Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBoosting financial literacy key to promoting financial inclusion in Indonesia

Financial inclusion is highly important to stabilize the Indonesian economy. Yet, a 2019 survey by the Financial Services Authority (OJK) revealed that Indonesia’s financial inclusion rate stood at only 76.1 percent, marking an increase of some 40 million unbanked adults from 2017, when the rate stood at nearly 50 percent.

Change text size

Gift Premium Articles

to Anyone

Financial inclusion is highly important to stabilize the Indonesian economy.

Yet, a 2019 survey by the Financial Services Authority (OJK) revealed that Indonesia’s financial inclusion rate stood at only 76.1 percent, marking an increase of some 40 million unbanked adults from 2017, when the rate stood at nearly 50 percent.

Apparently, low financial literacy has become the greatest barrier to financial inclusion.

In a survey conducted by the Indonesia Fintech Association (Aftech), about 75 percent of its fintech company members cited low financial literacy among its target markets. Some other companies cited basic infrastructure problems (57 percent) and limited capital or resources challenges (44 percent).

Therefore, boosting financial literacy is key to accelerating financial inclusion in Indonesia, especially amid the COVID-19 crisis.

“While the COVID-19 pandemic has accelerated financial inclusion in terms of digital payments through fintech companies, many stakeholders still need to accelerate savings among people during the crisis as well,” Institute for Development of Economics and Finances senior economist Aviliani told The Jakarta Post recently.

In this case, the stakeholders need to work hand-in-hand to educate specifically people of the lower socioeconomic bracket, who are in dire need of financial literacy. Only a small chunk of them have bank accounts and they do not even have enough emergency funds, according to Aviliani.

She cited a research study by the Organization for Economic Cooperation and Development (OECD), which revealed that the emergency funds that most Indonesians from the lower socioeconomic bracket had were enough to cover their expenses for a maximum seven days only.

Within the context of the financial fallouts brought by the COVID-19 pandemic, having sufficient emergency funds and savings has become more important than ever.

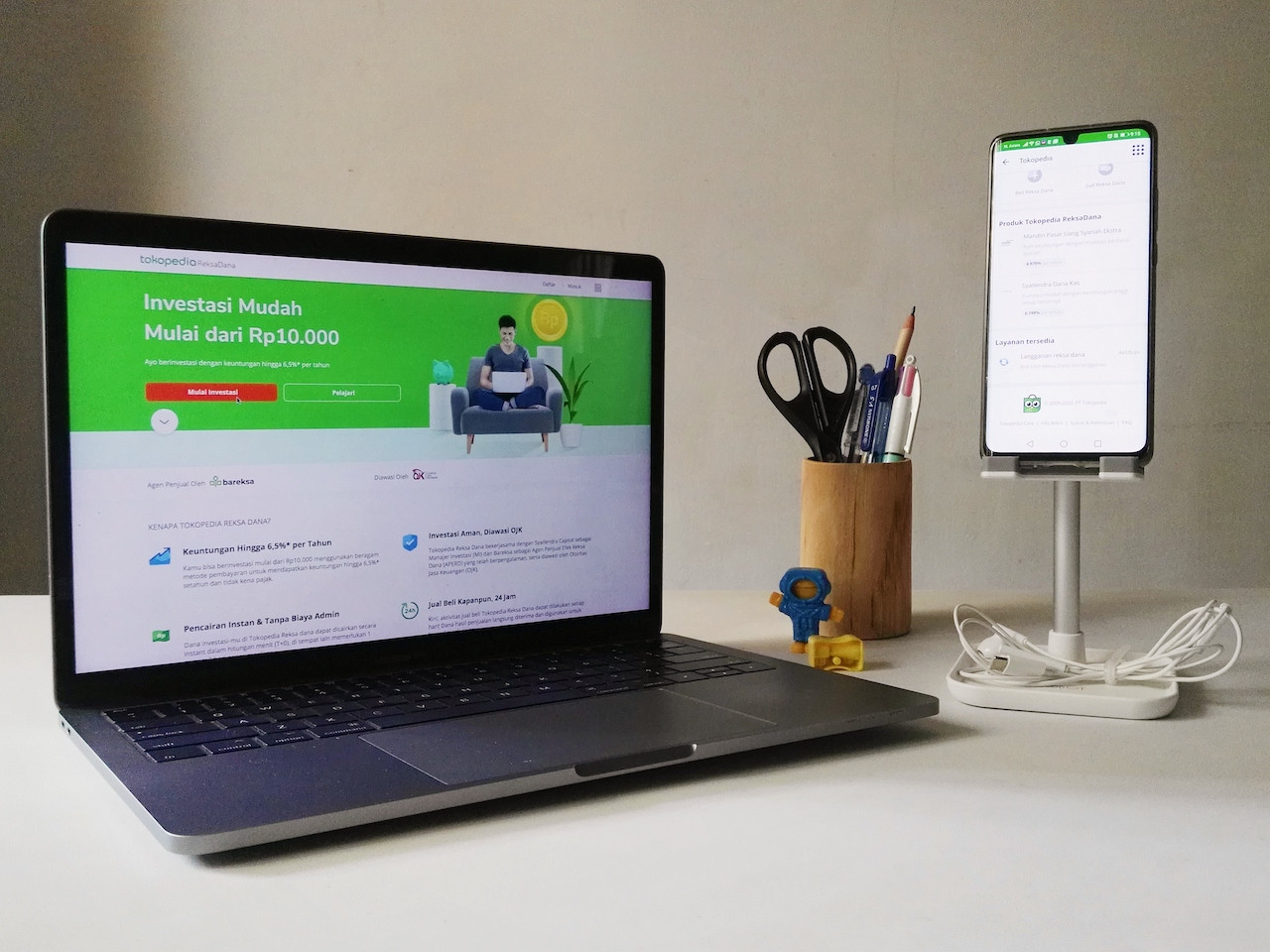

Boosting financial literacy is key to accelerating financial inclusion in Indonesia, especially amid the COVID-19 crisis. (Courtesy of/Tokopedia)To support financial literacy education to boost financial inclusion, especially in terms of encouraging people from all walks of life to start investing and saving their money, e-commerce platform Tokopedia has just launched its Rabu Nabung (Savings Wednesdays) campaign.

“The campaign also seeks to instill better financial management skills among people from as early an age as possible. They need to save and invest their money habitually and they can start small too,” Tokopedia Fintech Senior Lead Marissa Dewi said.

Therefore, the campaign also seeks to mainstream Tokopedia’s mutual funds and gold digital investment program in 2018 and 2019, respectively.

Through the campaign, individuals who purchase any mutual funds products through Tokopedia on Wednesdays can accumulate gift cards amounting to up to Rp 75,000 (US$5.04). Those who invest in gold, meanwhile, can get a total cashback of Rp 250,000.

Speaking of starting small, beginning investors can kickstart their investments from investing Rp 5,000 in gold and Rp 10,000 in mutual funds.

True to the idea of involving various stakeholders to promote financial inclusion, Marissa said that Tokopedia was working closely with various fintech companies as strategic partners to bolster its digital investment products.

The collaborative process is aligned with the platform’s mission to become a super ecosystem that supports Indonesia’s transformation into a cashless society, according to Marissa.

“[Our founder and chief executive officer] William Tanuwijaya once said that instead of building walls, Tokopedia wanted to build bridges so that we can collaborate with our strategic partners to help bolster the progress of our digital economy,” she said.

In this case, Tokopedia works closely with state pawnshop Pegadaian in its gold investment product, while for its mutual funds product, it has worked together with PT Bareksa Portal Investasi as the selling agent, Syailendra Capital and Mandiri Manajemen Investasi for the investment management.

“All our partners have been licensed and are supervised by the Financial Services Authority (OJK), so people don’t need to be afraid of bogus investment schemes,” Marissa said.

She added that mutual funds and gold investments were relatively low-risk and stable, thereby suitable for beginning investors, including people who had just entered the workforce, graduated from university, as well as housewives.

She cited data that the market had responded very positively to the new digital investment products so far.

Tokopedia works closely with various fintech companies as strategic partners to bolster its digital investment products. (JP/Muthi Kautsar)Read also: Strategy key in stocks investment amid volatility: Experts

The number of mutual funds investors in Tokopedia has multiplied 57 times since it was first launched, with total transactions multiplying by 27 times for the same product.

Meanwhile, Tokopedia has also seen the number of people investing in gold multiply 20 times, with the number of transactions multiplying by 20 times.

Apparently, the digital investment program has done its bit in boosting users’ financial literacy: A recent research study by the University of Indonesia (UI) revealed that about 78 percent of all Tokopedia users surveyed said the program helped them understand the importance of investment.

Tokopedia’s previous initiatives in trying to boost the use of e-wallets among Indonesians have also yielded great results among both its consumers and merchants alike.

“The same UI study pointed to more than 50 percent of Tokopedia buyers [who] said using the platform actually introduced them to e-wallet features for the first time,” Marissa explained.

“The case with merchants is even more intriguing for me: About 90 percent of our merchants, who previously conducted their entire transactions offline, revealed through the survey that they finally felt comfortable doing cashless transactions.

“Whereas previously, these merchants would probably not be reassured of a transaction’s safety unless they held the rupiah bills in their hands,” she said.

According to Aviliani, by taking part in a collective effort to promote financial inclusion in Indonesia, e-commerce platforms and fintech companies will also boost their digital transactions.

“This is a great campaign which will also help their fellow financial institutions,” she said.

In this case, going back to idea of inter-stakeholder collaborations, Aviliani suggested that the government also use the pandemic social assistance program as an opportunity to persuade people from the lower socioeconomic brackets to eventually open bank accounts.

“The government also has to devise a clear financial inclusion road map, along with clear technical implementation details, to give financial institutions a clue about the concrete investments they need to make to accelerate financial inclusion in the next few years,” she said.