Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search results[ANALYSIS] Understanding the low utilization of digital financial services

Change text size

Gift Premium Articles

to Anyone

R

ecently the government enacted Presidential Regulation (Perpres) No. 114/2020 on the national financial inclusion strategy, replacing Perpres No. 82/2016. Part of the reason was the achievement of the financial inclusion target, which is defined by the percentage of individuals with access to financial products and services.

The index, based on a Financial Services Authority (OJK) survey, exceeded the target of 75 percent. The survey suggests that 76.19 percent of the population has access to financial services. The new Perpres is therefore aimed at achieving a new target and formulating new strategies.

First of all, the achievement is welcome news. Other data — the 2018 Financial Inclusion Insight (FII) survey — reaffirm this, despite suggesting a lower figure due to the narrower definition of financial inclusion.

The FII survey shows that around 57 percent of adult individuals have an account with a formal financial institution. This figure suggests an increase of 24 percentage points compared to the 2017 Global Financial Inclusion database (Findex) figure, showing the percentage of individuals having bank accounts at 49 percent.

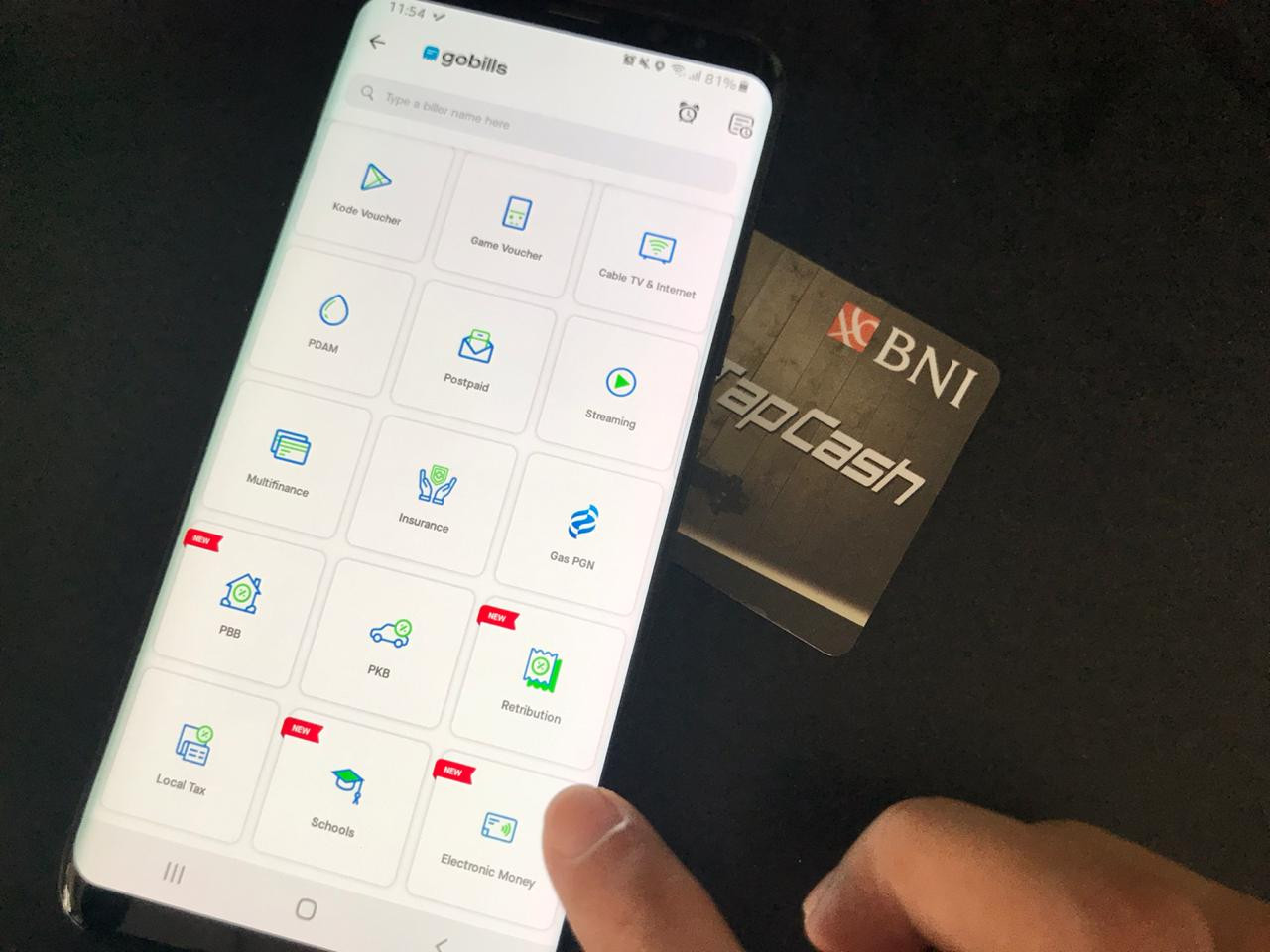

Despite showing significant progress in some financial inclusion metrics, the usage of digital financial services (DFS) is surprisingly low. This is in contrast with rapid innovations in digital technologies and DFS.

For instance, evidence from the 2018 FII survey points out that only 4.7 percent of the adult population — those aged 15 years old or more — use electronic money, which is the most basic of DFS. While this figure perhaps is much higher recently, we can safely assume that a significant proportion of the population remains untouched by e-money or DFS in general.

Growing innovations in digital technologies provide us opportunities to exploit and expand financial services across all corners of the country. The basic notion is, again, that efficient financial services will benefit the population and promote economic development. Thus, the utilization of DFS should be an important metric for financial inclusion development as well.