Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

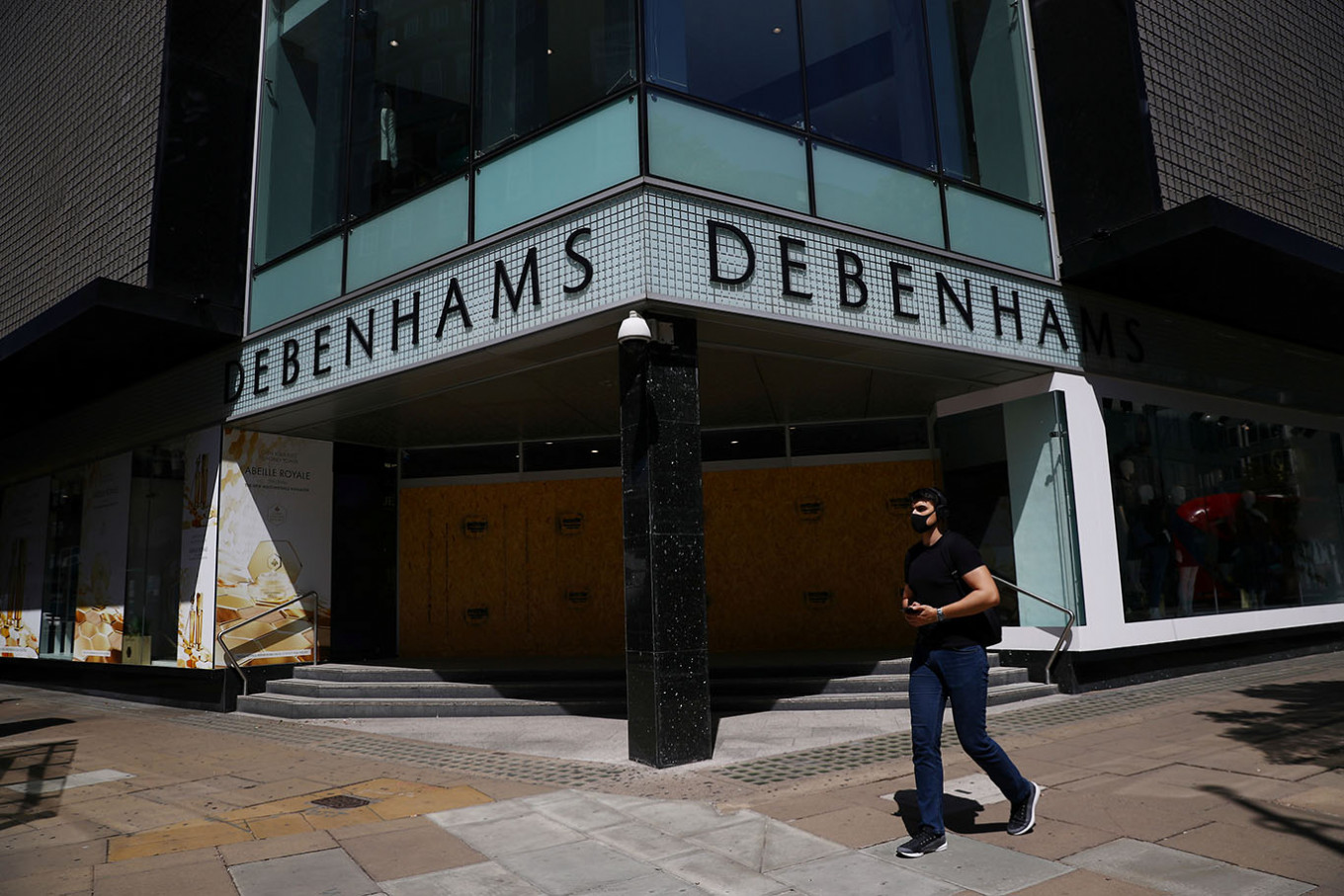

View all search resultsDebenhams set to shut shop after 242 years as pandemic hammers UK retail

Change text size

Gift Premium Articles

to Anyone

B

ritish department store group Debenhams is set to close all its UK shops after 242 years in business, putting 12,000 jobs at risk in the country's second major corporate failure in as many days.

The decision to liquidate Debenhams comes after Philip Green's Arcadia fashion group collapsed into administration on Monday, threatening 13,000 jobs, after the COVID-19 pandemic hit business.

Arcadia is the biggest concession operator in Debenhams, accounting for about 5 percent of Debenhams' sales, and its collapse looks to have been the final straw, making a sale of Debenhams that would be worth more than a winding down process impossible.

Administrators FRP Advisory said on Tuesday that Debenhams would be wound down after it failed to find a buyer.

Sportswear and clothing retailer JD Sports Fashion had been seen as the department store operator's last hope for a rescue deal but it confirmed on Tuesday it had ended takeover talks with Debenhams, which trades from 124 UK stores.

Debenhams, founded in London in 1778, has struggled for years and was placed in administration for the second time in a year in April by its owners led by US hedge fund Silver Point Capital.

"Given the current trading environment and the likely prolonged effects of the COVID-19 pandemic, the outlook for a restructured operation is highly uncertain," FRP said.

"The administrators have therefore regretfully concluded that they should commence a wind-down of Debenhams UK, whilst continuing to seek offers for all or parts of the business."

The administrators will continue to trade Debenhams' stores and online business through Christmas to clear its current and contracted stocks.

"On conclusion of this process, if no alternative offers have been received, the UK operations will close," FRP said.

Read also: Menswear shop T.M. Lewin to close all UK stores, go online only

Liquidation process

Debenhams' pension schemes, which have about 11,000 members, have been in an assessment period for the government's Pension Protection Fund since April 2019 when the group first went into administration.

Debenhams' Danish business Magasin du Nord is not impacted by the liquidation process.

Former chairman Ian Cheshire believes some parts of the UK business can be saved.

"(There) is a fantastic business inside it, probably 70 stores, and a very good website which I'm sure someone will be buying, so I don't think all these jobs are going," he told Sky News.

Prime Minister Boris Johnson's spokesman said the government stood ready to support those employees affected by the winding-down decision.

Shopworkers union Usdaw urged the government to develop an urgent recovery plan for retail.

Even before the pandemic, bricks-and-mortar retailers in Britain were facing a major structural challenge with the economics of operating stores on traditional leases proving increasingly difficult as more trade migrates online.

Britain's department store sector has particularly struggled.

BHS went bust in 2016, House of Fraser was bought out of administration in 2018 by Mike Ashley's Sports Direct, now called Frasers Group, and even John Lewis has seen profits crash.

Frasers said on Monday it was interested in participating in the Arcadia sale process.

Frasers was Debenhams' biggest shareholder before the department store went into administration for the first time, wiping out Frasers' 150 million pound ($200 million) investment.

Ashley walked away from buying Debenhams this time round but analysts expect him to take another look at its assets in the liquidation process, which is being run by turnaround specialist Hilco.

"Ashley continues to give a very good impression of somebody who tries to win a game of 'Monopoly' by buying up the useless brown and light blue squares on the board," said independent retail analyst Nick Bubb.