Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe wide liquidity support available to Indonesian banks

Indonesian banks can rest assured that the central bank offers a variety of liquidity support in the event that they need immediate and massive injections to stay afloat.

Change text size

Gift Premium Articles

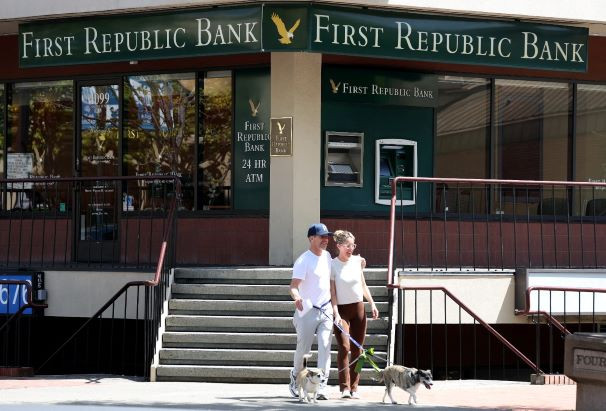

to Anyone

Banked on no more: Customers leave a First Republic Bank office on April 25 in San Rafael, California, the United States. Shares of the San Francisco-based bank fell 50 percent today following the company's earnings report that showed clients had withdrawn US$102 billion in deposits in the first quarter following the collapse of Silicon Valley Bank. (AFP/Getty Images/Justin Sullivan)

Banked on no more: Customers leave a First Republic Bank office on April 25 in San Rafael, California, the United States. Shares of the San Francisco-based bank fell 50 percent today following the company's earnings report that showed clients had withdrawn US$102 billion in deposits in the first quarter following the collapse of Silicon Valley Bank. (AFP/Getty Images/Justin Sullivan)

T

he global financial system experienced a shock in March by the sudden failure of three small and medium-sized banks in the United States. Those banks failed to obtain liquidity to meet rapid depositor flight (bank runs) and suffered huge losses from the large fixed-income securities they held. The series of bank collapses threatened global financial stability.

One of the lessons learned from the recent banking turmoil was over the late liquidity support from the US central bank, the Federal Reserve (Fed), when those banks needed a large amount of immediate liquidity. The Fed injected emergency liquidity support, particularly into Signature Bank and Silicon Valley Bank after the two banks were no longer able to withstand the wave of deposit withdrawals.

Finally, the two banks were taken over by the Federal Deposit Insurance Corporation (FDIC). Meanwhile, Silvergate Bank was liquidated by its owner.

If the three failed banks had received immediate liquidity assistance from the Fed during their bank runs, perhaps they would have survived. In fact, the three banks hold high-quality liquid assets in the form of US government securities. Therefore, they could have collateralized government bonds to get fresh funds from the Fed through a repurchase agreement (repo).

A repo is basically a type of a short-term loan agreement in which borrowers sell the securities they hold and then repurchase them within a certain period. If they had used a repo, the banks could have avoided significant losses from being forced to sell government bonds in the market at low prices to obtain liquidity. The regulation that reserves repos only for systemic banks had a role in the collapse of the three US banks.

To prevent other banks from a similar experience and to restore market confidence in the US banking system, the Fed introduced on March 12 the Bank Term Funding Program (BTFP). The program is a short-term loan facility valid for up to one year with high-quality collateral at par value, such as US Treasuries and mortgage-backed securities. This lending facility allows all banks to generate liquidity without selling securities in times of stress that can lead to losses. According to Bloomberg, the Fed disbursed US$148.7 billion until April 5.

Then what about banks in Indonesia? Bank Indonesia (BI), as the central bank, is fully aware that liquidity is vital to the stability of both banks and the financial system. BI provides liquidity support to prevent banks from failing to meet their liquidity needs, mainly to serve sudden, massive withdrawals of public deposits.