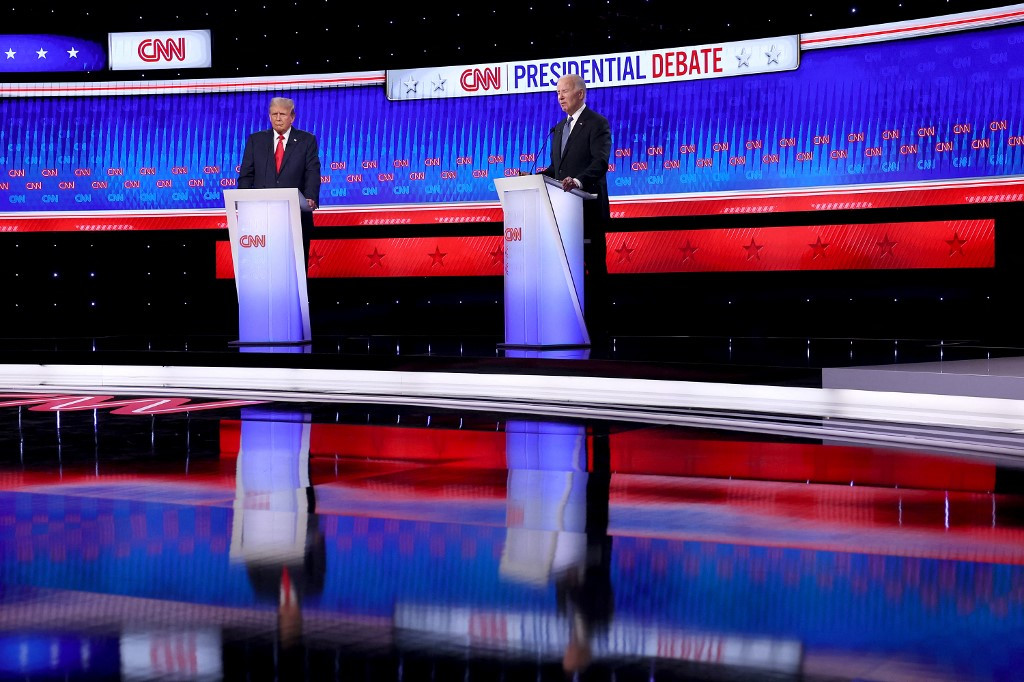

S stock futures and the dollar rose in early Asian trading on Friday as 2024 presidential election candidates Joe Biden and his predecessor Donald Trump sparred in their first debate, with Trump viewed as putting in a stronger showing than his opponent.

While the election is four months away, investors anticipate a Trump presidency would mean lower corporate taxes, tougher trade relations and therefore higher stock prices and bond yields.

"Wall Street indices have crept higher over the past hour, which could be taken as a sign that Trump made the better case - as we all know he is Wall Street friendly," said Matt Simpson, senior market analyst at City Index in Brisbane.

The US dollar rose to a 10-day high against the Mexican peso and climbed against other trade-sensitive currencies, including the Canadian dollar.

Stock futures extended gains as the debate progressed, with the S&P 500 E-minis rising 0.3 percent and Nasdaq 100 E-minis up 0.46 percent.

China's benchmark edged up 0.4 percent while Hong Kong's Hang Seng Index .HSI was flat as the two US presidential candidates debated tariffs on China, with Trump criticizing Biden for not doing more.

Biden, sounding hoarse and tentative at times, stumbled over his words on several occasions during the debate's first half-hour. Trump rattled off one attack after another including about Biden's handling of the economy, though fact-checkers deemed many of his comments misleading or false.

Biden acknowledged that inflation had driven prices substantially higher than at the start of his term but said he deserves credit for putting "things back together again" following the coronavirus pandemic.

Trump asserted he had overseen "the greatest economy in the history of our country" before the pandemic struck and said he took action to prevent the economic free-fall from deepening even further.

Karl Schamotta, chief market strategist at payments company Corpay in Toronto, saidBiden turned in a "disastrous performance" that had triggered a sharp rise in the odds of a Trump victory.

"This is translating into a tumble in trade-sensitive currencies," he said.

Both Biden and Trump have favored a tough trade stance by imposing and threatening tariffs, on China in particular. But investors are leery about the impact of tariffs on inflation.

Online prediction market PredictIt's 2024 presidential general election market showed Biden's odds down to 39 percent from 45 percent a day earlier, while Trump's were up to 61 percent from 55 percent.

US Treasury yields rose slightly, with those on 10-year notes up 2 basis points to 4.313 percent and 5 basis points higher for the week but still off 20 basis points for June so far.

Analysts at JPMorgan noted Trump's team had proposed wide-scale tariffs on imports, which would lift prices, while restrictions to immigration would put upward pressure on wages and extended tax cuts would likely add to government debt.

"Investors are hedging against a more isolationist turn in the United States after the November election," Corpay's Schamotta said.

Some investors, however, warned against reading too much into the move in stock market futures.

"We are in the early days with more to go. Don't assume an outcome," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder.