Allianz taps new customer base with newly introduced Sharia entity

Change text size

Gift Premium Articles

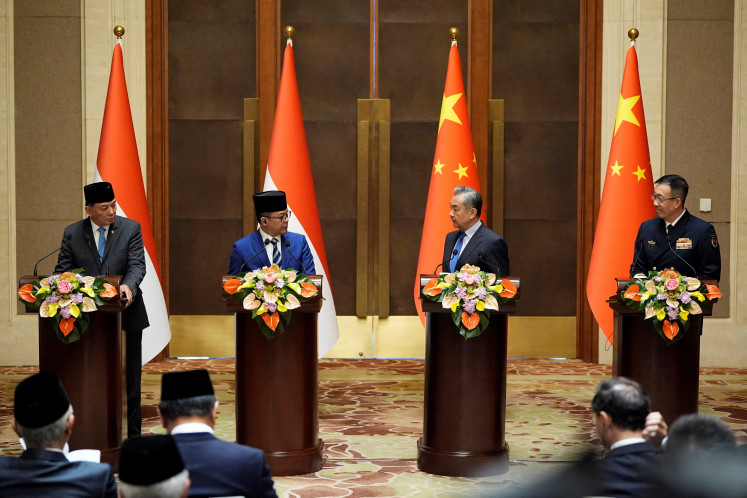

to Anyone

Sunadi, president director of Allianz Utama Indonesia, Alexander Grenz, country manager and president director of Allianz Life Indonesia, Anusha Thavarajah, regional chief executive officer of Allianz Asia Pacific,and Achmad K. Permana, president director of Allianz Life Syariah Indonesia attend the inauguration of PT Asuransi Allianz Life Syariah Indonesia in Jakarta on Nov. 16.

Sunadi, president director of Allianz Utama Indonesia, Alexander Grenz, country manager and president director of Allianz Life Indonesia, Anusha Thavarajah, regional chief executive officer of Allianz Asia Pacific,and Achmad K. Permana, president director of Allianz Life Syariah Indonesia attend the inauguration of PT Asuransi Allianz Life Syariah Indonesia in Jakarta on Nov. 16.

A

llianz, one of the biggest insurance companies in the region, launched the newly established PT Asuransi Allianz Life Syariah Indonesia, as evidence of their commitment to providing services adhering to the values of Sharia goodness and to further penetrate the Indonesian market.

While Allianz Sharia has been operational since earlier this month, the launch event was held on Nov. 16, and was inaugurated by Vice President Prof. Dr. (H.C.) K. H. Ma'ruf Amin.

Also in attendance were the Commissioner Board of the Financial Services Authority (OJK), and the chief executive of insurance supervision, suretyship, and pension fund Ogi Prastomiyono, country manager and CEO of Allianz Life Indonesia Alexander Grenz, and CEO of Allianz Life Syariah Indonesia Achmad K. Permana. They were also joined by the German Ambassador to Indonesia H.E. Ms. Ina Lepel, and the regional chief executive officer of Allianz Asia Pacific Anusha Thavarajah.

“According to the World Bank statistics, this is a growing market. There are US$2 trillion in Sharia compliant assets around. And the market is growing at 10 to 12 percent. So it's not surprising that a company like Allianz also tries to access this very interesting and dynamic market segment,” said Ina on the current landscape of the industry.

The Financial Sharia Development Report from OJK states that the Sharia economy continued to experience significant growth until the end of 2022. The total assets of the sharia non-bank financial industry (IKNB) reached Rp 146.12 trillion, with asset growth at 20.88 percent. Sharia life insurance accounted for 5.62 percent of the market share, indicating significant market potential.

As a country with one of the largest Muslim population, Indonesia shows tremendous potential to be a leading market for insurance that lines up with the values of sharia, which encompasses justice, transparency, inclusivity, and mutual assistance. This is an addition to Allianz’s commitment of inclusive protection for all.

“When you look at the population in Southeast Asia, a big part of our population is the Muslim population and when we want to offer protection to the Muslim population, it is important that we offer them the right products that meet their beliefs and values and that is why Allianz continues to be present today in 15 markets. In the 15 markets, every single market has very different cultural values, religious values, economic values and what we want to do is to make sure in every single market that we do the right thing to protect more people in each of the markets,” said Anusha.

Alex said that the insurance company started the first sharia business unit in 2006 and the demand has evolved greatly over the years. He added that with Allianz Sharia launched as a separate entity, it opens the doors to more opportunities with new ways to approach the growing customer base.

He revealed that Sharia insurance is by far the fastest growing area in the industry with the lowest penetration, hence it is a responsibility for Allianz Sharia to reach all layers of the Indonesian society. Concurring, Ina also said that underinsurance is the biggest risk for marginalized people, as the population that is most affected by natural disasters and other life hazards.

“Allianz Sharia always provides protection to its participants while simultaneously spreading the spirit of sharing strengthening goodness. One of our ways to achieve this is through the launch of the 'Insuring 10,000 Indonesian People' Movement. We believe that everything initiated with good intentions will yield even greater goodness for all of us," echoed Permana on the company’s commitment to the people.

“Well, no matter which religion, I think we all share values like compassion, solidarity with the less fortunate, or protecting the natural environment. And so I think this is something we all share in. And that's why it's an interesting concept,” Ina said. “I would also say that Indonesia practices this very well. That they focus more on what they share rather than what is different. And in that sense, it's something we can all learn from in terms of managing diversity, having people of different faiths, different languages and cultural backgrounds under one roof in one country and working together like a big family.”