Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesian steel producers see bigger margins, higher stocks price

Change text size

Gift Premium Articles

to Anyone

A

fter facing a sluggish market last year, three steel companies listed on the Indonesia Stock Exchange (IDX) enjoyed better financial performances in the first half of 2016, leading to stock price increases of more than 100 percent year-to-date.

Krakatau Steel (KRAS), a state-owned enterprise and the largest player in the industry, booked a net loss of US$93 million in the first half of 2016. However, the Cilegon-based company has generated gross profits of $99 million, reversing the $38 million loss in the same period last year.

Efficiency was key to Krakatau Steel's recent gross profits. It recorded $544 million in revenue in the first half 2016, rising 3.5 percent from the achievement in the same period 2015. At the same time, it managed to cut steel production costs by 21 percent, on the back of lower raw material costs.

In more detail, Krakatau Steel's material costs were trimmed by 17.7 percent to $349 million during January-June 2016, compared to $424 million in the same period last year. As a result, the gross profit for steel products rose to $80 million, compared to $71 million in losses earlier.

Better financial performance was also seen in Saranacentral Bajatama (BAJA).

The Karawang-based steel producer improved its profit margin in the first half of 2016 despite a 30-percent drop in revenue. Its gross profit rose 8.3 percent due to the 29 percent decline in production costs. Thus, the company's gross profit margin was up to 6.1 percent from 4 percent earlier.

The stable exchange rate in the first half of 2016 helped Bajatama to avoid losses. In the first six months of this year, the company received gains on foreign exchange worth Rp 21 billion, reversing the Rp 34 billion losses in the same period of 2015.

Source: Bareksa.com(Graphic/File)

Source: Bareksa.com(Graphic/File)

Another steel producer, Gunawan Dianjaya (GDST) also managed to create efficiency amid lower revenue. With a production capacity of 400,000 tons of steel plate a year, the company posted Rp 414 billion in revenue during January-June 2016, down 15 percent from Rp 488 billion in the same period last year.

However, the company succeeded in cutting its costs to Rp 340 billion, 33 percent lower than the Rp 515 billion earlier. With lower costs, Gunawan Dianjaya could generate a gross profit of Rp 73 billion, compared to last year's losses of Rp 27 billion.

Stock price

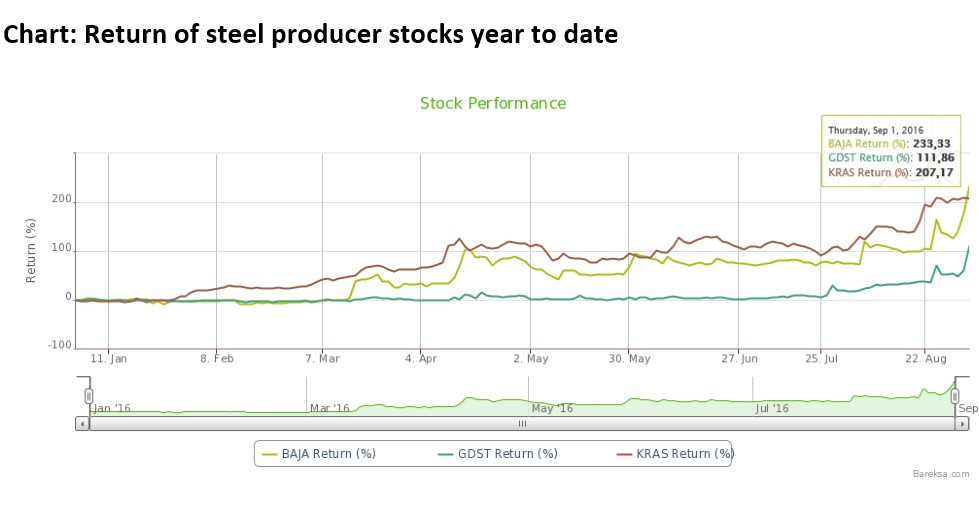

Along with better margins, stock prices of the three companies also climbed. Throughout the year until Sept. 7, KRAS stock prices rose 188.39 percent to Rp 845 apiece from Rp 293 on Dec. 30, 2015.

During the same period, BAJA’s stock price skyrocketed by 233.33 percent to Rp 290 per share, compared to Rp 87 previously. Meanwhile, GDST stocks closed at Rp 146 a piece, 147.46 percent higher than Rp 59 at the end of 2015.

The hike in stock prices was also supported by external sentiments, such as the exception for Indonesian steel products from the safeguard tariff in Vietnam. This policy allows Indonesian producers to sell their steel to the country without the 23-percent tariff. This reflects the good quality of Indonesian steel.

On the other hand, the steel market in Indonesia is still facing a shortage in supply. According to Industry Ministry data last year, the total industry demand for steel was 14 million metric tons, while the total national production was less than 9 million metric tons. (ags)