Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsDeepening markets or deepening risk? Rethinking the 20% equity rule

Doubling the equity limit for insurers and pension funds to 20 percent from currently 8 percent can be either a bold boost for market stability or a dangerous gamble with institutional solvency. However, "flexibility" might be a double-edged sword that threatens to undermine asset-liability matching and trigger a capital-requirement crisis.

Change text size

Gift Premium Articles

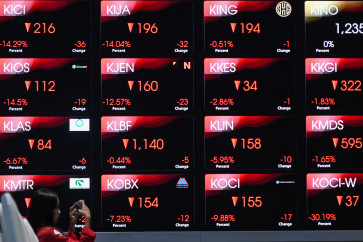

to Anyone

A visitor takes photos on Feb. 2, 2026, of a digital screen showing the movement of the Composite index at the Indonesia Stock Exchange (IDX) in South Jakarta. The Composite index fell 442.44 points, or 5.31 percent, to 7,887.16 in the first trading session, while the LQ45 index of 45 leading stocks dropped 33.16 points, or 3.98 percent, to 800.37. (Antara/Sulthony Hasanuddin)

A visitor takes photos on Feb. 2, 2026, of a digital screen showing the movement of the Composite index at the Indonesia Stock Exchange (IDX) in South Jakarta. The Composite index fell 442.44 points, or 5.31 percent, to 7,887.16 in the first trading session, while the LQ45 index of 45 leading stocks dropped 33.16 points, or 3.98 percent, to 800.37. (Antara/Sulthony Hasanuddin)

T

he recent turbulence in Indonesia’s capital market has prompted the government to reconsider its stabilization strategy. One policy option is an increase in the equity investment limit for pension funds and insurance companies from roughly 8 percent to up to 20 percent per eligible issuer, as per an announcement by Office of the Coordinating Economy Minister Airlangga Hartarto during a press briefing on regulatory reform at the Indonesia Stock Exchange.

Under the existing framework, equity investment is governed by Financial Services Authority Regulation (POJK) No. 26/2025, particularly Article 15(1)(h), which caps equity exposure at 10 percent per issuer and 40 percent of total invested assets. The proposed reform would raise the per-issuer ceiling to 20 percent for selected stocks, notably large-cap and liquid equities such as those included in the LQ45 index.

Yet flexibility comes at the cost of higher concentration risk. A 20 percent exposure to a single issuer implies that a sharp price correction or corporate distress could materially weaken an institution’s financial position.

Equally important is the consistency of this policy with the liability structure of each institution. The primary objective of investment management for insurers and pension funds is not to maximize returns per se, but to ensure that assets remain sufficient and well-matched to liabilities. Liability profiles vary widely across institutions, implying that a uniform investment approach would be inappropriate.

For general insurers, liabilities tend to be short-term and require high liquidity to meet claims. Accordingly, portfolios are typically concentrated in low-risk, liquid instruments. As of November 2025, OJK data indicate that equity allocations for general insurers remain below 5 percent, reflecting a conservative, liquidity-driven strategy. In this context, a higher equity limit should be seen case-by-case depending on various factors.

By contrast, life insurers and pension funds hold long-term liabilities, allowing for greater use of equities as a source of asset growth. Even so, asset-liability matching remains the cornerstone of prudential management. Ideally, allocations to higher-risk assets such as equities should occur only after policyholder and beneficiary obligations are fully secured by stable and predictable income streams, primarily derived from fixed-income instruments.

As of November 2025, life insurers have allocated roughly 22 percent of their total investment portfolios to equities, whereas pension funds, mandatory and social insurance schemes, and reinsurers each maintained equity exposures of below 10 percent. Sharia (takaful) insurers, in aggregate, exhibited a higher equity share, at approximately 19 percent.