Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsPriority Banking: Banks put travelers' minds at ease abroad

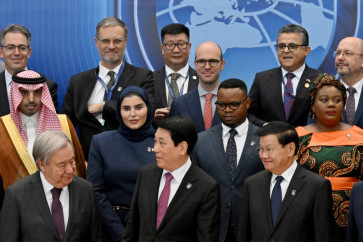

Clear cut: A discerning Citibank customer (right) listens to an explanation about the bankâs travel-related program, delivered by a bank staff in Jakarta

Change text size

Gift Premium Articles

to Anyone

C

span class="caption">Clear cut: A discerning Citibank customer (right) listens to an explanation about the bank's travel-related program, delivered by a bank staff in Jakarta. Courtesy of Citibank

International banks operating in Indonesia are taking advantage of a growing trend of overseas travel among affluent customers by fulfilling their financial needs while they are abroad.

Traveling overseas has become an increasingly popular 'enrichment off the job' activity among affluent Indonesians.

With the surge in the number of people traveling overseas, especially for holiday breaks, several major banks with international networks are racing to net premium travelers by promising myriad benefits and privileges.

'Today, traveling has become a necessity, with overseas destinations becoming favorite options among discerning Indonesian travelers,' said a bank executive. 'Certainly, shopping has become an inseparable part of their leisure activity and we provide convenience when it comes to payments and transactions,' she added.

Citibank's retail bank head Rustini Dewi said that Citibank customers traveling overseas had benefited greatly from the bank's global operations, as they could make transactions in any country. The bank has banking services in more than 4,000 branches and 13,000 ATMs around the world.

'Customers can also use online banking in any country in real time,' she said.

However, the privileges that banks offer to travelers are not always related to financial needs.

Citibank is aware that on returning from an overseas leisure destination, travelers often bring home more goods from their shopping activities. As such, the bank has collaborated with national flag carrier Garuda Indonesia to jointly issue the Citi Garuda Card, which favors travelers under the Citigold Duo Combo Bundling Program.

'Those who hold Citi Garuda Cards are entitled to an extra baggage allowance,' said Dewi.

Following the success of the traveler-favoring program, the bank has relaunched it with more benefits. 'Now families can share the delights of using the card,' she said.

According to Dewi, the number of Citigold customers has increased by 30 percent since the program opened in April. 'Of course, I hope more people will join the program.'

Citibank's operations are supported by many experts in wealth management from various countries. 'We offer financial solutions. That's why we have a strong wealth advisory team,' she said.

Meanwhile, Standard Chartered has launched Standard Chartered WorldMiles, claimed by the bank to be a better product than those offered by its competitors, and to have received an excellent response from customers.

Almost all holders of Standard Chartered WorldMiles have added their mileage to the Frequent Flyer program that the bank has been cooperating with because 'that's the main feature of the card,' said Standard Chartered Bank Indonesia segment head Ruddy Martono.

Standard Chartered WorldMiles allows international transactions (foreign currencies and overseas) above the level allowed by other types of credit card.

'This is also supported by the WorldMiles feature, which gives more mileage to make transactions overseas,' Ruddy said.

Apart from WorldMiles, Standard Chartered also provides a variety of credit cards that have unique functions.

Standard Chartered Titanium gives cash back for all transactions. 'Holders of Standard Chartered Platinum receive reward points and life style benefits.

'Meanwhile, Standard Chartered Priority is Standard Chartered Infinite, the highest credit card that provides the most reward points and best facilities for customers and families,' Ruddy said.

In 2015, the bank is focusing on obtaining priority customers by offering premium services for priority customers, including wealth solutions, service assurance, relationship privileges and international banking.

Through international banking, the bank provides convenience in making transactions overseas.

'By becoming our priority customers and placing Rp 500 million in funds, customers can enjoy the aforementioned facilities and benefits. Our acquisition team will help the process,' he said.

'Through the four pillars of services that we offer, Standard Chartered not only gives priority banking services and wealth management but also benefits and features through Standard Chartered Infinite credit card, specially dedicated to priority customers,' the bank said.

The advantages of the credit cards include zero annual fees for the main card and additional card, four x point rewards, buy-one get-one tickets at selected The Premiere XXI theaters, free access to local and overseas airport lounges with the Priority Pass, free green fees in 12 golf clubs in Asia Pacific and exclusive benefits at more than 900 luxury hotels across the world.

Ensuring security

The banking convenience that travelers can enjoy when traveling by using debit or credit card has made cashless transactions increasingly popular, but it should be acknowledged that card-related crime is a reality, which leads to banks constantly innovating systems to cope with potential crime.

Citibank has a technology that can avert a range of security disruptions, such as the misuse of cards by irresponsible individuals, according to Dewi.

As part of the bank's efforts to ensure security for the holders of Citigold card when it comes to transactions, the bank has create an IT-based system enabling holders who shop and make transactions for certain amounts of money to receive a notification via SMS soon after the transaction.

'The notification can serve as a reminder for the card holders if he or she makes a transaction or not. If it turns out that he or she has not made a transaction, he or she can immediately call a member of staff, as explained in the notification,' she said.

Ruddy of Standard Chartered said that the bank always gave protection to every transaction made by customers. 'For an online transaction, customers can take advantage of 3D secure. Layered protection is ensured,' he said.

Apart from that, in compliance with Bank Indonesia regulations, any transactions detected as dangerous, unusually large, or against other stipulations, would be run by the respective customer so that they could avoid the possible misuse of their credit card, he said.