Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInterpreting anticipated high growth in the second quarter

Relative improvements in the first two months of Q2 2021 indicate light at the end of the tunnel for economic growth.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s economy was still in the recession zone in the first quarter of 2021. It shrank 0.74 percent year-on-year (yoy) despite the expansive fiscal measures, accommodative monetary policy and the COVID-19 vaccine rollout. The figure marked economic contraction for the fourth straight quarter, yet was the smallest in the sequence amid the ongoing battle against the COVID-19 pandemic.

The increase in daily cases at the start of the year, along with the risk of new virus strains, kept the government imposing restrictions on community activities, particularly those related to travel and recreation. This inevitably restricted public mobility, thus hindering faster economic recovery. As a result, household consumption, which contributes 57 percent of gross domestic product (GDP), kept contracting on an annual basis.

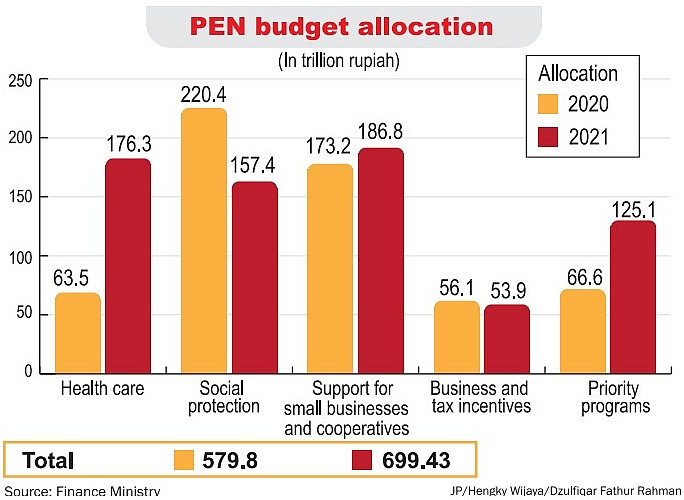

Government spending and exports were two GDP components that helped the economy improve, as they recorded growth in the first quarter. Spending growth was due to front-loading, mainly in relation to accelerating the national economic recovery (PEN) program, including strategic infrastructure projects and vaccine procurement.

Meanwhile, exports were driven by robust external demand, thanks to the better than expected global economic recovery led by the two largest economies in the world, the United States and China, which happen to be Indonesia’s main export destinations. The two countries posted economic expansion in the first quarter, with the US economy expanding 0.4 percent yoy and the Chinese economy jumping by 18.3 percent yoy.

The first two months of the second quarter have passed to indicate a light at the end of the tunnel. The most recent economic indicators, on both the demand and supply sides, suggest that Indonesia may escape the recession. The consumer confidence index (CCI) has slipped back into optimistic territory, rising to a 13-month high of 101.5 in April 2021. It was the first time the CCI hit above 100 since March 2020, the beginning of the pandemic. Moreover, the manufacturing purchasing managers’ index (PMI) spiked to 54.6 in April 2021, in the sixth straight month of manufacturing activity growth and the highest on record.

National spending grew 15.90 percent yoy to April, with government spending rising 28.05 percent yoy, with the greatest yoy rise in goods and capital expenditures at respectively 87.13 percent and 132.35 percent. Exports and imports continued to strengthen, increasing by 51.94 percent and 29.93 percent yoy in April 2021, respectively. The import increase is a positive indicator, since a huge chunk of total imports are input goods (raw materials and capital goods), suggesting that investment and production activities are picking up.

All major components of GDP are hence expected to accelerate in the second quarter. The government has even projected that the economy could expand significantly between 7 percent and 8 percent yoy. This is a rather high growth rate compared to the historical pattern. In the few years prior to the pandemic, the annual growth rate for each quarter hovered at around 5 percent yoy. If the 7-8 percent growth indeed occurs, it will be the strongest annual growth since the fourth quarter of 2004 (7.16 percent yoy).

Many analysts are questioning whether it is possible to reach that rate. The answer is most likely to be yes. The first quarter of 2021 recorded real GDP of Rp 2.68 quadrillion (US$188.21 billion), already well above real GDP of Rp 2,589.82 trillion in the second quarter of 2020. This means that second-quarter annual growth is inclining toward the positive. If it is assumed that real GDP will remain flat, annual growth will reach at least 3.60 percent yoy, but this seems to be too low due to the obvious economic improvements in April and May 2021.

However, the high forecast figure should be interpreted carefully. While it is arguably true that economic recovery is accelerating, it cannot be denied that the expected high annual growth in the second quarter is mainly caused by the low base effect of second-quarter contraction last year. During this period, the economy shrank 5.32 percent yoy, the largest contraction throughout 2020, as the government implemented the large-scale social restrictions (PSBB) to contain the coronavirus transmission and notably harmed all aspects of the economy. Another cause of the jump is the effect of the Ramadan and Idul Fitri holiday season, which almost always increases household consumption temporarily.

Furthermore, to attain at least 7 percent yoy growth, Indonesia merely needs quarter-to-quarter (qoq) GDP expansion of 3.28 percent in the second quarter. This is relatively low growth, as GDP in every second quarter before the pandemic grew qoq by an average 4 percent. It totally makes sense to assume a quarterly growth rate of below 4 percent amid the restrictions on some community activities and the government ban on mudik (exodus) for Idul Fitri, yet the growth rate is most likely to remain above 3 percent on the abovementioned improvements.

The bigger picture is how Indonesia’s economy will perform in the second semester, which needs more focus. The “bonus” from last year’s low base effect will diminish amid the bottoming out and narrowing contraction in the third and fourth quarters of 2020. Assuming a 7 percent yoy growth in the second quarter, GDP will expand only 3.05 percent yoy in the first half of 2021, below the 5-year pre-pandemic average of 5 percent yoy. This hints at the need of going the extra mile to full recovery and quickly return GDP growth to its pre-pandemic trajectory.

The fiscal stimulus will be reduced eventually to achieve fiscal sustainability (budget deficit narrowing) and monetary easing will end, as money supply growth has been high to raise concern of inflationary pressure in the near future. The private sector should therefore be the growth engine in the second half of 2021 and onwards. However, it cannot be refuted that this will require easting of mobility restrictions to increase public activities, which may strengthen demand and encourage more investment activities. To do so, all parties must continue to maintain and practice the health protocols in line with the government agenda to accelerate vaccine availability for all.

*****

Economist at Bank Mandiri