Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsDigital investment applications for millennials increasingly promising

Change text size

Gift Premium Articles

to Anyone

T

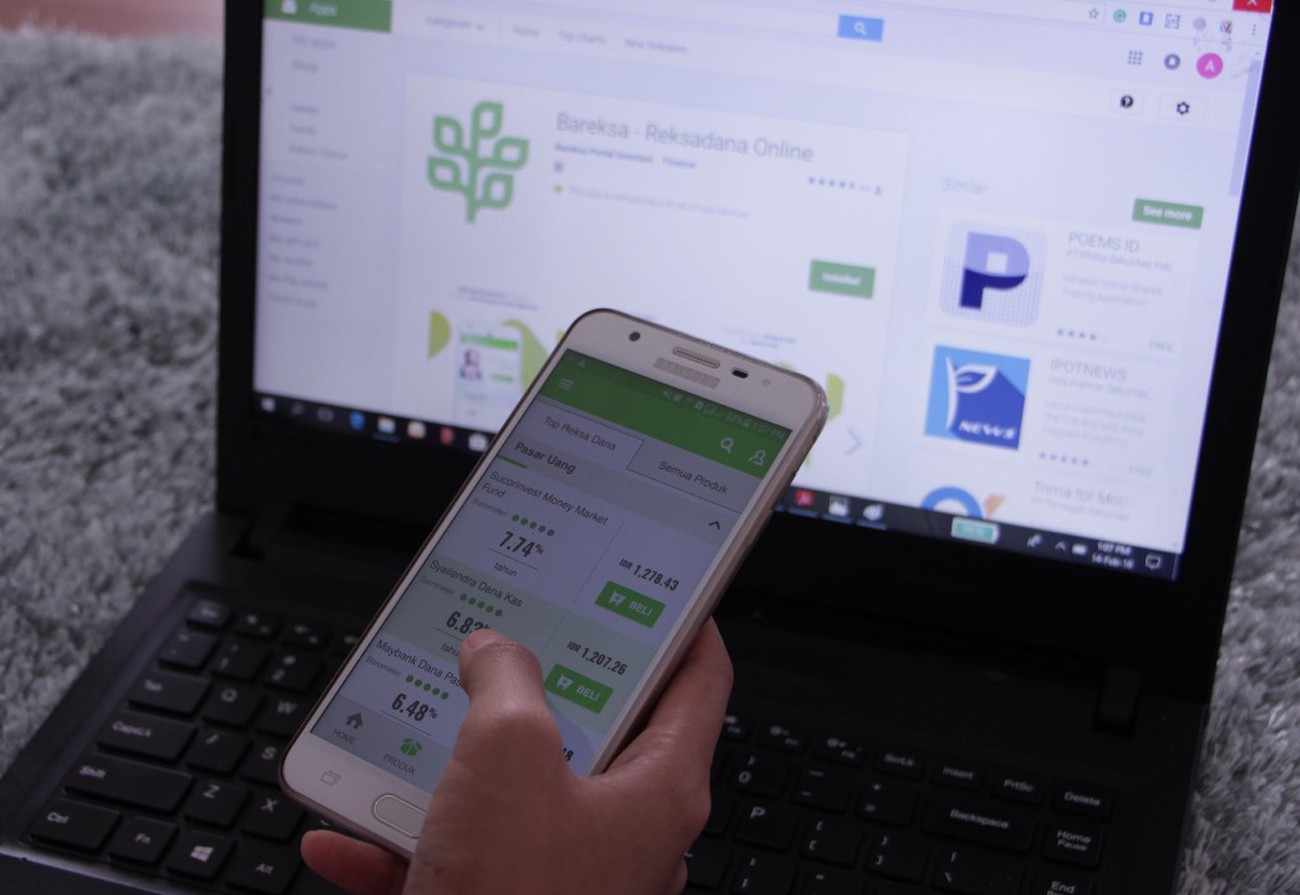

he rise of investment support applications makes it easier for millennials to choose a container that can facilitate their needs. In this era, millennials prefer things that are simple, such as digital investment solutions.

Investment is the action of using funds for a certain period of time with the aim to generate profit. Before the digital era entered Indonesia, investment could only be done conventionally, such as by opening an account with a bank.

For example, if someone wants to buy reksa dana (mutual funds), he or she must personally approach a bank or office that provides mutual fund services with the aim of opening an account.

Once the account is ready, the investor can only buy mutual funds with a minimum purchase of Rp 500,000 (US$35).

But now, there are many investment applications that attract young investors. These applications must have been licensed and overseen by the Financial Services Authority (OJK).

They have specific focuses according to various investment strategies. But at this time, the realm of investment is not only owned by e-commerce, but e-marketplaces that have penetrated the investment world by adding several investment services to their applications.

These types of investment include reksa dana, digital gold savings as well as stocks, and these investments work in different ways. Examples are ShariaCoin, Pegadaian (pawnbroking) Digital and INDOGOLD for digital gold savings.