Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsWealth gap narrows in Indonesia as stock market slumps, house prices grow

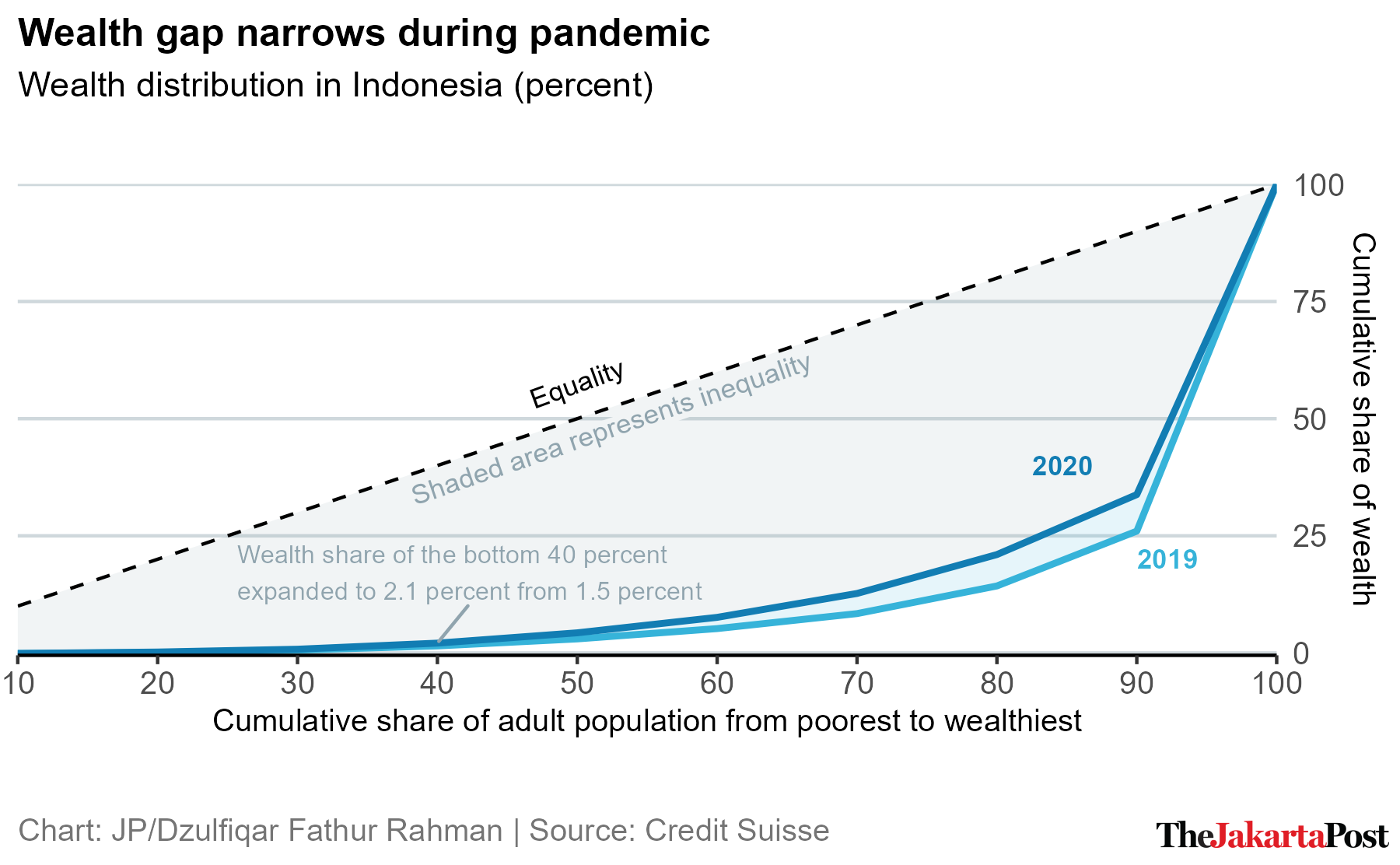

The richest 10 percent held around two-thirds of wealth last year, down from 74.1 percent in 2019, according to the latest global wealth report from Swiss investment bank Credit Suisse.

Change text size

Gift Premium Articles

to Anyone

W

ealth inequality in Indonesia fell during the first year of the pandemic as the rich earned less from the stock market and the wealth share of adults in the middle and poorest groups expanded amid shrinking debts.

The richest 10 percent held around two-thirds of wealth last year, down from 74.1 percent in 2019, according to the latest global wealth report from Swiss investment bank Credit Suisse. At the same time, the wealth share of adults in the middle expanded to 2.2 percent from 1.5 percent. The portion of wealth held by the poorest 40 percent also expanded slightly.

The latest shift in wealth distribution brought Indonesia’s Gini ratio down to 0.777 last year from 0.833 in 2019, the lowest level since 2011. A Gini figure below 0.7 is considered low and one above 0.8 is high by global standards, according to the report.

The Gini ratio for wealth inequality is far higher than that for both income and expenditure inequality. For inequality of expenditure, for example, the Gini figure was 0.385 in September last year, up 0.004 from a year earlier, Statistics Indonesia (BPS) reported.

“Wealth is more unequal because expenditure does not account for savings. The rich have large savings but spend less, while the poor barely have savings,” Arief Anshory Yusuf, a professor of economics at Padjadjaran University in West Java, told The Jakarta Post in a phone interview.

Read also: Indonesia’s ultra rich to increase in number by 57% by 2024

Pandemic batters stock market

The wealth gap in Indonesia narrowed in line with the decline in stocks, which typically account for the majority of wealth among the rich. The Jakarta Composite Index, the benchmark index of the Indonesia Stock Exchange, was down around 5.1 percent year-on-year (yoy) at 5,979 points at the end of 2020. But the index has rebounded somewhat since.

For the middle class, houses are usually the main asset, and for those at the bottom, it is usually cash. The house price index grew 1.43 percent yoy to 213.98 in the period from October to December 2020, according to Bank Indonesia. The growth continued slowing.

These trends led the average nonfinancial assets to grow 2.25 percent from a year earlier, nearly twice the pace of financial assets. With debts shrinking on average, the overall wealth per adult, which was made up mostly of nonfinancial assets, grew 2.24 percent annually to US$17,693.

While Indonesia saw a fall in its Gini ratio, wealth inequality across the world mostly went up. Another country that posted a decrease in its Gini is India. But its share price index grew by a staggering 16 percent while its house price index fell 0.1 percent, the report found, quoting data from Thomson Reuters.

The rise in wealth inequality worldwide, however, was neither a direct result of the pandemic nor its direct economic impact, but rather the policy response to the shock, especially lower interest rates, according to economists James Davies, Rodrigo Luberas and Anthony Shorrocks, who wrote the wealth report. Lower rates have boosted asset prices.

“Where government transfers and other support such as government-backed furlough schemes have not been implemented, the economic impact of the pandemic on employment and incomes in 2020 are likely to have damaged the lowest groups of wealth holders, forcing them to draw down their savings and/or incur higher debt,” the economists wrote in the report.

Arief said he trusted the report’s credibility, but feared Indonesia’s wealth inequality might be worse than reported. This is in part due to the limitation in the report’s estimates that were based on household survey data and not household balance sheet data, the latter was more common in developed countries.

Inequality may also decrease because the pandemic has led some people to save more and consume less, according to Arief. As a result, their wealth level rises.

“I personally experienced it,” said Arief.

“I used to spend a big enough amount of money on traveling almost every year. But I have not spent [on traveling] for nearly two years.”

Last year, the number of adults with wealth ranging from $10,000 to $100,000, namely those in the middle, nearly doubled to 55.6 million. Adults with wealth between $100,000 and $1 million also nearly doubled to 3.46 million. The number of millionaires expanded by 62.3 percent to around 172,000. At the same time, adults with wealth below $10,000 shrank by 13.9 percent to 121.5 million.

Wealth remains heavily concentrated at top

The top 1 percent in Indonesia controlled 36.6 percent of wealth in 2020. While other emerging economies, such as India and South Africa, had a higher wealth concentration at the top, Indonesia’s is higher than that of China and some developed countries, like Japan and the United Kingdom.

However, the average wealth was nearly four times higher than the median wealth at $4,693, which suggests that the wealth distribution remains heavily skewed to the rich.

Read also: Indonesia aims to tax rich more to finance large pandemic deficit

Arief said the wealth concentration at the top indicated that Indonesia’s tax policy had failed to redistribute wealth. This was largely because the government relied more heavily on corporate tax and value-added tax. In contrast, advanced economies with better welfare systems, such as countries of the Organization for Economic Cooperation and Development (OECD), relied less on those taxes and more on personal income tax.

The government plans to tax the rich by raising the income tax rate for people earning above Rp 5 billion ($343,690) to 35 percent in a proposed revision to the General Tax Procedure Law. At the moment, the top income tax rate is 30 percent for those earning more than Rp 500 million.

“It will put a brake on the wealth accumulation,” said Arief, referring to the new income tax bracket.

“The problem is, to what extent it will reduce wealth inequality? If not by much, maybe we need a more radical idea, such as a wealth tax.”