Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe Fed, coronavirus and Indonesia’s fiscal policy

Change text size

Gift Premium Articles

to Anyone

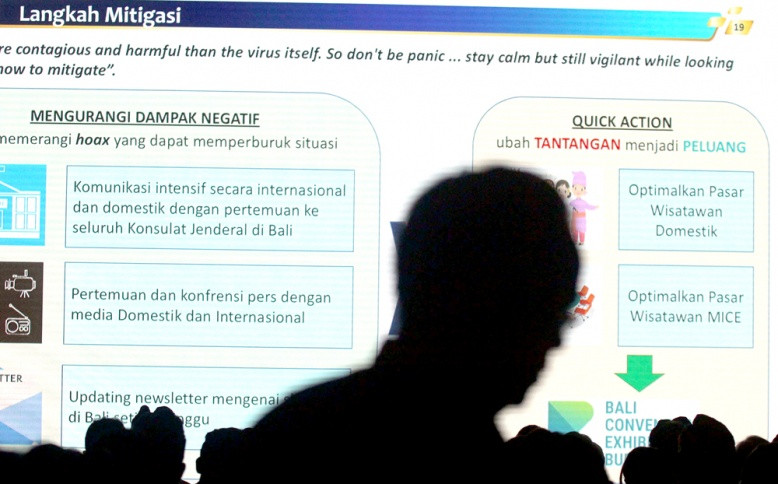

Contagious: The Bali representative office of Bank Indonesia uses a screen to explain measures the government has been taking to address the COVID-19 outbreak and its impacts on industry during the launch of the Bali Convention Exhibition Bureau on Feb. 13. The outbreak has battered China’s economy, resulting in a nearly 0.2 percent drop in economic growth in Indonesia. (JP/Zul Trio Anggono)

Contagious: The Bali representative office of Bank Indonesia uses a screen to explain measures the government has been taking to address the COVID-19 outbreak and its impacts on industry during the launch of the Bali Convention Exhibition Bureau on Feb. 13. The outbreak has battered China’s economy, resulting in a nearly 0.2 percent drop in economic growth in Indonesia. (JP/Zul Trio Anggono)

A

number of recent events appear to be unrelated, but are actually connected to each other, particularly in their effects on the Indonesian economy.

The first event was the market and investor confusion over the policy steps taken by the United States’ central bank, the Fed, which has been inflating its balance sheet since October. Many suspect that the Fed’s inflated balance sheet is quantitative easing (QE), wherein the central bank injects large funds into the economy as part of an expansionary monetary policy to overcome a financial crisis.

Jerome Powell, its chairman, has tried to clarify that what the Fed is doing is not QE, because what is doing is not in the context of monetary policy. Many investors remain skeptical, however, since the Fed continues to buy US$60 billion in short-term government securities every month, and given the central bank’s unclear signals to the market.

How does this affect Indonesia? If we look back, the Fed’s QE after the 2008 global financial crisis resulted in excess liquidity in the global economy.

This gave investors an incentive to invest the excess liquidity in high-yield markets, mostly in developing countries such as Indonesia. This effect strengthened the rupiah as a result of the large inflow of foreign funds to Indonesia.

However, when the US economy started recovering and its central bank began to reduce the QE funds (later known as the Tantrum Taper), the increased capital market volatility and exchange rates due to increased capital outflows slightly disrupted Indonesia’s financial stability.

We should be wary of this kind of effect, since it could repeat this time around. The Fed’s expanding balance sheet is one of the important factors that can stabilize the rupiah to below 14,000.

However, because of the unclear policy signals from the Fed, many investors speculate that it may take the initiative to stop inflating its balance sheet, which in turn will have an adverse impact on the stability of Indonesia’s financial system.

The second occurrence is the novel coronavirus outbreak, which has been declared a global emergency and is expected to slow the global economy further. The Chinese city of Wuhan — the epicenter of the outbreak — has a large industrial zone and is connected to the global supply chain.

The disruption of economic activities in the city will affect global economic growth, including Indonesia’s growth.

US rating agency Standard and Poor’s has projected that the outbreak will slow China’s economy to around 5 percent in 2020, from 6.1 percent in 2019. On the other hand, the International Monetary Fund’s analysis shows that a 1 percent fall in Chinese growth will cause Indonesia’s growth to decline almost 0.2 percent.

In other words, we must expect a correction of about 0.2 percent to the baseline projection of Indonesian growth.

The final event is Indonesia’s fiscal condition, which may be a cliché. The government announced last month that Indonesia’s fiscal budget deficit reached 2.2 percent of gross domestic product (GDP) due to a revenue shortfall of Rp 207.9 trillion ($15.4 billion). This figure is below the government’s 1.8 percent target.

The government has targeted tax growth of 13 percent in 2020, but this is more optimistic than the historical average increase in the 8-9 percent range.

The Institute for Development of Economics and Finance (Indef) estimates that, if the government fails to achieve its optimistic tax growth target, the budget deficit can widen to 2.8 percent of GDP, closer to the legal ceiling of 3 percent.

Put another way, the three abovementioned events are interconnected vis-à-vis how they could have simultaneous, negative effects on Indonesia’s financial stability.

In terms of monetary and financial stability policies, Bank Indonesia must send a clear signal to the market regarding its policy direction. Policy transparency will increase policy effectiveness and reduce information asymmetry. Market intervention may also be necessary to anticipate a greater shock that might occur in the future.

In terms of fiscal policy, the Indonesian government may face many challenges in increasing the driving force behind fiscal policy effectiveness.

Despite its efforts to reform the economy through the omnibus bill, this can be realized only in the medium term.

Therefore, there is a need for fiscal prudence in the short term, especially in spending and debt management, in order to maintain Indonesia’s fiscal health as a cushion against the possibility of short-term turmoil.

***

Doctoral researcher at the University of Birmingham and financial risk manager