Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFintech lenders, OJK launch data center as bad loans rise

The data center will be able to integrate peer-to-peer (P2P) fintech lending platforms data in a bid to identify excessive lending, bad credit and fraud.

Change text size

Gift Premium Articles

to Anyone

T

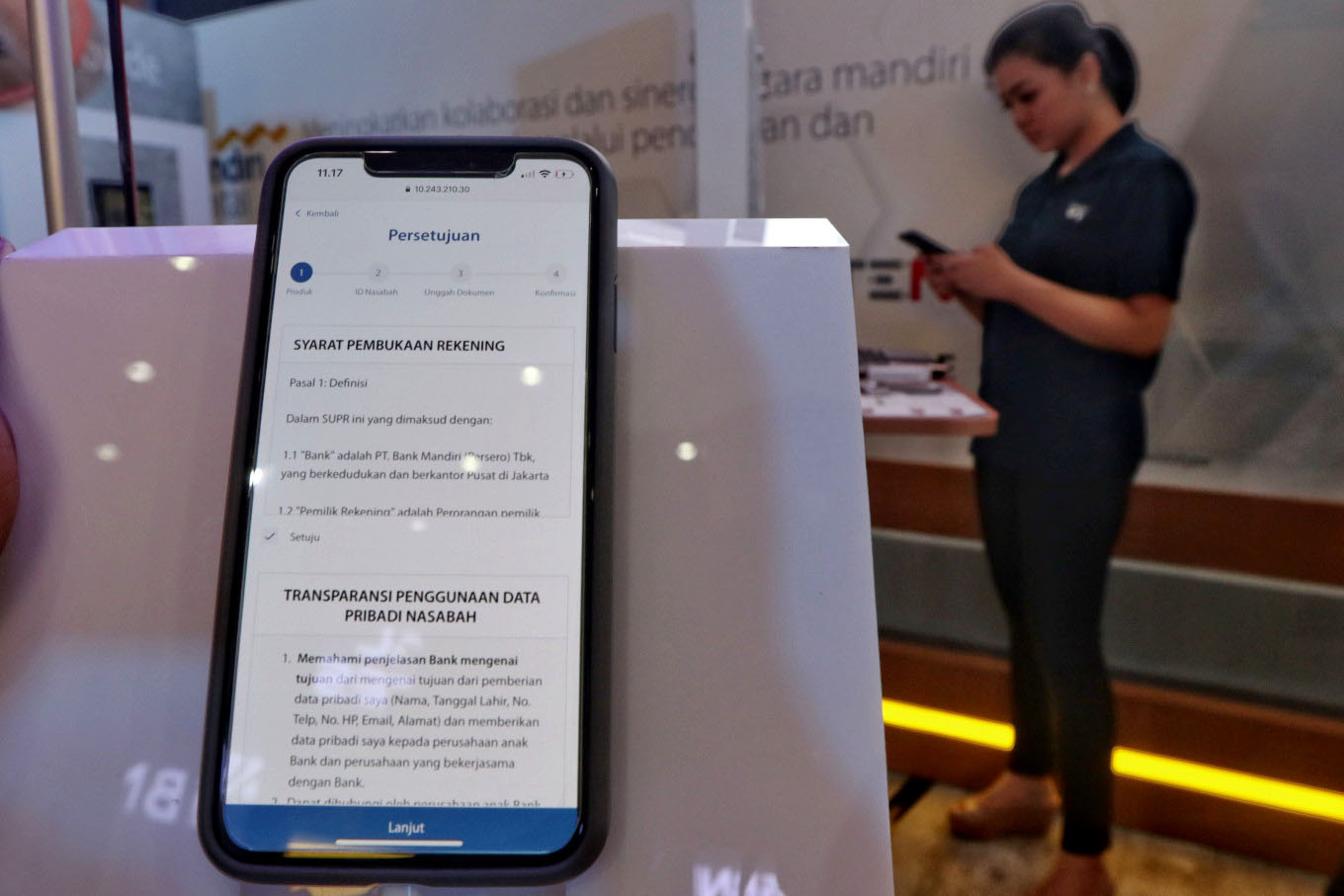

he Indonesian Fintech Lenders Association (AFPI) is partnering with the Financial Services Authority (OJK) to open a data center that will enhance the assessment of customers' credit rating as bad loans rise in the burgeoning fintech lending sector.

AFPI technical support head Ronald Andi T. Kasim said the data center would integrate peer-to-peer (P2P) fintech lending platforms data in a bid to identify excessive lending, bad credit and fraud.

"P2P platforms are obliged to assess borrowers' background at the data center before providing them with loans,” Ronald said during the launch of what the AFPI and OJK called the “data center” in Jakarta on Monday, adding that the data bank would be helpful to ensure the "health of the industry."

“The assessment can only be conducted should the borrowers apply for loans or still have outstanding loans to prevent any abuse," Ronald added.

Ronald said companies' membership could be revoked should they breach the association's rules, adding that the total 144 P2P platform members were obliged to provide daily reports of loans to the data bank and the OJK.

As of now, 15 P2P platforms have made their data available for the data bank, such as Amartha, Koinworks and Modalku. The data center will be fully functioned by the end of the month, according to Ronald.

OJK fintech licensing and supervision director Hendrikus Passagi said non-performing loans in the industry were relatively unstable due to fast rising P2P platforms.