Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsCredit growth revival may rekindle banking stocks’ appeal

Persistent headwinds, including weak household purchasing power and a softer rupiah, meanwhile, may constrain loan growth and dampen investor sentiment, slowing the recovery in banking stocks.

Change text size

Gift Premium Articles

to Anyone

W

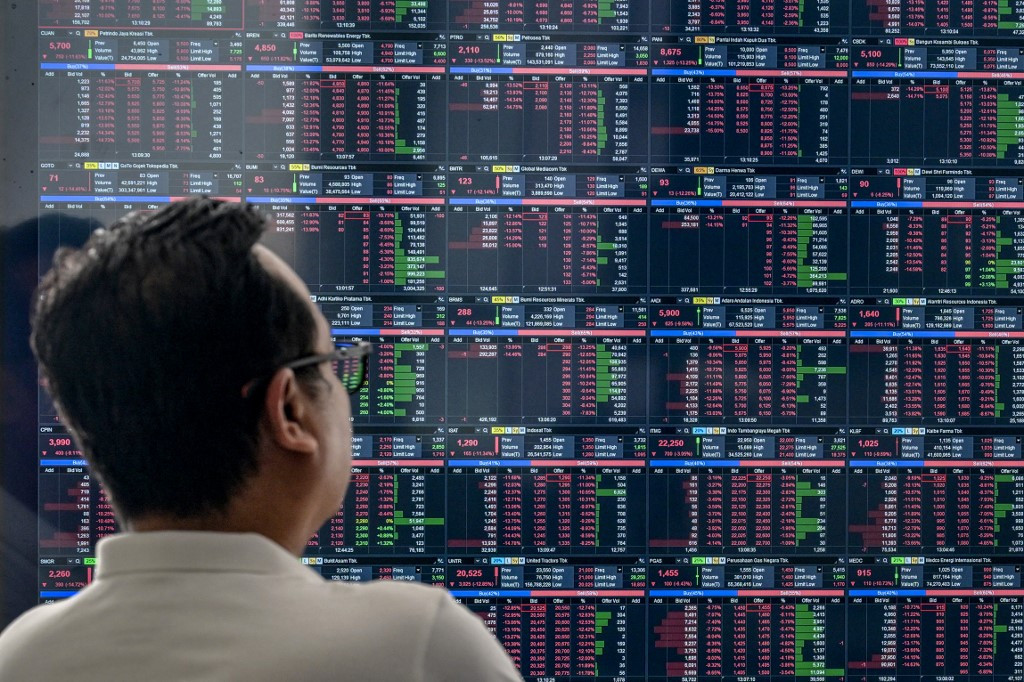

hile the Indonesia Stock Exchange (IDX) Composite index repeatedly reached record highs last year, the rally largely bypassed big bank stocks, long regarded as the market’s primary growth engine. Shares of major lenders came under pressure as a prolonged high-interest rate environment dampened credit demand, while global market turbulence prompted foreign investors to pare back exposure to emerging markets, including Indonesia.

Sentiment toward the sector, however, may be turning this year. Analysts expect banking stocks to regain their leadership role as Bank Indonesia (BI) began easing monetary policy toward the end of last year, a move that could revive loan growth and improve earnings prospects.

Still, the recovery is far from assured. Lingering risks such as sluggish household purchasing power and a weakening rupiah could limit credit expansion and weigh on investor confidence, potentially delaying a full rebound in bank shares.

In 2025, the IDX Composite index hit record highs 24 times, closing the year at 8,646.9 points, up 22.1 percent from the beginning of the year. Yet, shares of the country’s largest private lender, Bank Central Asia (BCA), plunged 16.54 percent over the same period, making it the single biggest drag on the benchmark index given its outsized market capitalization.

Major state-owned lenders were not spared. Bank Rakyat Indonesia (BRI) and Bank Mandiri also landed in the top five worst contributors to the index, after their shares fell 10.29 percent and 10.53 percent, respectively.

The waning appetite for banking stocks, long regarded as blue-chip safe havens backed by solid fundamentals, came as loan disbursement growth slowed to just 7.74 percent in November, well below BI’s year-end target range of 8 to 11 percent.

Meanwhile, investors appeared to rotate into mining, energy and data center stocks. Shares of Sinar Mas Group’s PT Dian Swastatika Sentosa, data center operator PT DCI Indonesia and PT Barito Pacific more than doubled over the year.