Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGoTo launches Gopay e-wallet as stand-alone app

Indonesian tech giant GoTo is rolling out its Gopay e-wallet nationwide after its initial introduction in 2016.

Change text size

Gift Premium Articles

to Anyone

G

oTo Financial, the fintech provider of Indonesian tech giant GoTo, is rolling out its Gopay e-wallet nationwide after its initial introduction in 2016.

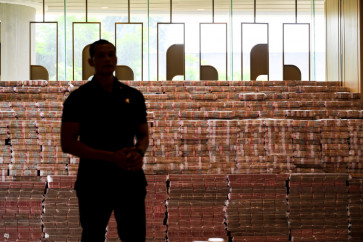

“We hope Gopay will reach a wide public, especially those who are not yet users of Gojek and Tokopedia,” GoTo Group CEO Patrick Walujo said on Wednesday at the launch event for the app.

As a part of GoTo’s fintech ecosystem, Gopay was previously exclusively integrated into the ride-hailing app Gojek and e-commerce platform Tokopedia. Now, the e-wallet has transformed into a stand-alone app independent of both platforms, allowing users to access it directly.

Hans Patuwo, president of GoTo's fintech unit, said the nationwide launch of the e-wallet was “a significant milestone for the company”. He clarified that the new app would not replace the Gopay access through the Gojek and Tokopedia apps.

“We won’t remove Gopay from them; instead, we will keep developing [Gopay for these apps],” Hans assured.

Read also: Indonesia spearheads efforts to digitalize payments, local currency adoption across ASEAN

The app had been soft-launched in April, Hans said, adding that the public response was overall positive.

In 2016, Gopay was born as Gojek’s payment instrument, according to Hans, as both users and Gojek partners were sometimes uncomfortable with cash payments, because the transactions did not always add up.

“Thus, Gopay emerged to reduce the friction of this inconvenience,” he said, adding that the firm would like to continue developing the app domestically for now.

During the launch event, Hans reintroduced familiar features available in the app, including bill payments and various transfer options, such as transferring funds between Gopay accounts or even between banks. Additionally, he announced that the app now allowed up to 100 free transfers per month.

“Making transfers is one of the biggest activities [conducted] in the app,” Hans emphasized.

An expense report in the app gives users an overview of their expenditure within the Gopay ecosystem, including transactions made in Gopay and Tokopedia. Hans expressed hope that this feature would improve the public’s financial literacy in the long run, as the app not only automatically recorded transactions made through Gopay but could also include other transactions users input manually.

However, Hans clarified that the digital wallet would remain a fintech product and not turn into a bank, noting that the firm would continue to work closely with publicly listed Bank Jago, which GoTo acquired in 2019.

Read also: Improving financial literacy in Indonesia

GoTo Financial was created during the merger of Gojek and Tokopedia to serve as an integrated payment option for both apps.

GoTo Financial had 63 million active users as of December 2022.