Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsHow can European companies win in RI’s e-commerce market?

This massive online population uses not just e-wallets but also a wide range of bank-transfer apps (contributing to almost 30 percent of online transactions) and a range of other local payment methods (7 percent).

Change text size

Gift Premium Articles

to Anyone

I

f you see the words “Southeast Asia” in connection with e-commerce, you probably think of Singapore’s savvy online shoppers or the Filipino e-commerce boom that’s making Manila one of the world’s digital hubs.

And for sure, these markets are exciting, important and will continue to attract investment for a long time to come. But one country is often left off the list of the region’s digital powerhouses: Indonesia. And that omission is likely to prove an expensive one for companies who don’t capture the opportunities this rapidly expanding market has to offer.

In 2020 alone, Indonesia’s digital economy grew by 11 percent to a value of US$44 billion. And the digital economy already contributes 4 percent to their national GDP. This will come as no surprise to seasoned observers of Indonesia’s digital economy, and particularly its payment sector, which is both thriving and innovative.

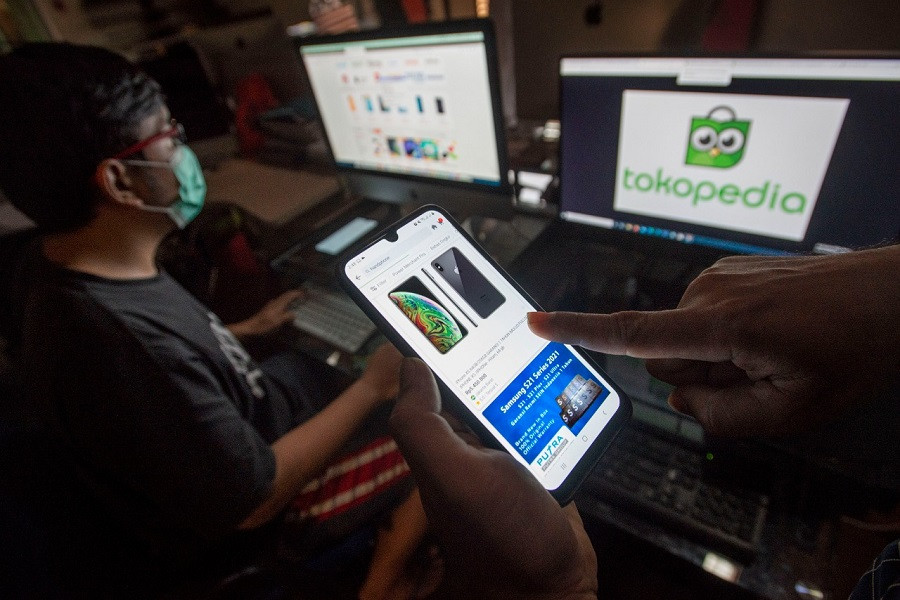

In May 2021, ride hailing and payments giant Gojek and marketplace Tokopedia, Indonesia’s two biggest startups, merged to form payments and e-commerce giant GoTo. With more than 100 million active users, the new group is opening up Indonesian and Southeast Asian e-commerce to new users, demographics and markets.

It would be a mistake to believe that GoTo, or its payments arm GoPay, are the only kids on the block. There are almost 150 million Indonesians with Internet connections. This massive online population uses not just e-wallets but also a wide range of bank-transfer apps (contributing to almost 30 percent of online transactions) and a range of other local payment methods (7 percent). Indonesians even use cash in around 13 percent of online purchases.

One of the highly popular Indonesian payment methods is the local bank-transfer app Jenius, which has 3.3 million active users, up from 1.6 million just two years ago. Similarly, Indonesian e-wallet LinkAja recorded a 65 percent increase in the rate of new-user sign-ups in 2020, during which time it quadrupled its transaction volumes and grew its revenue by 250 percent.

Even the Indonesian credit-card market has a local twist. Used in just 34 percent of online transactions, cards are mainly issued by global giants such as Visa and Mastercard. But the cards used in 13 percent of transactions are issued by local schemes. This is a substantial chunk of the market which merchants entering the Indonesian e-commerce sector would miss, if they only supported the standard payment methods for developed markets.

So, what should merchants, and the service providers which support them, do to prepare themselves for a successful entry into Indonesia’s booming e-commerce and online-payments markets? The key is, as ever, localization.

The most obvious way merchants and others entering the Indonesian market need to adapt, is by optimizing for mobile. According to the International Telecoms Union (ITU), just 4 percent of Indonesians have a fixed-broadband subscription, while 89 percent have a mobile-broadband subscription. And almost 100 percent of the adult population has a smartphone, while just 19 percent has a tablet computer.

Language is also an important aspect of localization for Indonesians. Over 90 percent of the population speak and read Indonesian, and the most common spoken language is actually Javanese, spoken by almost a third of the country’s inhabitants.

It may be worth noting that the English Proficiency Index, which ranks countries by the proportion of their citizens who speak and read fluent English, puts Indonesia at 74 out of 100.

Probably the most important requirement, however, is to localize payment methods. Only 29 percent of all online transactions in Indonesia are paid using globally recognized credit cards. And even this may be an overestimate. With smartphones now ubiquitous and the uptake of e-wallets, bank-transfer apps and other local payment methods (LPMs) surging, the Indonesian payment market seems set to diversify rapidly.

To win in such a fast-evolving environment, merchants and payment service providers (PSPs) need to work with a partner that understands local payment culture, preferences and e-commerce conditions.

***

The writer is head of Global Market Development at PPRO.