Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsTaxes, trusts and offshore wealth amid presidential election

The offshore leaks laid bare the reality that Indonesian wealth is finding refuge in trusts based in tax havens, posing a considerable threat to the nation's revenue stream and fiscal integrity.

Change text size

Gift Premium Articles

to Anyone

A

s Indonesia is gearing up for the elections, the nation is confronted with a looming economic challenge that demands immediate attention: the perilous state of its tax ratio.

Positioned as one of the lowest in the region and showing a concerning trend of decline over the last 20 years, this issue has spurred sophisticated discussions, including in the recent vice presidential debate, on how to reverse this fiscal descent.

However, amid the intricate fiscal debates, there exists an overlooked “elephant in the room”— the utilization of trusts by the wealthy to hide offshore wealth, a silent but potent quake undermining Indonesia's economic foundations. Regrettably, the discourse aimed at rectifying the potential revenue losses resulting from undeclared wealth is notably absent from the mission statements of all three presidential candidates.

In 2016, Indonesia's high-net-worth individuals were believed to collectively possess offshore wealth worth US$250 billion (Said, 2017). According to The Atlas of the Offshore World, a research initiative affiliated with the EU Tax Observatory under the Paris School of Economics, the offshore wealth of Indonesian citizens is estimated to have reached $32 billion in 2022, constituting 2.36 percent of the country's gross domestic product (GDP).

This projection is based on an analysis of official statistics from the Swiss central bank and the Bank for International Settlements, as well as the identification of systematic anomalies in the international investment positions of various nations.

Moreover, the dataset indicates a decline in Indonesia's estimated offshore wealth as a percentage of GDP from 2.51 percent in 2015 to 1.86 percent in 2016, when the tax amnesty took place. However, this decline appears to have reversed in the subsequent year, with a steady increase observed.

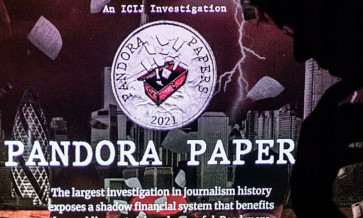

The latest offshore leaks from the Pandora Paper, brought to light by the International Consortium of Investigative Journalists (ICIJ) in 2021, exposed a significant number of Indonesia's wealthy population engaging in the utilization of offshore trusts. The Pandora Papers, constituting the largest leaks of offshore data in history, encompassing 11.9 million leaked documents with 2.9 terabytes of data, revealed the secret offshore accounts of global politicians and wealthy elites.