Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsModalku empowers MSMEs through capital funding and more

Change text size

Gift Premium Articles

to Anyone

T

he Modalku Group, a digital funding platform for micro, small and medium enterprises (MSMEs) in Southeast Asia, has revealed that it has distributed as much as Rp 53 trillion in funding to more than 5 million MSME transactions in Indonesia, Singapore, Malaysia, Thailand and Vietnam.

Indonesia’s transactions alone have proven to be significantly high, as the MSME industry most funded by Modalku is dominated by the trade sector, both wholesale and retail, including online entrepreneurs at 61 percent. It is then followed by the service sector, including the procession, construction and logistics industries. It is important to note that MSMEs have widely been credited as the backbone of Indonesia’s economy.

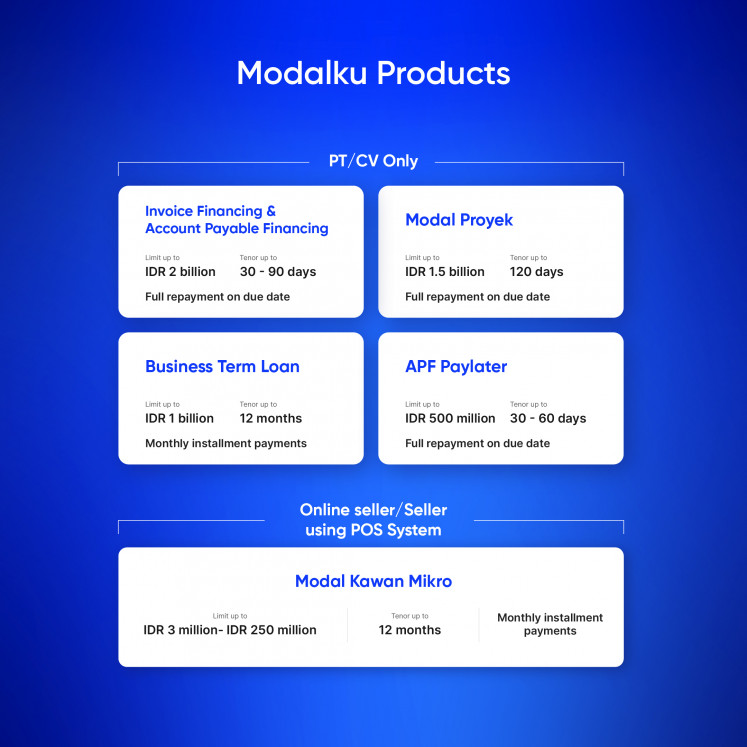

While Modalku offers a variety of funding solutions to meet each consumer’s needs, most of the company’s funding facilities are tailored to the business characteristics of MSMEs, both those of legal entities (PT/CV), as well as online sellers and offline sellers that use a point of sale (POS) system.

For the PT/CV businesses, products offered by Modalku include Invoice Financing, Accounts Payable Financing, Project Capital, Business Term Loan, and APF Paylater. Through the Invoice Financing product, a user can turn invoices or receivables into a productive source of funding, while the Accounts Payable Financing product can be utilized to finance purchase orders to suppliers.

Next up is the Modal Proyek, which is catered to vendor entrepreneurs working on LKPP and LPSE (Electronic Procurement Services), e-catalogue government projects that require alternative funding without collateral. This facility is suitable for those who need business capital to work on government projects with a flexible commitment of up to 120 days.

Furthermore, through the Business Term Loan product, businesses can get working capital of up to Rp 1 billion with a tenor of up to a year. Lastly, the APF Paylater product, businesses can increase their inventory, smooth cash flow, and shop for office equipment and other needs with a limit of up to Rp 500 million.

Moreover, the product Modal Kawan Mikro offers funding suitable for online and offline sellers who use a POS system. The business capital can be used to purchase inventory or stock of goods for sale or other business operational needs for up to 12 months.

Utilizing the product can result in beneficial outcomes, such as undisrupted cash flow, and to be able to buy stocks of goods without having to think about the lack of capital. All the products offered are also made greater by the easy steps it takes for businesses to apply.

The first step is to fill in and complete the application data required on the application website. Then, the Modalku team will reach out to collect other documents. This is then followed by the confirmation or credit approval for those that are eligible and have submitted the required documents. Usually, the team takes up to three working days to process. Lastly, if the application has been approved, it will continue with the credit approval process until the funds or business capital limit are disbursed.

Modalku provides digital funding services, where fund recipients, particularly MSMEs, can get unsecured business capital of up to Rp 2 billion funded by individuals or institutions through a digital platform. Apart from Indonesia, Modalku also operates in Singapore, Malaysia, Thailand and Vietnam under the name Funding Societies.