Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsCurrencies slip as OPEC+ output cuts provide little cheer

The greenback drifted higher against its Australian and New Zealand counterparts, which are seen as risk sentiment barometers, in a sign investors remain concerned about the global demand for commodities.

Change text size

Gift Premium Articles

to Anyone

C

ommodity currencies slipped against safe-haven units such as the dollar and yen on Monday as a record output cut agreed by OPEC and other oil producing nations failed to offset broader concerns about global demand for resources.

The greenback drifted higher against its Australian and New Zealand counterparts, which are seen as risk sentiment barometers, in a sign investors remain concerned about the global demand for commodities.

Financial markets remain on edge over the spread of the novel coronavirus pandemic as severe restrictions on personal movement drag the global economy into a deep recession.

"The initial reaction suggests that the decline in oil demand is well ahead of the output cuts that were agreed," said Yukio Ishizuki, FX strategist at Daiwa Securities in Tokyo.

"This is a negative for oil producers. This also encourages risk-off trading, which should support the yen."

The dollar rose 0.24 percent against the Norwegian crown to 10.21 and 0.44 percent to 23.43 Mexican pesos.

Against the Canadian dollar, the US currency held steady at C$1.3965.

Trading could be somewhat subdued as financial markets in Australia, New Zealand, Hong Kong, and Britain are closed for the Easter Monday holiday.

Major oil producers agreed to the output cuts on Sunday to prop up oil markets amid the coronavirus pandemic.

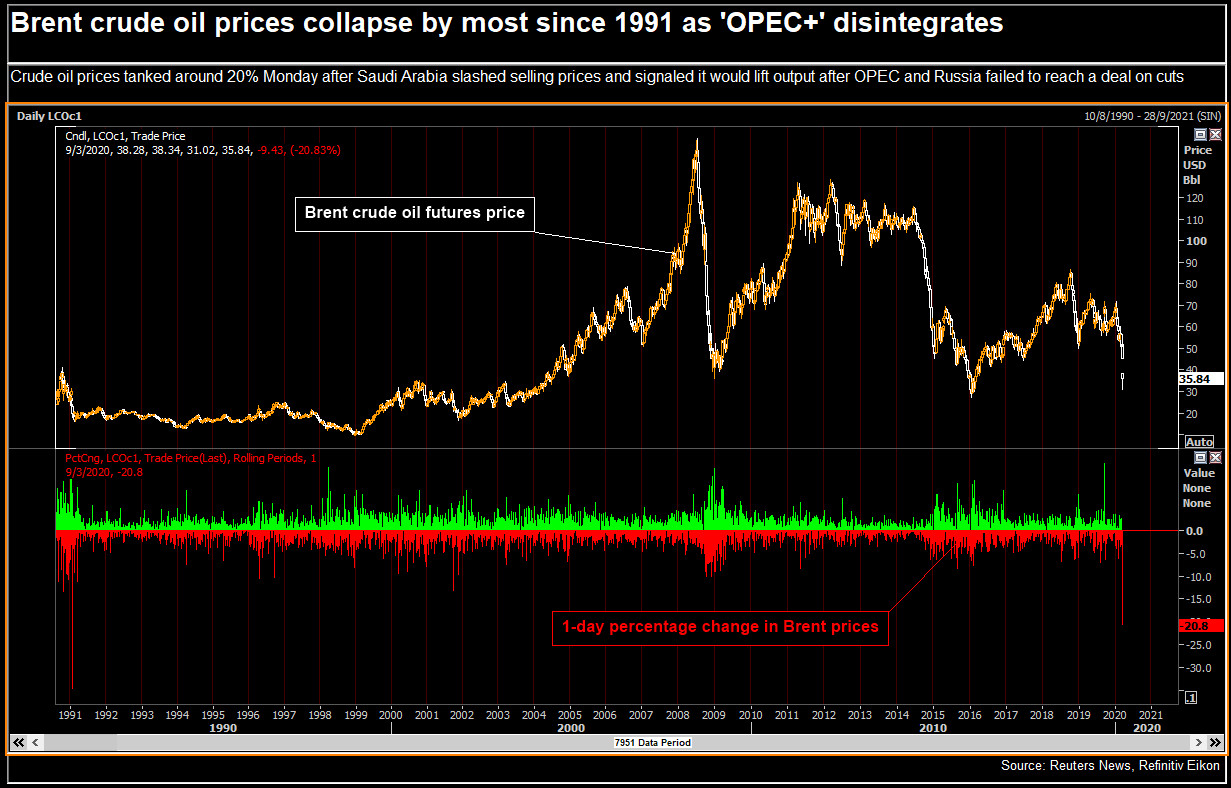

Oil prices had gone into freefall on worries about the virus and a price war between Saudi Arabia and Russia, which was seen straining the budgets of oil producers and hammering the US shale industry.

Currencies from Norway, Mexico, and Canada - all major oil producers - got a boost on Friday as the agreement to cut output began to take shape, but these gains disappeared on Monday as investors avoided risk assets.

While oil futures erased early losses to trade higher in Asia, currency markets showed some investors remain concerned about excessive risk.

Other currency traders pointed to a decline in US stock futures as a supportive factor for risk-off trades.

The cautious mood boosted the yen, which is sometimes sought as a safe-haven because of Japan's current account surplus.

The yen rose 0.18 percent to 108.31 per dollar in Asia on Monday and jumped more than 0.3 percent against the Australian and New Zealand currencies.

Against the safe-haven Swiss franc, the greenback held steady at 0.9656.

The dollar traded at $1.0936 per euro, near its lowest level in more than a week.

Further declines in the dollar may be limited with speculative net short positions in the US currency having risen to their highest since May 2018, according to calculations by Reuters and US Commodity Futures Trading Commission data.

The Australian dollar fell 0.29 percent to $0.6329, pulling back from a four-week high, while the New Zealand dollar fell 0.21 percent to $0.6072 as investors shunned risky trades.