Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOil prices jump on report of Israel prepping Iran strike

Change text size

Gift Premium Articles

to Anyone

C

rude prices surged Wednesday following a report that US intelligence suggested Israel was planning a strike on Iranian nuclear facilities, which would send geopolitical tensions into overdrive and fuel regional conflict fears.

While safe haven gold pushed almost two percent higher, the news from CNN appeared to be having little detrimental effect on Asian equities in early trade, with most extending the previous day's rally.

Still, investors are keeping tabs on China-US relations after Beijing hit out at Washington's "bullying" over chip export controls, just over a week after the two sides dialed down trade tensions by temporarily slashing eye-watering tit-for-tat tariffs.

Both main crude contracts jumped almost two percent after CNN reported multiple US officials as saying the government had received intelligence indicating Israel was preparing to target Iranian atomic facilities.

There are fears that such a sharp escalation could tip the Middle East into a war, with tensions already high over Israel's strikes on Gaza.

"This is the clearest sign yet of how high the stakes are in the US Iran nuclear talks and the lengths Israel may go to if Iran insists on maintaining its commercial nuclear capabilities," Robert Rennie, at Westpac Banking Corp, said.

"Crude will maintain a risk premium as long as the current talks appear to be going nowhere."

Crude prices have risen around 15 percent since the start of the month on softening worries about the economic outlook as tariff tensions grow relatively calmer.

Equities mostly built on Monday's gains on trade talk hopes.

Hong Kong, Shanghai, Sydney, Seoul, Wellington, Taipei and Manila all outshone Tokyo and Singapore.

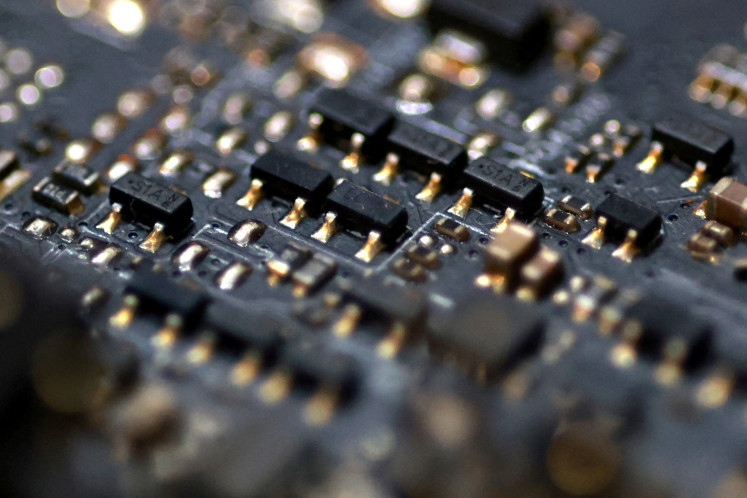

But the recent detente between China and the United States suffered a jolt Wednesday when Beijing slammed Washington's "bullying" chip export controls.

It also warned it would take steps against measures aimed at restricting Chinese access to high-tech semiconductors and supply chains.

The remarks came after US officials last week unveiled guidelines warning firms that using Chinese-made high-tech AI semiconductors, most notably tech giant Huawei's Ascend chips, would put them at risk of violating US export controls.

Several Federal Reserve members appeared to dampen hopes they will cut US interest rates anytime soon as they warned over the effects of Trump's tariffs on the economy and inflation.

St. Louis Fed chief Alberto Musalem warned the measures would likely hurt growth and jobs, even as countries look to dial down the blistering tariffs the president proposed.

"Even after the de-escalation of May 12 [with China], they seem likely to have a significant impact on the near-term economic outlook," Musalem said.

"On balance, tariffs are likely to dampen economic activity and lead to some further softening of the labor market."

He added that "committing now to ignoring higher inflation from tariffs, or to easing policy, runs the risk of underestimating the level and persistence of inflation".

Atlanta Fed chief Raphael Bostic said Moody's ratings cut and Trump's proposed tax cuts could compound uncertainty and force officials to keep rates elevated.