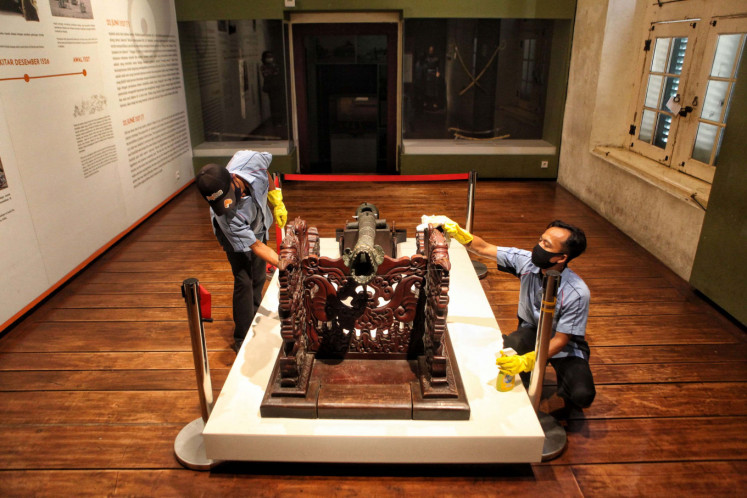

Dual banking leverage model

Indonesiaâs banking sector is characterized by a growing economy, with a population of 250 million, increasing per capita income (US$3,500), high financing margins and low banking penetration (loan to gross domestic product [GDP] ratio of 26 percent)

Change text size

Gift Premium Articles

to Anyone

I

ndonesia's banking sector is characterized by a growing economy, with a population of 250 million, increasing per capita income (US$3,500), high financing margins and low banking penetration (loan to gross domestic product [GDP] ratio of 26 percent).

Islamic commercial banks had Rp 250 trillion ($21 billion) in assets in June 2014, expected to grow to $100 billion plus by 2018 at a four-year compound annual growth rate of 37 percent. Islamic bonds had $15.48 billion in June in 2014 (government bonds $14.9 billion and corporate bonds $0.58 billion). Total Islamic commercial and investment bank assets amounted to $36.48 billion in June 2014.

The Dual Banking Leverage Model (DBLM) is a business model that was first introduced by CIMB Group in 2005. The Islamic division of a financial institution leverages on and operates parallel to its conventional platform.

Some sharia units act as the Islamic banking window of conventional commercial banks. There are at least three benefits for banks that apply this model.

First, it allows the sharia unit to utilize the full resources and infrastructure of the conventional bank without raising additional unnecessary costs, through engagement and economies of scale. Second, it fosters close cooperation between relevant departments, emphasizing synergy and integration throughout the bank.

As a result, the potential effects of diseconomies of scale are minimized. Third, this model provides bank customers with the convenience of enjoying both Islamic and conventional banking offerings at all branches.

The implementation of the DBLM, which has a meaningful role in boosting the performance of sharia bank units, requires well-defined strategies that focus on three main areas, building awareness among both employees and customers, ensuring sharia compliance fulfillment and internal coordination across functions related to key performance indicators (KPI), products offered and the process.

The first task is to identify the nature of the Islamic banking system and products that are appropriate for and easily understood by customers.

There needs to be an exploration of strategies that make sure all employees understand basic sharia principles, the products offered and ways to sell them.

The second task is putting in place the comprehensive sharia compliance framework, especially for the conventional branches offering Islamic banking products.

With support of the distribution network, as well as a reliable electronic channel owned by the conventional bank, the sharia unit has the power to penetrate larger markets compared to other Islamic banks, even to conventional banks.

An existing customer base can be developed to use the facilities of sharia, while meeting the needs of major clients in transactional banking. In this way, customers can try out Islamic banking gradually.

To achieve the expected target, the establishment of appropriate KPIs is required. KPIs are determined through a clear target and consistency with a timetable.

___________________

The writer is the sharia and microfinance academy head of Bank CIMB Niaga. The views expressed in this article are his own.