Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBeware of central economic forecasts for 2026

With China’s efforts to upgrade its growth model progressing slowly, the US will serve by far as the global economy’s primary engine, a concentration that creates its own set of risks.

Change text size

Gift Premium Articles

to Anyone

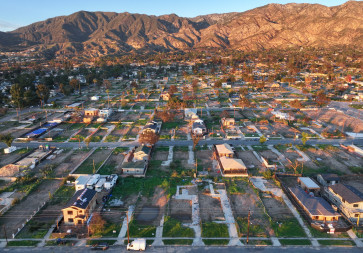

Slow recovery: Homes are seen as they are rebuilt amid cleared lots on Dec. 28, 2025, in Altadena, California, the United States, where homes were destroyed by the Eaton Fire one year ago. The Eaton Fire ignited on Jan. 7, 2025, killing 19 people and destroying more than 9,000 structures, most of them homes in Altadena. The fire is the fifth deadliest and the second most destructive wildfire in California history. (AFP/Getty Images/Mario Tama)

Slow recovery: Homes are seen as they are rebuilt amid cleared lots on Dec. 28, 2025, in Altadena, California, the United States, where homes were destroyed by the Eaton Fire one year ago. The Eaton Fire ignited on Jan. 7, 2025, killing 19 people and destroying more than 9,000 structures, most of them homes in Altadena. The fire is the fifth deadliest and the second most destructive wildfire in California history. (AFP/Getty Images/Mario Tama)

F

orecasting a central scenario for the United States economy in 2026 appears to be a straightforward exercise. But the probability that this baseline forecast would materialize probably does not exceed 50 percent: the “normal” bell distribution has been replaced by one with unusually “fat tails”: the probability of more extreme outcomes, both virtuous and vicious, is significant and equally possible. The US economy is not so much on a single trajectory as it is locked in a tense tug-of-war between three distinct futures: a “Goldilocks-lite” central baseline, a productivity-fueled upside scenario and a volatile downside scenario.

The central scenario envisions a relatively strong economy, which continues to defy predictions of a cyclical downturn and gradually builds secular strength, owing primarily to robust AI-related investment. By next year, the US will be moving on from the currently dominant infrastructure phase of the AI revolution, the frenetic build-out of data centers and hardware, and will include more integration. Capital expenditure will remain historically high, driven by the dual imperative of working “on” and “with” AI.

Complementing this corporate dynamism is a still-resilient consumer base, supported by accommodative fiscal and monetary policies. The American household has proven to be a durable growth engine, albeit a weakening one. With the fiscal taps open, and the Federal Reserve poised to reduce interest rates, it may well remain so, despite elevated prices that hit lower-income households particularly hard.

But sticky inflation will remain a reality. While price increases might not be severe enough to de-anchor expectations, they will likely remain above the Fed’s target, precluding a return all the way to the ultra-low interest rates of the 2010s.

This scenario also includes the crystallization of an unsettling phenomenon: the decoupling of employment from GDP. Historically, robust economic growth has been inextricably linked to strong job creation.

But this relationship appears to be under pressure, meaning that growth in 2026 may be accompanied by a relatively stagnant labor market. Such jobless growth would exacerbate the K-shaped nature of the economy’s performance. As such, affordability will remain a social and political flashpoint, keeping inequality at the forefront of the national discourse.

This is a central scenario that includes a lot of “dispersion,” and not just domestically. Internationally, the US significantly outperforms other major economies. Hampered by structural rigidities, the eurozone and the United Kingdom remain trapped in a low-growth, low-investment equilibrium. With China’s efforts to upgrade its growth model progressing slowly, the US will serve by far as the global economy’s primary engine, a concentration that creates its own set of risks.