Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsUnionPay’s New Four-Party Model Makes Cross-Border QR Payments Seamless in Indonesia

Change text size

Gift Premium Articles

to Anyone

C

ross-border QR payments between China and Indonesia are entering a new phase, as UnionPay International and Indonesia’s national payment institutions have launched a pilot to build an interoperable framework for seamless transactions between the two markets.

The pilot, developed under a new four-party model and guided by both countries’ central banks, brings together local switching networks and payment service providers to explore a more efficient and inclusive approach to cross-border digital payments.

Digital cross-border payment solutions are becoming increasingly important for tourism and retail. As a payments solution provider, UnionPay helps make these payments faster, seamless and more convenient. Unlike traditional payments, which can be slow, costly or require physical transactions using foreign currencies, QR code-based solutions offer transparency, speed and ease of use, supporting growing travel and commerce between both countries.

This transition aligns with Indonesia’s national digitalization agenda and ASEAN’s collective push to empower micro, small and medium enterprises (MSMEs). By enabling merchants to accept foreign payments instantly without additional hardware or integration costs, systems like the UnionPay APP support regional economic growth and tourism recovery.

QR payments on the rise

Southeast Asian countries have advanced rapidly in digital financial services, with QR code payment systems increasingly embedded in daily transactions. According to the e-Conomy SEA 2024 report by Google, Temasek and Bain & Company, digital payments across six regional economies reached US$220 billion in 2024, representing more than 80 percent of the region’s e-commerce transaction volume.

Indonesia has seen particularly fast adoption. On Oct. 10, 2025, Coordinating Economy Minister Airlangga Hartarto announced that users of the Quick Response Code Indonesian Standard (QRIS) exceeded 50 million, surpassing credit card users nationwide and cementing QRIS as the country’s mainstream cashless payment method.

Despite widespread adoption however, interoperability remains limited. Many countries have achieved “one code access” domestically, yet QR payments often cannot function across borders. Fragmented standards lead to inconsistent user experience, especially in offline travel scenarios.

Cross-border QR payment systems still face several hurdles before they can achieve true seamlessness. One of the biggest challenges is unequal access. In many markets, the system works in only one direction, not reciprocally. This creates a fragmented experience and limits the benefits for both consumers and merchants.

Another challenge is the diverse payment systems and currencies across countries. Each market often relies on different platforms, standards and regulatory frameworks, making interoperability difficult and slowing adoption.

UnionPay’s approach is designed to bridge these gaps. By building an interoperable framework grounded in mutual openness and equal access, UnionPay aims to ensure that cross-border QR payments are not only convenient but also inclusive, benefiting users on both sides of the transaction and contributing to a more connected digital payment ecosystem.

Strategic collaboration in the new four-party model

UnionPay’s cross-border QR payment pilot between China and Indonesia did not emerge overnight: It was built through a strategic alliance among key players from both countries.

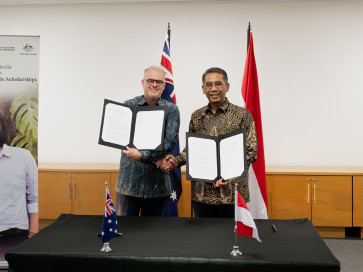

The collaboration began in January 2025 with UnionPay’s cooperation memoranda with ASPI, Ant International and the Bank of China (Hong Kong) Jakarta Branch, establishing the foundation for technical and regulatory alignment.

With guidance from Bank Indonesia and the People’s Bank of China under a government-to-government (G2G) framework, the project advanced into system integration with Indonesia’s four national switching networks—Rintis, ALTO, Artajasa and Jalin (collectively known as RAJA).

A key milestone arrived on September 11, 2025, when UnionPay International and ASPI, together with RAJA, announced the pilot launch of cross-border QR payment linkage between the two markets. This marked a major step toward enabling seamless digital payment interoperability.

During the ongoing sandbox phase, selected users from China’s mainland can make QR payments with those two Chinese mobile payment app at over 40 million QRIS merchants in Indonesia. Meanwhile, pilot merchants in the UnionPay and Alipay networks in the Chinese mainland can also accept QR payments from more than 30 mainstream Indonesian mobile payment apps including DANA, ShopeePay, GoPay, myBCA and Livin’ by Mandiri.

The sandbox is currently limited to whitelisted participants and merchants. The cross-border QR payment linkage is expected to be fully operation once the sandbox phase is completed.

This rollout is built on a next-generation four-party model, which extends the traditional card payment architecture by incorporating digital wallets and aggregated QR payment providers on both the issuance and acceptance sides. The model respects existing national payment infrastructures while making them interoperable, instead of replacing them.

Under the new four-party model, UnionPay establishes bilateral and multilateral cooperation with other payment institutions, benefiting partners, users and the wider industry. Local institutions gain access to China’s vast payment market, and users can make cross-border payments without installing new apps. This creates an ecological win-win, numerically expressed as “1+1>2”, moving beyond the traditional zero-sum mindset in global payments.

Seamless integration across borders

A core principle of the cooperation is full integration without altering the established QRIS system: UnionPay adjusted its framework to ensure full two-way scanning compatibility.

Within the arrangement, Ant International provides technology support while the Bank of China (Hong Kong) Jakarta Branch leads local currency settlement. This ensures compliance with central bank directives that cross-border QR payments must be settled using local currencies, reducing exchange friction while supporting financial sovereignty.

As a result, Indonesian merchants can widen their customer base while Chinese visitors enjoy the familiarity of their preferred e-wallet, without needing cash or additional apps in the coming future.

UnionPay continues expanding QR interoperability across Asia and beyond. Up to now, UnionPay has launched or is working on QR payment linkage with the local switches of 50 countries and regions outside China's mainland. As a result, tens of millions of merchants overseas will accept UnionPay QR payments.

This momentum continues across Southeast Asia. In 2024, UnionPay signed a milestone agreement with Vietnam’s NAPAS under G2G cooperation, followed by partnerships with Laos’s LAPNet. In 2025, UnionPay integrated with Thailand’s PromptPay and enabled two-way QR payments with Cambodia’s Bakong.

These collaborations align with regional initiatives to empower MSMEs to access cross-border digital commerce. In Indonesia alone, 96.3 percent of tourism-related enterprises are MSMEs, from homestays and cafés to travel operators.

The impact aligns strongly with travel trends. According to Statistics Indonesia (BPS), arrivals from China rose 52 percent year-on-year to 1.19 million in 2024, exceeding national targets. Chinese travelers now contribute 8.6 percent of foreign exchange earnings and spend $1,188 per trip on average, among the highest globally.

As cross-border QR code interoperability expands, payment convenience can further stimulate tourism, increase merchant revenue and strengthen economic ties between partnering countries.

Looking ahead, ongoing development will allow Indonesian users to scan and pay at all UnionPay and Alipay QR-enabled merchants in the Chinese mainland, covering nearly the entire QR merchant ecosystem. Travelers from both countries will be able to use their preferred domestic payment methods abroad, making cross-border travel more seamless, secure and inclusive.

With QR code integration, local currency settlements and G2G partnership model, UnionPay’s model demonstrates how fintech can strengthen region-wide economic partnerships, empower MSMEs and advance ASEAN’s inclusive digital transformation.