Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsReconsidering investment strategies for haj funds

Change text size

Gift Premium Articles

to Anyone

T

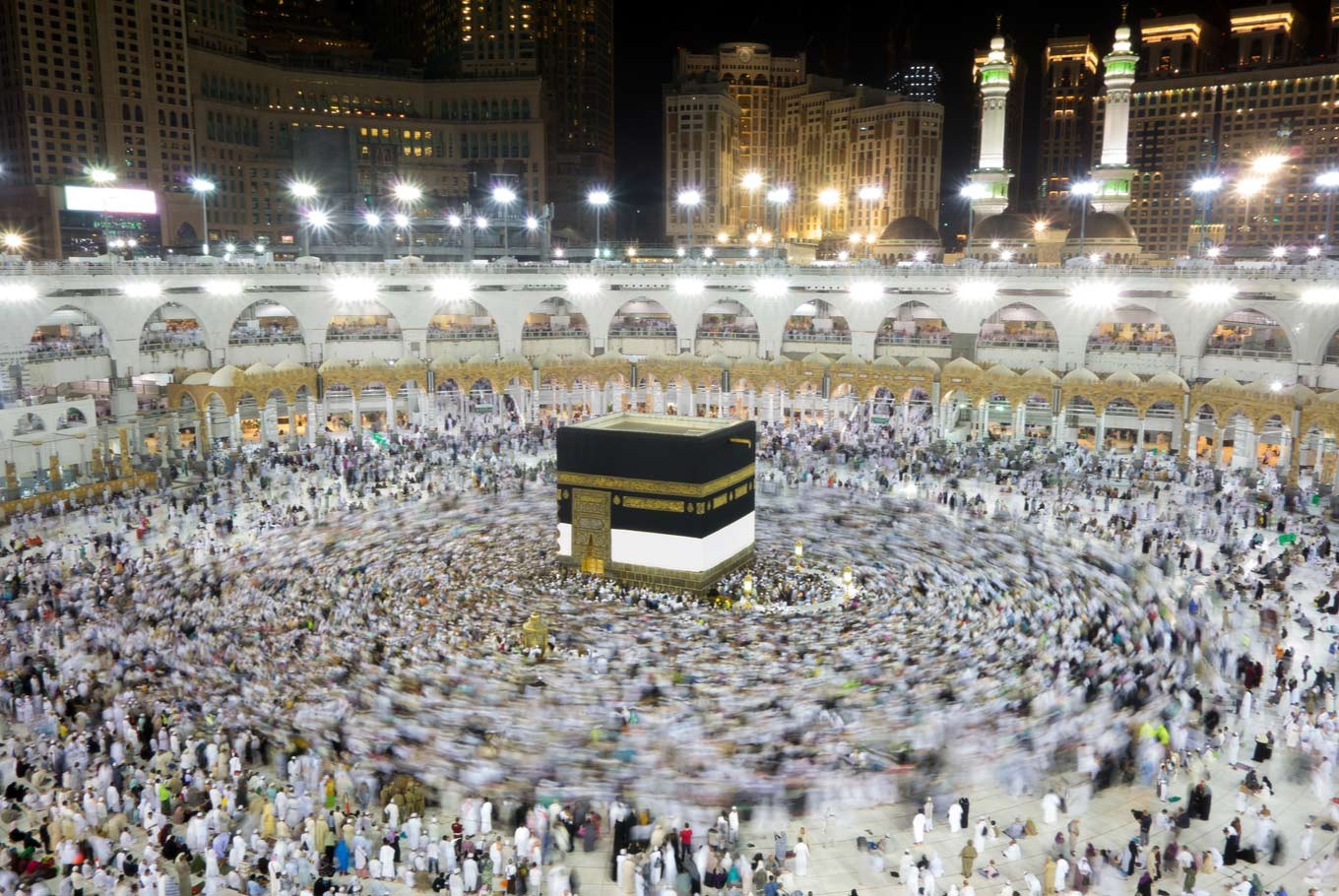

he establishment of the Haj Fund Management Agency (BPKH) in August 2017 was very strategic for improving the quality and efficiency of our haj fund management.

The existing haj funds should be more professionally managed by investing them in more productive assets, indubitably while observing sharia and prudential principles. The change in investment strategy is needed so they would gain higher returns, which would be beneficial both for the owners of the funds and the government, including for anticipating the increase in the cost of the haj in the future.

The haj funds currently managed by BPKH amount to about Rp 110 trillion (US$775.69 million) and have an annual return of about 5.5 percent. The funds are raised from millions of people who have paid deposits to go on the haj.

Almost the same rate of return is targeted by the BPKH for 2019. With the inflation rate and the fluctuation of the rupiah exchange rate, such a rate of return may not be sufficient to cover future increases in haj costs.