Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia urgently needs law to regulate finfluencers

Many people have reportedly suffered losses from failed investments after following influencers' advice on social media platforms.

Change text size

Gift Premium Articles

to Anyone

T

he Australian Securities and Investments Commission (ASIC) released a new regulation on April 4 that banned financial influencers (finfluencers) from providing financial advice without a license on social media platforms such as Instagram, YouTube or TikTok. Failure to follow the rule could result in the influencer being sent to jail.

Australia is the first country to regulate influencers after being the first to adopt a regulation mandating media digital platforms to pay compensation fees to local news media outlets for displaying their content on their platforms.

The new ASIC regulation specifically states that a business is eligible for providing financial services if the owner holds an Australian Financial Services (AFS) license. Financial product advice may take various forms, including attempts to influence someone to purchase particular financial products.

While giving advice about financial services or promoting a particular product is strictly prohibited, advising on budgeting would not be considered breaking the law. Following the law, ASIC has taken influencer Tyson Scholz, who has 22,500 followers on Instagram, to court for delivering training courses and seminars about trading in securities without a license.

Financial influencers have significant power over the younger generation. Based on research conducted by ASIC, 28 percent of young people follow financial influencers, and 64 percent of them change their behavior because of a post on social media.

Influencers use social media to not only promote a product but also advise on nearly everything, from budgeting to choosing financial products. This includes promoting investment in specific stocks or assets with a promising return, despite many not holding licenses. Many display their luxurious lifestyles on Instagram and TikTok and credit their investing habits for their wealth, in Indonesia such influencers have earned the sobriquet “crazy rich”.

Australian influencers have had a mixed response to this regulation. Some have followed the new regulations by deleting several of their previous posts and unlinking products that they promoted. In contrast, others have complained that the rule is unfair to Australian influencers claiming that many Australians will seek advice from overseas information sources that ASIC cannot control.

They further argue that not everyone can afford financial advice from a licensed financial advisor and that their activity is a free-of-charge instrument for promoting financial literacy in society. While obtaining a license often costs a lot of money and hassle going through complicated administrative procedures, the influencers assert that having a license does not guarantee competence.

Social media is a double-edged sword that comes with positive and negative impacts. As a medium of information exchange, social media has indeed increased society's financial literacy. At the same time, social media can affect our emotions, such as jealousy and insecurity, which may cause overspending. Social media has also been a fertile ground for paid influencers, often celebrities. In investing in influencer marketing, companies usually target specific influencers that shape the opinions of the masses. However, researchers Bizzi and Labban found that online traders influenced by social media are unlikely to receive adequate returns. Many people reportedly have suffered losses from failed investments after following influencers' advice on social media platforms.

As the fastest-growing internet economy in Southeast Asia, Indonesia has been in a similar situation as several investment fraud cases have made the headlines lately. The tremendous number of social media users in the country has opened ways for financial opportunists to make huge profits, often illegally.

The situation is made worse by the extremely low financial literacy of most people. Based on a Financial Services Authority (OJK) survey in 2019, Indonesia's financial literacy index stands at 38.03 percent, meaning that six in 10 people in Indonesia are not financially literate.

New investors, especially the younger generation, tend to seek free knowledge about finance and investment online, mostly from influencers. Since the majority of the influencers have no license guaranteeing their qualifications, the risks of following their suggestions without a complete understanding of the product could be perilous.

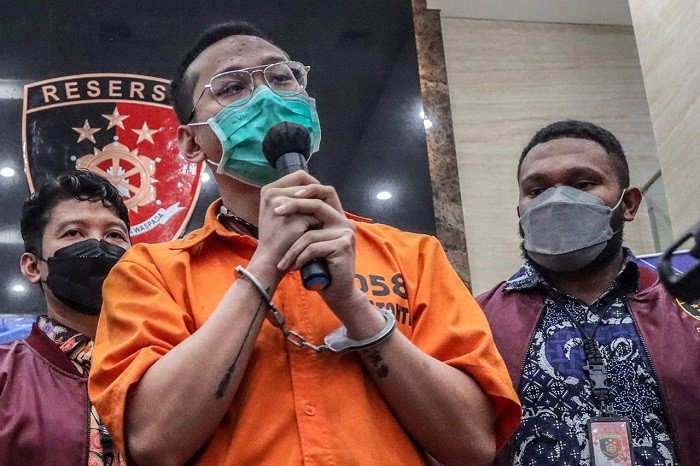

Indonesian authorities have recently received many reports on investment scams, including the seemingly endless wave of investment fraud of various forms and sizes. People wonder how “crazy rich” Indra Kenz, a suspect in the recent infamous investment fraud, earned such large sums of money before being caught.

Markets exist as a result of supply and demand; when the market is unhealthy, the government should intervene. In this case, many people on the demand side are lured away by the high returns offered by “financial advisors” on the supply side.

Despite the worrisome increase in financial fraud cases associated with the financial advice of finfluencers, so far, the Indonesian government has not yet taken any real action to regulate their activities. While certified financial advisors are an urgent need, the government must also keep working on increasing the financial literacy of society. Equipping society with proper knowledge and understanding of financial institutions and products will minimize the undesired effect of unlicensed finfluencers’ activities.

At the same time, it is essential to control the quality of the content of the finfluencers to ensure they align with the legal standards. One of the solutions could be by following the ASIC policy with some adjustments.

Learning from the Australian experience, the Indonesian government may consider issuing a license for financial advisors at an affordable price with transparent and practical procedures while enforcing strict legal punishment on finfluencers operating without a license.

In sum, the rampant financial frauds in Indonesia justify the immediate issuance of policies regulating finfluencers’ activities. The government also needs to redouble efforts to promote financial literacy.

***

Damiana Simanjuntak is an economic researcher and PhD candidate at the Department of Economics, National Dong Hwa University, Taiwan. Doriani Lingga is an economic researcher and PhD candidate at the Department of Economics, the University of Auckland.