Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsNew OJK warning on P2P lending apps leaves users unfazed

The OJK's latest initiative to deter people from taking out loans they cannot afford might not be as effective as intended, according to several frequent borrowers who spoke to the Post.

Change text size

Gift Premium Articles

to Anyone

T

he Financial Services Authority (OJK) has mandated peer-to-peer lending (P2P) platforms to display visible warnings on their websites and apps to discourage people without the capacity to repay their debts from taking out new loans.

However, users interviewed by The Jakarta Post said the warning hardly deterred them from continuing to borrow money due to financial pressures, regardless of the risks of owing more than they could afford to repay.

The OJK’s fintech warning policy is similar to the health warning label on cigarette packages and advertisements mandated by governments around the world, including Indonesia’s, to curb smoking prevalence and related health risks.

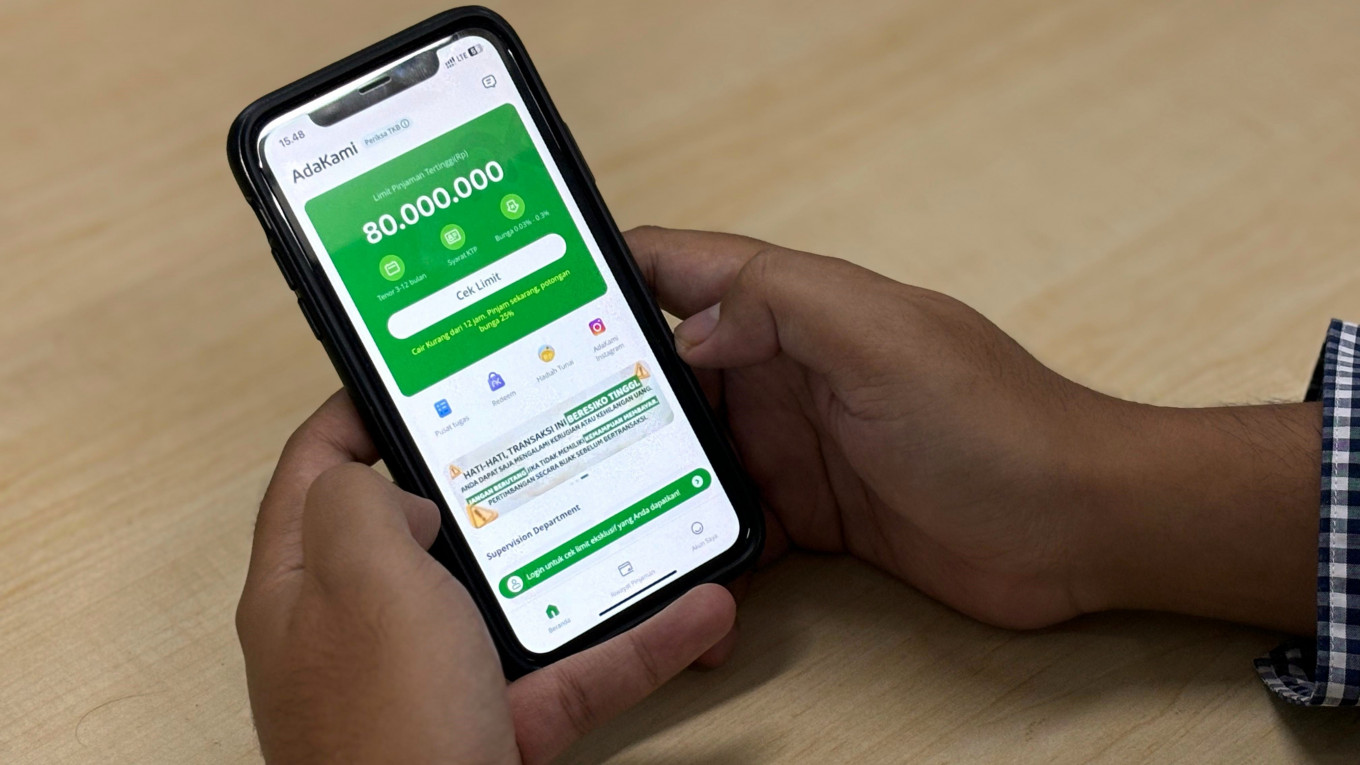

A full-page warning is displayed on a peer-to-peer (P2P) lending website in this screenshot taken on Sept. 13, 2024. The Financial Services Authority (OJK) and industry players have launched a new measure to discourage people from applying for loans they cannot repay. (JP/Aditya Hadi)“Beware, this is a high-risk transaction. You may experience [financial] losses or lose your money. Do not go into debt if you do not have the ability to pay. Consider carefully before making a transaction,” reads one such warning on a P2P lending platform.

Yasmine Meylia, executive director of the Indonesia Joint Funding Fintech Association (AFPI), told the Post on Thursday that the association had been conducting outreach efforts to ensure member compliance with the OJK’s warning policy since it was imposed in July.

She added that the new policy was the result of discussions between the OJK and the AFPI to ensure transparency and to educate consumers.