Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

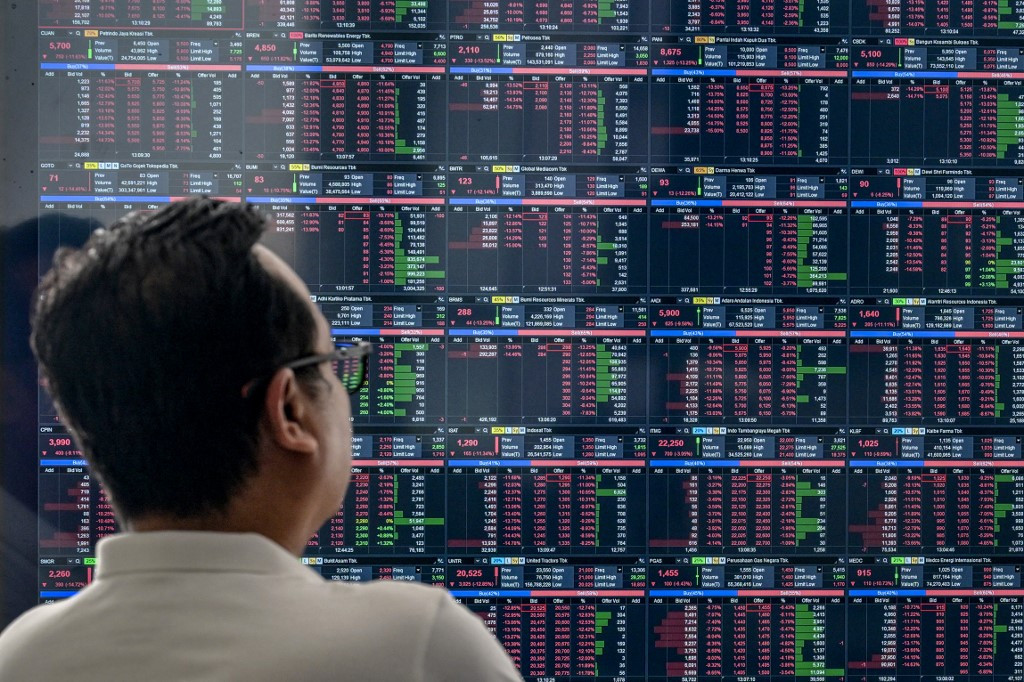

View all search resultsIDX Composite index nosedives at open

Change text size

Gift Premium Articles

to Anyone

T

he Indonesia Stock Exchange (IDX) Composite index nosedived as trading opened on Wednesday following an evaluation by Morgan Stanley Capital International (MSCI) that flags Indonesian stocks.

The index plunged by 6.53 percent from Tuesday’s closing value of 8,980 points to 8,393 points at Wednesday’s opening.

Stocks of two companies with the largest market capitalization, PT Barito Renewable Energy and Bank Central Asia, were down by 17.46 and 6 percent, respectively.

The MSCI temporarily froze several Indonesian stock indices with immediate effect on Tuesday due to its consideration that the transparency level of Indonesian stock ownership was inadequate.

“While there have been minor enhancements to IDX’s float data feed, investors highlighted that fundamental investability issues persist due to ongoing opacity in shareholding structures and concerns about possible coordinated trading behavior that undermines proper price formation,” reads the announcement from MSCI.

“To address some of these concerns, more granular and reliable information on shareholding structures, possibly including high shareholding concentration monitoring, is required to support a robust assessment of free float and investability across Indonesian securities,” it added.

The announcement added that some global participants used PT Kustodian Sentral Efek Indonesia’s (KSEI) Monthly Holding Composition Report as additional reference data, but many investors have expressed “significant concerns” about relying on KSEI's shareholder categorization.