Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGoTo ahead of Sea Ltd. and Grab in ESG ratings: Morningstar research

Change text size

Gift Premium Articles

to Anyone

T

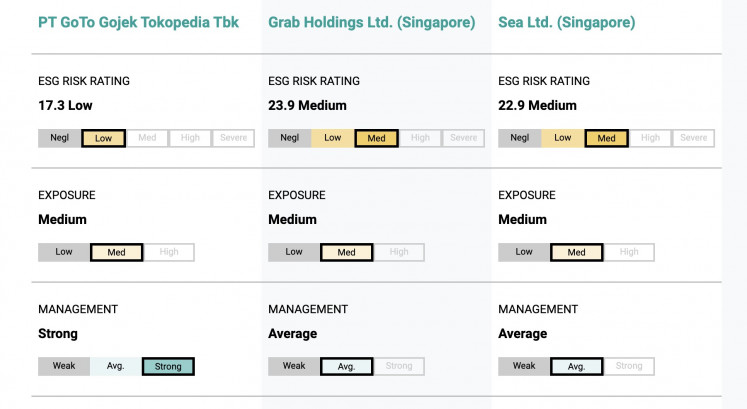

he latest global environmental, social and governance (ESG) risk ratings by agency Morningstar Sustainalytics has ranked GoTo ahead of its competitors Sea Ltd. and Grab.

GoTo Group, Indonesia’s largest digital ecosystem, scored an ESG Risk Rating of 17, putting it in the low risk category. Both Sea Ltd. and Grab are placed in the medium risk category, with a score of 22.9 and 23.9 respectively.

A higher score indicates a higher risk of material financial impacts driven by ESG factors, with a score between 30 and 40 considered as high risk and above 40 as severe.

GoTo’s ESG Risk rating ranks the company at 196th out of 1,094 companies assessed in the Software & Services category, with Sea Ltd. placing 619th and Grab at 732nd. Across all sectors, GoTo's ESG rating is also higher compared to its competitors, ranking 2,961 out of 16,009 global companies in all sectors, while Sea Ltd. and Grab trailed at 6,658 and 7,395 respectively.

GoTo, considered a ‘Core’ company by Morningstar Sustainalytics, was assessed by up to 30 management indicators to obtain its low risk status. Competitors Grab and Sea Ltd. were categorized as ‘Comprehensive’ companies, based on their market capitalization. Morningstar’s methodology ensures the assessments of both categories of companies are directly comparable.

A joint three-part report by Morningstar Sustainalytics and Natixis Investment Managers Solutions on August 2024, analyzing the return- and risk-related benefits of ESG risk ratings found that portfolios with low ESG risk “typically display better raw and risk-adjusted returns than portfolios with high ESG risk”, as well as displaying a better ability to withstand market turbulence and financial crises.

The study showed that reducing ESG risk is beneficial for performance and risk mitigation, noting associated factors including lower volatility, greater valuation certainty, stronger economic moats and financial health, as well as higher valuations.